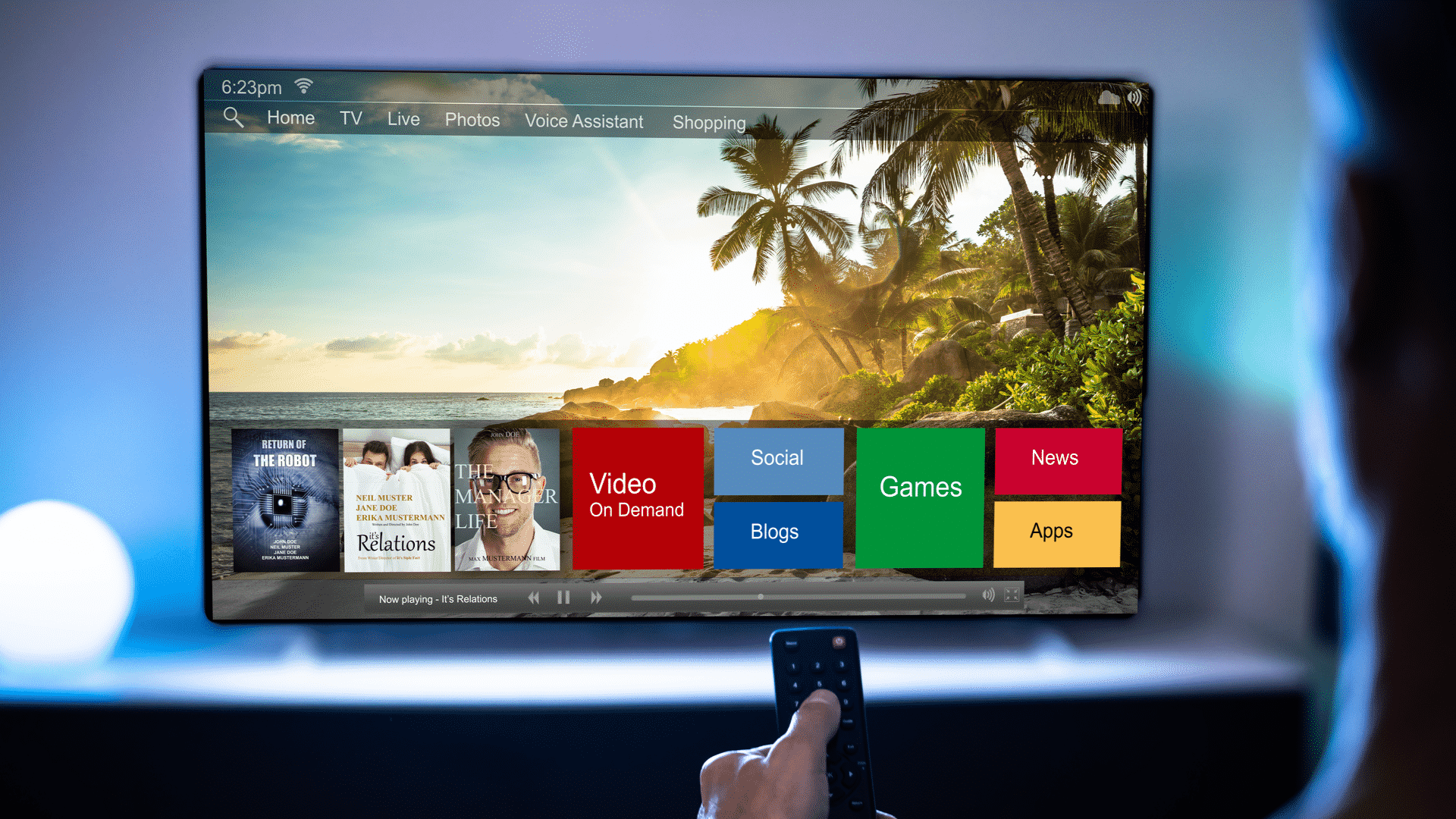

As the connected-TV (CTV) space matures, advertisers are finding more campaign opportunities in ad-supported video-on-demand (AVOD). This week, Yahoo expanded its partnership with Glewed TV, a significant player in AVOD with over 20,000 hours of premium content and display inventory in food, sports, movies, documentaries and other categories.

Glewed TV is now a preferred partner in Yahoo’s supply-side platform. It has also adopted Yahoo’s cookieless identity solution, Yahoo ConnectID, providing identity resolution for display ads.

Get the daily newsletter digital marketers rely on.

Why we care. Ad-supported streaming TV is a much different experience for viewers than Netflix and other ad-less streamers. This makes AVOD a question mark for advertisers without the identity resolution and performance metrics that enable this emerging channel to prove its worth within an omnichannel campaign.

Growing viewership. Viewers are flocking to AVOD, an eMarketer study shows. That’s a promising sign. Over half of video watchers are tapping into AVOD, which means that ad dollars aren’t being wasted.

These numbers are projected to climb even further to over 61% of all U.S. video viewers by 2025, or 165.4 million people. The costs of linear cable, and mounting subscription pricing for streaming services, is expected to attract viewers to free ad-supported alternatives.

“Growth in AVOD ad spend is outpacing other channels and is projected to be worth $47 billion of the global CTV market by 2023,” said Iván Markman, Yahoo Chief Business Officer. “That’s double its 2018 value.”

Advanced targeting. In addition to identity resolution methods like Yahoo’s ConnectID, advertisers will also be able to take advantage of advances in automatic content recognition (ACR).

“This will be the year the market fully realizes the value of ACR data – paired with the surge in ad-enabled CTV inventory and content consumption,” said Markman. “Its first-party data is highly beneficial to addressable advertising, incremental reach, and the ability to target streaming viewers outside of a linear campaign. In 2022, more advertisers will proactively seek out planning and buying solutions that include this coveted data.”

Explore platform capabilities from vendors like Acxiom, Infutor, Oracle, Neustar and more in the full MarTech Intelligence Report on identity resolution platforms.

CTV measurement. AVOD isn’t coming out of nowhere. As part of the CTV ecosphere, it benefits from the measurement and analytics advertisers gain by running campaigns through an omnichannel SSP.

“CTV platforms offer advertisers digital-quality targeting, attribution and analytics at scale, while traditional TV provides reach and scale,” said Markman. “Plus, AVOD is a new way to reach TV viewers who don’t subscribe to cable and/or are fans of streaming CTV content.”

He added that for advertisers, AVOD complements traditional TV ad spending.

AVOD and omnichannel campaigns. “The access to Glewed TV’s inventory is in line with our overall approach for our DSP,” Markman explained.

The aim is to provide “multiple dimensions” with AVOD and other ad formats, such as mobile, video, brand integrations, digital-out-of-home (DOOH), audio, and immersive XR (extended reality, including AR and VR).

Read next: IAB Tech Lab updates ad formats for CTV and digital video

“This is critical for modern marketers who increasingly want to buy all of their media programmatically, through the same, unified platform,” Markman said. “In fact, we are seeing consolidation in the category in an effort to deliver on that demand to advertisers.”

AVOD audiences. Yahoo is seeing increased interest from advertisers in media and entertainment, retail and e-commerce, pharmaceuticals, automotive and consumer packaged goods.

“These categories are capitalizing on CTV’s growing viewership, as well as its ability to provide deeper personalization, direct consumer relationships and more agile creative,” said Markman. “And while cord-cutters trend younger, AVOD has reached mainstream and is a mainstay across nearly every viewer demographic.”

![Navigating Google’s Third-Party Cookie Purge [Next Steps for Advertisers] Navigating Google’s Third-Party Cookie Purge [Next Steps for Advertisers]](https://articles.entireweb.com/wp-content/uploads/2024/02/Navigating-Googles-Third-Party-Cookie-Purge-Next-Steps-for-Advertisers-400x240.jpg)

![Navigating Google’s Third-Party Cookie Purge [Next Steps for Advertisers] Navigating Google’s Third-Party Cookie Purge [Next Steps for Advertisers]](https://articles.entireweb.com/wp-content/uploads/2024/02/Navigating-Googles-Third-Party-Cookie-Purge-Next-Steps-for-Advertisers-80x80.jpg)

You must be logged in to post a comment Login