AFFILIATE MARKETING

How The Online Platform Makes Money in 2023

Are you looking for a way to sharpen your skills and gain new knowledge? Udemy is an online learning platform with courses in almost every conceivable topic, from software development and personal finance to yoga and crochet. And the sustainability of the Udemy business model continues to drive innovation in how we learn, allowing students and instructors to connect and build expertise that can lead to career growth or lifelong learning.

In this blog post, we’ll explore what makes Udemy so successful and the range of benefits offered by its unique structure.

Overview of Udemy’s Business Model – How Does Udemy Work?

Udemy’s business model seems almost too good to be true; an online marketplace where people can access thousands of paid courses on a huge range of topics taught by the world’s best instructors – all at prices that won’t break the bank.

This inexpensive source of learning has become increasingly popular amongst students over the years, and it certainly sounds tempting. But how does the Udemy business and revenue model work?

Methods of Revenue for Udemy

It’s quite simple: Udemy allows everyone to sell their knowledge and skills in exchange for Udemy’s commission (plus any net revenue from each course sold). Once a course is published, buyers can purchase it, with payment taken via credit card, PayPal, or other reliable payment methods.

With more than 213,000+ courses on offer and over 57 million users across the globe, Udemy is becoming one of the leading online education providers.

The Udemy platform makes money through various revenue models, including tuition revenues from selling courses, paid acquisition, and Udemy for Business.

- Course sales involve a 50/50 split between the instructor and Udemy on any sale made.

- The paid acquisition piece of the Udemy revenue model involves buying advertising slots on other platforms, such as Google or Facebook, and charging instructors a 75 percent fee for each course sale.

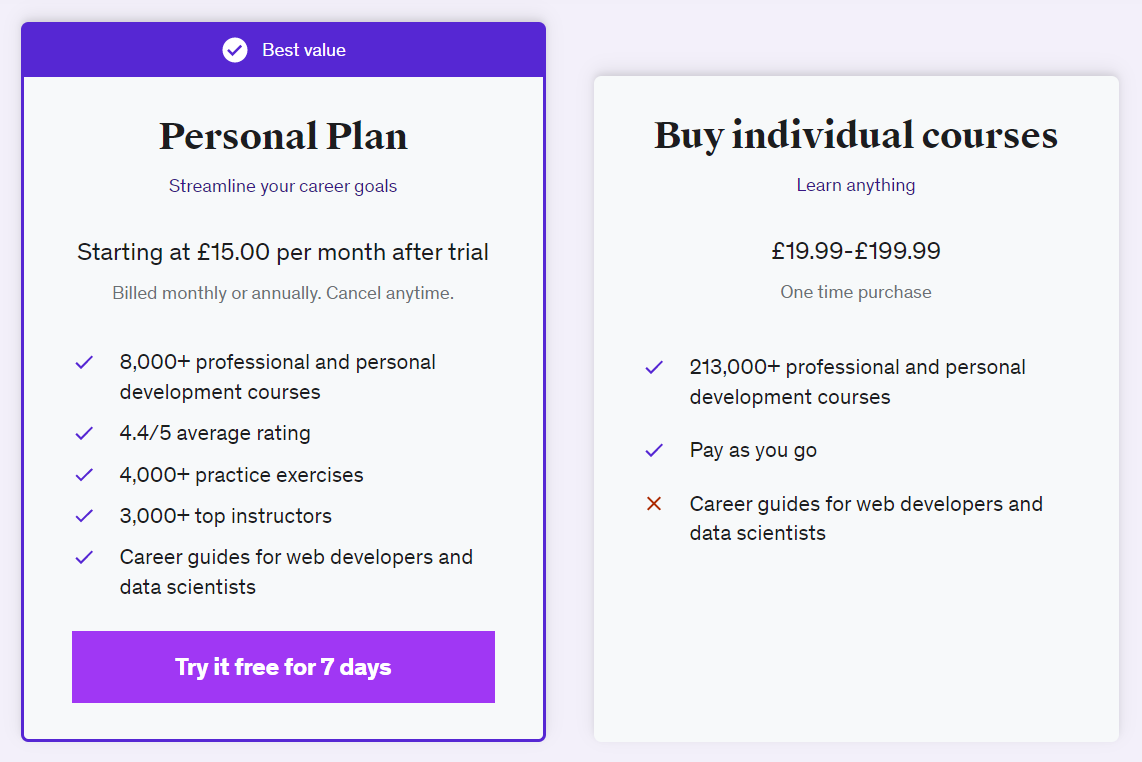

- Udemy also offers a personal subscription plan for individuals, giving access to thousands of courses.

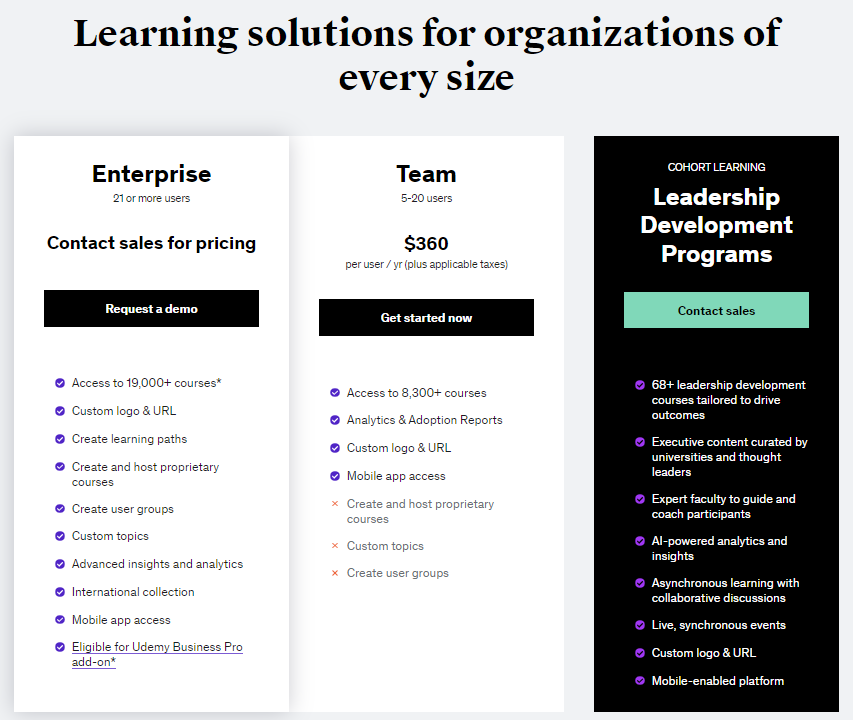

- Udemy for Business involves two subscription plans for companies, with pricing depending on the size of the team. These plans offer additional features such as custom categories and user groups, tracking user activity, and Slack integration.

All of these methods of revenue enable Udemy to expand its customer base and diversify its offerings while generating higher revenues.

Individual Course Purchases

Purchasing an individual course on Udemy involves creating an account and selecting the desired course. Once payment has been received, students have direct access to the content within their own personal dashboard.

Udemy Subscriptions

Udemy also offers a Personal Plan on an annual or monthly subscription service basis for individuals. This gives professional adults access to thousands of online courses they can take at their own pace, covering various topics such as IT and web development, soft skills, business, marketing & design.

Udemy Business offers a premium subscription for companies and teams that unlocks additional benefits for Udemy business customers with unlimited access to courses, personalized recommendations, learner engagement stats, and employee training plans.

This additional feature allows Udemy to earn annual or monthly subscription revenue from users.

How Much Money Does Udemy Make?

According to Crunchbase, the Udemy business ecosystem reported $90 million in 2018 and $140 million in 2019. This shows steady growth over the years.

Additionally, Udemy has seen tremendous success in its funding endeavors, raising an accumulative $311.4 million from 16 rounds of investment! On October 29th, 2021, Udemy made its debut on the NASDAQ stock exchange under the ticker UDMY with an initial public offering of $29.00 per share.

Udemy’s total income for the third quarter of 2022 increased an impressive 22%, totaling $158.4 million! In addition, Udemy Business saw its revenue grow by a staggering 67% year-over-year and achieved Annual Recurring Revenue (ARR) of $350 million – demonstrating that it is well on its way to becoming a leader in online education and learning solutions.

Who is Udemy For?

Udemy is for anyone who wants to learn new skills and gain knowledge in various subjects. Udemy courses are created by instructors from all backgrounds and cover dozens of topics, such as programming, personal development, business, marketing, and more.

Through the Udemy marketplace, users can find short courses that will help them quickly develop the skills they need for their careers or hobbies.

The Udemy online platform is also great for organizations and businesses looking to provide employees with educational opportunities, as the Enterprise plan offers a centralized hub of learning materials.

Finally, Udemy is an excellent platform for those who want to become instructors themselves and share their knowledge with others.

Take a look at our article on how to make money on Udemy.

Udemy For Companies

Udemy Business provides learning solutions for organizations of every size, with access to 19,000+ courses covering a wide range of topics.

With leadership development programs and international course collections available, the platform provides insights and analytics to help businesses track user engagement.

Finally, customers can access 24/7 customer support with a dedicated customer success partner.

Udemy For Individuals

Udemy offers over 19,000 courses in various topics, such as Business Fundamentals, Entrepreneurship, Digital Marketing, Development, and Personal Development.

This learning platform also provides tailored recommendations for students to find the perfect course to suit their needs and interests.

With the Personal Plan, users can access 8,000 of Udemy’s top-rated courses at discounted prices with exclusive longtime-learner deals.

Udemy For Course Creators

Udemy offers the opportunity to share your knowledge with learners worldwide and gives you the support you need to become a successful teacher.

With their user-friendly instructor dashboard, creating courses is simpler than ever! Instructors are provided detailed guides that offer step-by-step instructions for making classes – as well as a helpful Instructor Support Team available 24/7 if clarification or feedback on test videos is required.

Udemy provides everything needed for teachers to deliver remarkable online learning experiences! Check out our article looking into how much Udemy instructors make.

Why Is Udemy Such a Bargain?

The Udemy marketplace business model means courses are affordable for several reasons.

- First and foremost, they are created by individuals without the support of a larger organization or institution, which reduces the cost associated with producing a course.

- Secondly, automated assessment tools such as quizzes help to eliminate manual grading costs.

- Udemy often puts courses on sale to generate sales and create a sense of urgency and scarcity. This encourages potential students to take advantage of the discounted prices before they expire.

- In addition, Udemy’s subscription plans allow businesses and organizations to purchase access to thousands of courses at reduced rates.

These strategies enable Udemy to offer customers high-quality courses without breaking the bank. It is no wonder that Udemy has become one of the leading online learning platforms in the world.

Udemy Business Model – Conclusion

Udemy is an online learning platform that allows instructors to create, share, and sell their courses to a huge audience.

It takes a 50 percent cut when users buy a course directly through the Udemy website and a 75 percent cut when they purchase it via paid acquisition channels like Google Ads or Facebook Ads.

Furthermore, Udemy offers a personal subscription plan for individuals as well as plans for teams called Udemy Business.

Udemy courses are relatively cheap due to the automated grading system and creating a perception of value and scarcity effects.

Additionally, Udemy has amassed an enormous total of $311.4M in investment capital over 16 distinct funding rounds, skyrocketing its potential to new heights. Udemy continues to expand into new markets and spend on product development.

Overall, Udemy provides a valuable e-learning platform for instructors to put their courses out there and make money while also allowing students to access an abundance of knowledge at affordable prices.

With the rise of online learning platforms offering more convenient options for education, Udemy is likely to remain a leading player in the space.

AFFILIATE MARKETING

AI Marketing vs. Human Expertise: Who Wins the Battle and Who Wins the War?

Opinions expressed by Entrepreneur contributors are their own.

Uncover the truth about AI in marketing and why it’s a ticking time bomb for unprepared businesses! As AI revolutionizes the marketing landscape, understanding its long-term impact is crucial.

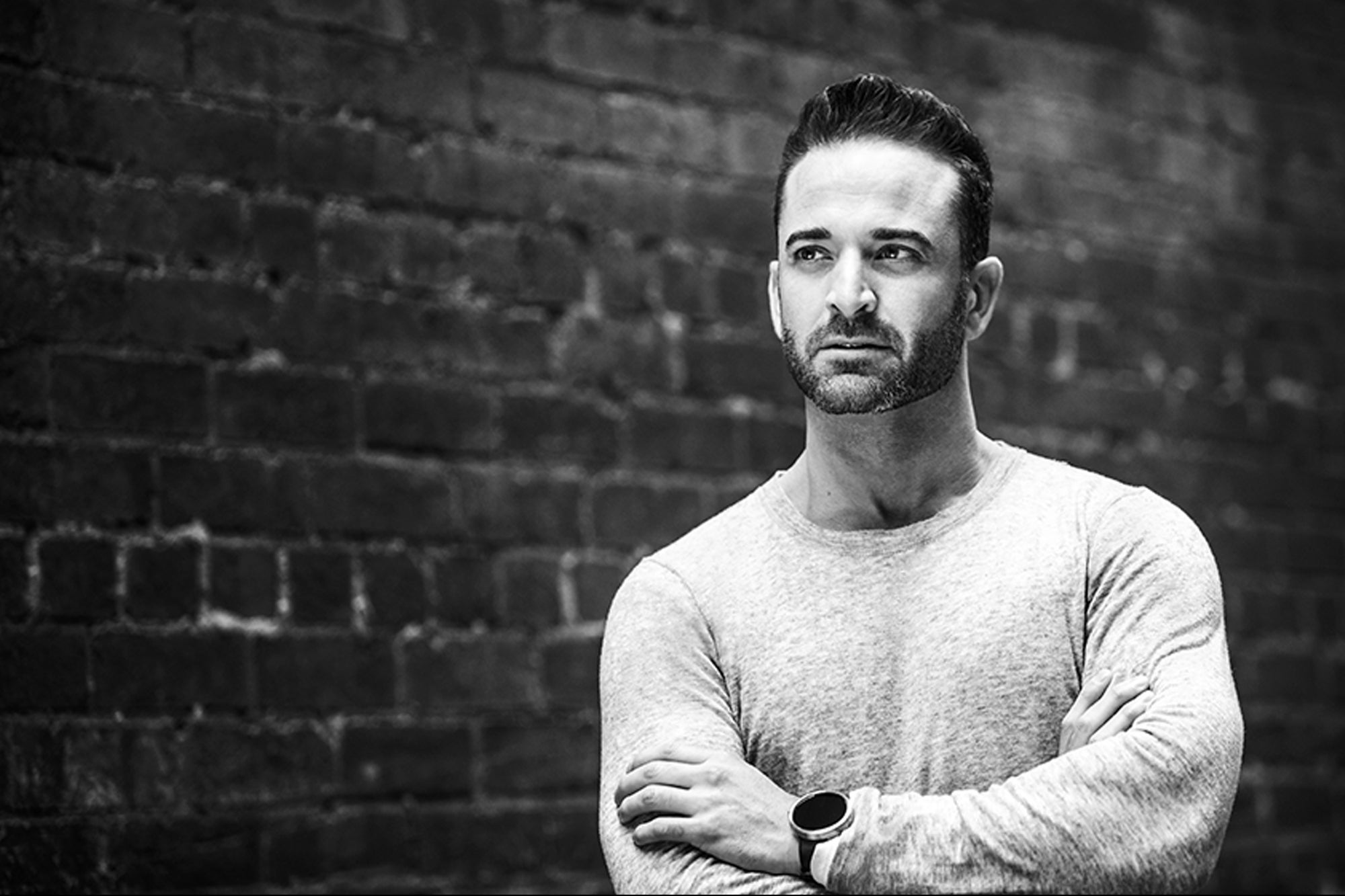

In this video, I dive deep into the reality of AI marketing, exposing the myths and revealing strategies to stay ahead of the curve. Learn why AI might play in your favor for the next 3 years, but could spell trouble if you’re not prepared for what’s coming. Discover how to leverage AI tools effectively while developing a future-sighted approach that will keep you competitive in an AI-driven world.

Download the free ‘AI Success Kit‘ (limited time only). And you’ll also get a free chapter from Ben’s brand new book, ‘The Wolf is at The Door – How to Survive and Thrive in an AI-Driven World.’

AFFILIATE MARKETING

5 Financial Blind Spots That Could Be Preventing You From Making More Money

Opinions expressed by Entrepreneur contributors are their own.

Money can often be the barrier between being stuck where you are or breaking through to the next level. This includes having or not having a budget, using it properly, hidden revenue or even misaligned goals — all of which influence your growth trajectory. These four common secrets have helped my company elevate our clients to the next level.

1. Financial transparency for ROI

The first blindspot we often notice with new clients is not having a clear reporting connection between your tools, like ads and a CRM like HubSpot, to see which channels drive the most significant return on investment (ROI). Do you know your best-performing channels? Or your best-performing piece of sales copy? What is the most opened document that leads to a closed deal?

And we’re not just talking about marketing and sales; this applies to many connected platforms — for example, the closed-loop revenue or your ERP systems. When things are not connected, they are disjointed and siloed. You end up flying blind. Without connecting your marketing tools with your revenue tools, and with that being CRMs, finance platforms, or ERPs, to name a few, there is a disconnect, and the arms and legs end up moving in different directions.

Here’s a simple example we see all the time: If you knew that one channel drove more deals by a 75% faster conversion rate, wouldn’t you invest more time and energy in that channel than one that only had a conversion rate of 10%? Many people don’t want to share the revenue numbers within the company, but all of that information informs the other departments; without sharing these revenue numbers, your money secret is keeping it in hidden silos.

2. Strategic investment for avoiding blind spots

Another financial blindspot is not investing in marketing. We have had prospects come in with no budget and no internal marketing team, but we want to grow by 150% and spend a total of $1,000. I wish achieving growth like this was possible, but unfortunately, it’s not. The old adage that you get what you pay for, or it takes money to make money, speaks the truth. Your investment goals should match your growth goals. The amount of money invested should be measured not just by short-term, quick wins but also by looking at long-term investment to growth.

You would never measure an HR department strictly on the number of hires. However, looking at the whole picture of longevity amongst many other important KPIs, You would not use an HR department for a few months. It is something that is constant and needs care and attention. Marketing is no different — if you strictly only measure marketing by the number of leads, you are missing out on the full picture. Marketing helps push leads through nurture campaigns, creates automation, leads scoring, builds new campaigns and tests, supports sales enablement activities and many other components. A buying cycle is rarely a straight line to click and buy unless we’re discussing Amazon.

That said, everyone has budgets, margins and bumper lanes they need to stay in. I am by no means saying throw your budget to the wind, but your goal should match your budget. If you have modest growth goals, be realistic about the budget needed to get there. Set incremental micro goals but stay the course for long-term growth.

Related: You Won’t Have a Strong Budget Until You Follow These 5 Tips

3. Data-driven decisions to save money

Another money secret that costs companies is spending without the data to back it. We had a company inquire about a new website, a full blow-up, new navigation, new content, new page layouts, migration onto a new CMS, a new theme and the works. They said they had a $75,000 budget for the whole project. In theory, it sounds great, right? Willing to invest? Check. Has a budget? Check. Know what they want the end result to be? Check. But when we asked them the next question, they looked at us like we were crazy, “Do you have data that backs the changes you are looking to make?” Are you running a tool like Hotjar to see real user data behind how these proposed changes will impact your existing inquiries and the only source the sales team was currently using for leads?

The answer was no. When the heat map was overlaid, do you know what happened? Well, they were looking to build that new navigation out and replace the old one — nearly 90% of the traffic was going to two pages of their site directly from the navigation, both of which they had originally wanted to remove. In this case, it wasn’t just about having the money but also about making sure the decisions you make with the budget are informed by real data: user data, sales data, marketing data and more. The more informed you can be by closing the loop on your data, the better your end result will be.

Related: Want to Be Better at Decision Making? Here are 5 Steps to Better Data-Driven Business Decisions

4. Modern marketing channels to drive growth

What is likely costing you the most is using old-school channels without the ability to measure. Companies have spent the last decade on traditional marketing channels and are switching to digital. The company’s historical growth has relied on things like trade shows, print, postcards and online magazines. We ask what the ROI you have seen by each channel is, and rarely can they share a specific revenue number and say it is for brand awareness. Some of the budgets can be over 50 to 100 thousand dollars spent on these traditional methods, but there is no ROI attached, yet they continue them.

When the pandemic happened, we saw a massive influx in businesses shifting from once only boots on the ground to digital. The lockdown changed everything; there were no more trade shows, no more door knocking and no one picking up their mail or faxes daily. It made traditional selling channels challenging and obsolete and forced a new level of openness to try new ways to get the job done. In the example of running online magazine ads there are lots of ways to capture them, we can use UTM tracking, referral analysis or create a custom landing page for the offer and capture the leads directly. Without running them to a landing page or form, you rely only on the online publication for leads and analytics. We’ve had people show a list of just names, no emails to follow up with, or only show a random number of visitors to the page, not a single name. It’s important to know what they will provide for reporting and tracking when you publish or use traditional channels. The rule of thumb is to use connections and tools that leverage old-school methods into technology and not blindly spend on channels that cannot be measured.

Stop wasting time, energy and revenue on these blind spots. They have easy solutions, so you can avoid them and focus on growing your business!

AFFILIATE MARKETING

How Nvidia Pivoted From Graphics Card Maker to AI Chip Giant

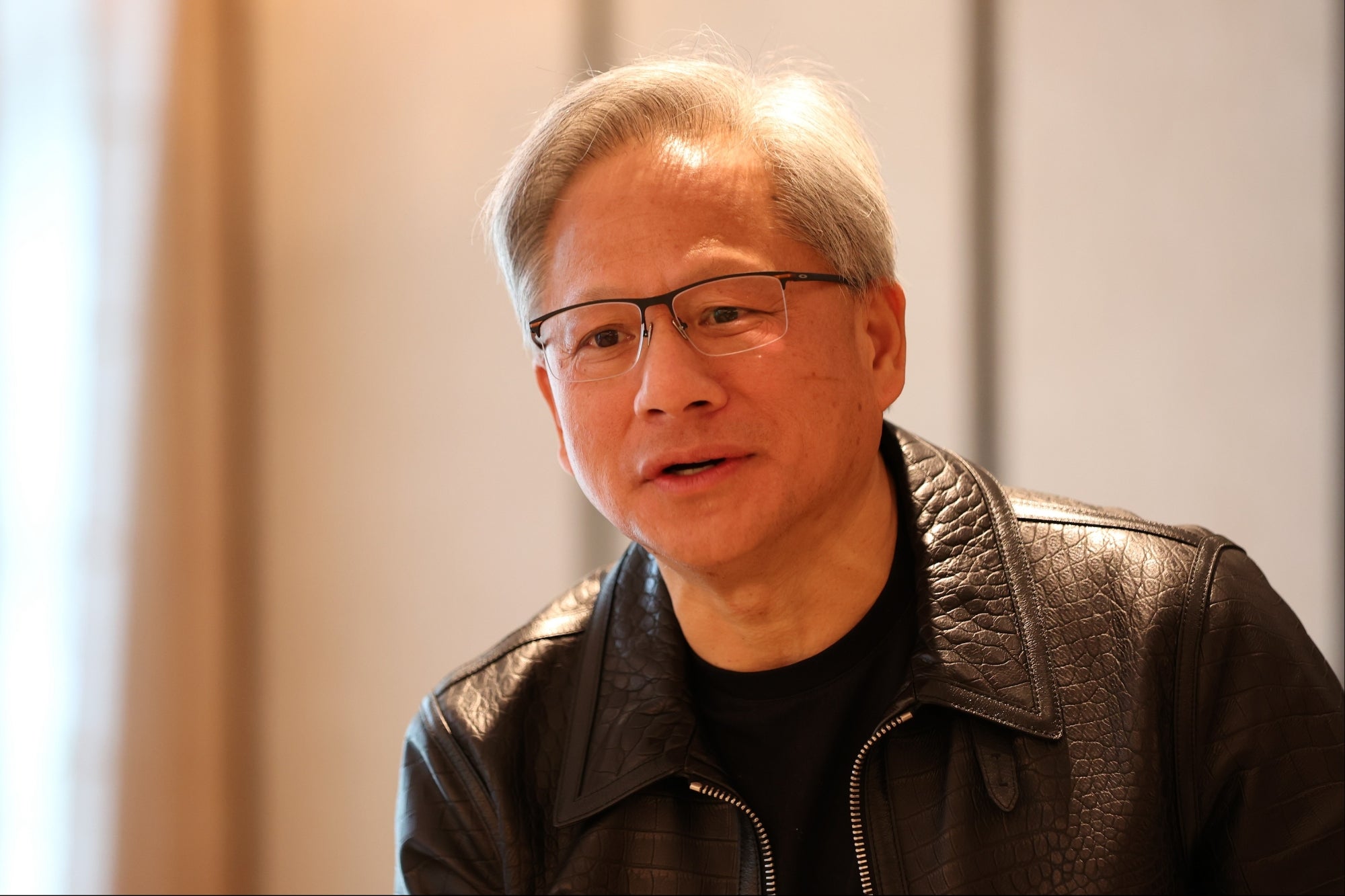

A decade ago, Nvidia was a major graphics card maker, vying with competitors like AMD and Intel for dominance. Now it’s an AI giant with 70% to 95% of the market share for AI chips, and the brains of OpenAI’s ChatGPT. It’s also the best-performing stock with the highest return in the past 25 years.

Why did Nvidia invest in AI chips over 10 years ago, ahead of the competition? CEO Jensen Huang and board member Mark Stevens, Nvidia’s two largest individual shareholders, talked to Sequoia Capital partner Roelof Botha to explain what Botha called “one of the most remarkable business pivots in history.”

Nvidia’s original product was 3D graphics cards for PC games, but company leaders noticed by the mid-2000s that the PC market was hitting a growth limit.

“We felt we were always gonna be boxed into the PC gaming market and always knocking heads with Intel if we didn’t develop a brand new market that nobody else was in,” Stevens explained.

Jensen Huang, co-founder and chief executive officer of Nvidia. Photographer: Lionel Ng/Bloomberg via Getty Images

That need for a new market intersected with a product Nvidia already had on hand: its graphics processor unit, or GPU, which could be used to power tasks outside of gaming. Researchers at universities across the world began exploring the graphics cards, eventually building advanced computers with them.

Related: Is It Too Late to Buy Nvidia? Former Morgan Stanley Strategist Says ‘Buy High, Sell Higher.’

Huang recalled meeting a quantum chemist in Taiwan who showed him a closet with a “giant array” of Nvidia’s GPUs on its shelves; house fans were rotating to keep the system cool.

“He said, ‘I built my own personal supercomputer.’ And he said to me that because of our work… he’s able to do his work in his lifetime,” Huang said.

Other researchers, like Meta AI chief Yann LeCun in New York, began reaching out to Nvidia about the computing power of its chips. Nvidia began considering the AI market when AI had yet to enter the mainstream and was a “zero billion dollar market” or a market that had yet to materialize.

“There was no guarantee that AI would ever really emerge because, keep in mind, AI had had many stops and starts over the last 40 years,” Stevens said. “I mean, AI has been around as a computer science concept for decades. But it had never really taken off as a huge market opportunity.”

Huang and other company leaders still believed in AI and decided to invest billions in the tech in the 2010s.

“This was a giant pivot for our company,” Huang said. “The company’s focus was steered away from its core business.”

Huang highlighted the extra cost, talent, and skills Nvidia had to account for with the pivot, as it affected the entire company. It took 10 to 15 years of effort, but that business decision led to Nvidia powering the AI revolution with an early ChatGPT partnership.

“Every CEO’s job is supposed to look around corners,” Huang said. “You want to be the person who believes the company can achieve more than the company believes it can.”

Related: How to Be a Billionaire By 25, According to a College Dropout Turned CEO Worth $1.6 Billion

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoBillions Of Google goo.gl URLs To 404 In The Future

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: July 22, 2024

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Core Update Coming, Ranking Volatility, Bye Search Notes, AI Overviews, Ads & More

-

SEO6 days ago

SEO6 days ago11 Copyscape Alternatives To Check Plagiarism

-

SEO6 days ago

SEO6 days agoGoogle Warns Of Last Chance To Export Notes Search Data

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: July 23, 2024

-

AFFILIATE MARKETING6 days ago

AFFILIATE MARKETING6 days agoThe Top 5 AI Tools That Can Revolutionize Your Workflow and Boost Productivity

-

SEO4 days ago

SEO4 days agoSystem Builders – How AI Changes The Work Of SEO

You must be logged in to post a comment Login