MARKETING

What Diners Write About Most: A Study of Restaurant Review Place Topics

The author’s views are entirely their own (excluding the unlikely event of hypnosis) and may not always reflect the views of Moz.

Marketing a restaurant? You already know what a huge role online reviews play in your reputation, rankings, and revenue, with 98% of US adults reading this content and 86% writing it. You may have read that there’s a demonstrable Google local ranking boost when a brand-new restaurant gets its first ten reviews. You may also have seen that many experts consider your overall Google review rating to be the sixth most important of all local search ranking factors.

But have you advanced yet to full use of Google reviews as a source of business intelligence for the brands you’re marketing? Formal surveys can be costly to run, so don’t overlook the free, ongoing sentiment analysis shorthand offered right on your listings in the form of Google Place Topics, telling you at-a-glance what real-world attributes inspire reviewers to get typing. These most compelling offline components, aggregated by Google online, can give insights into the areas a business should focus on most.

Back in 2020, I examined Place Topic trends for US grocery stores. Today, I’ll do the same for restaurants, and I want to emphasize that this is a case study you can do for any industry to get a sense of what drives customers to take the time to leave reviews. Given the impact of reviews on business viability, this type of study is a very smart thing to engage in!

Methodology

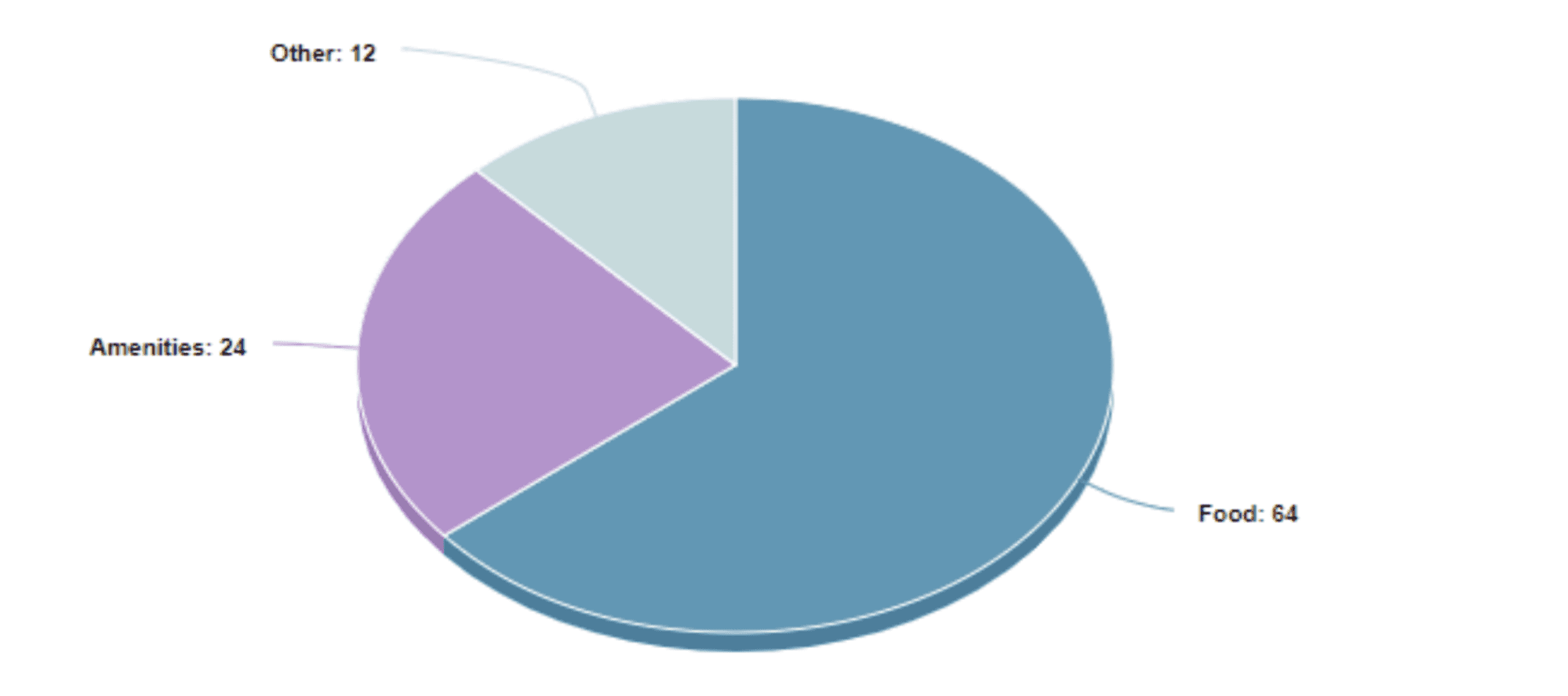

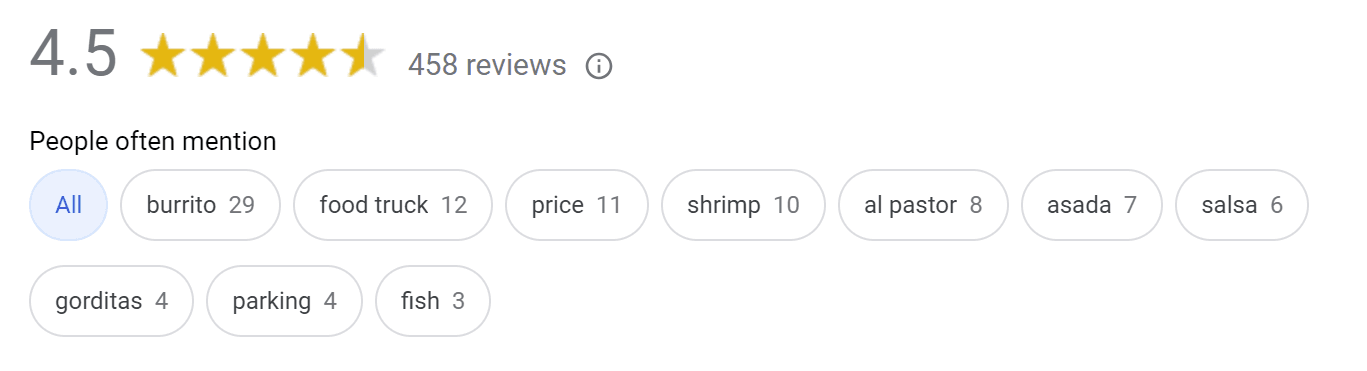

I wanted to find out which factors inspire the most mentions in restaurant reviews. This small survey looks at 250 data points. I found the top-ranked business for the phrase restaurant+city (like “restaurant sacramento”) in all 50 US state capitals. I then recorded the top 5 place topics for each restaurant, put them in a spreadsheet, and after reviewing the data, realized I could bucket the findings into three main categories: food & drink, amenities, and other.

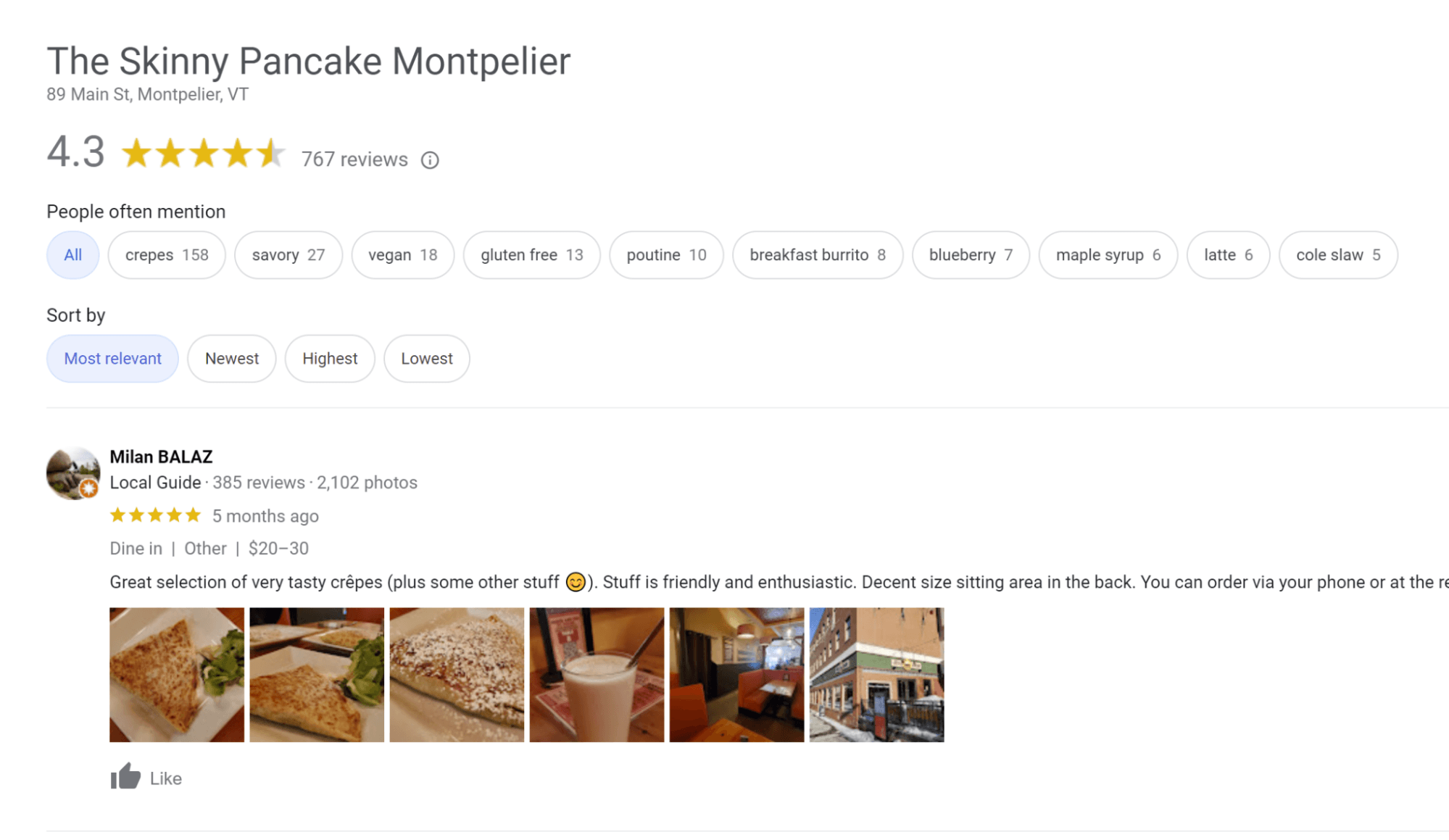

But first, what is a Google Place Topic?

If you navigate from a Google Business Profile to the full review overlay, you’ll see a section right below the star rating labeled “People often mention.” Place Topics consist of this row of clickable tabs displaying the words that come up most in the review set, including the number of times each phrase was mentioned.

Restaurant review results

Here’s what I’ve learned:

-

64% of reviews for the top-ranked restaurants in state capitols across the US mention food & drink most prominently.

-

24% mention amenities prominently.

-

12% mention something else prominently.

Under the ‘food & drink’ category, I included any reference to specific foods (tacos, risotto, coffee, etc.), any mention of meals (brunch, dinner, etc.), as well as food qualifiers like “vegan” or “gluten-free.” Fun fact: people seem very excited about paella at the moment in the United States.

Under the ‘amenity’ category, I included any reference to physical amenities (patio, lake, antiques, etc.), any reference to intangible amenities (atmosphere, happy hour, entertainment, fine dining, etc.), and any reference to staff and services (bartender, valet parking, waitress).

The ‘other’ category proved interesting. One thing that stood out to me was the number of references to personal celebrations, most prominently “birthday” and “anniversary.” So much is riding on a restaurant when it’s chosen to mark an occasion. There were also several compliments like “gem” and some concerning trends like “cold.” I also filed a few things in this category that weren’t immediately intelligible to me, like “6:00,” “night,” and “silver.” Fun fact: I had to figure out why reviewers kept mentioning “wall,” only to discover they were describing an eatery as a “hole-in-the-wall.”

Interpreting the results

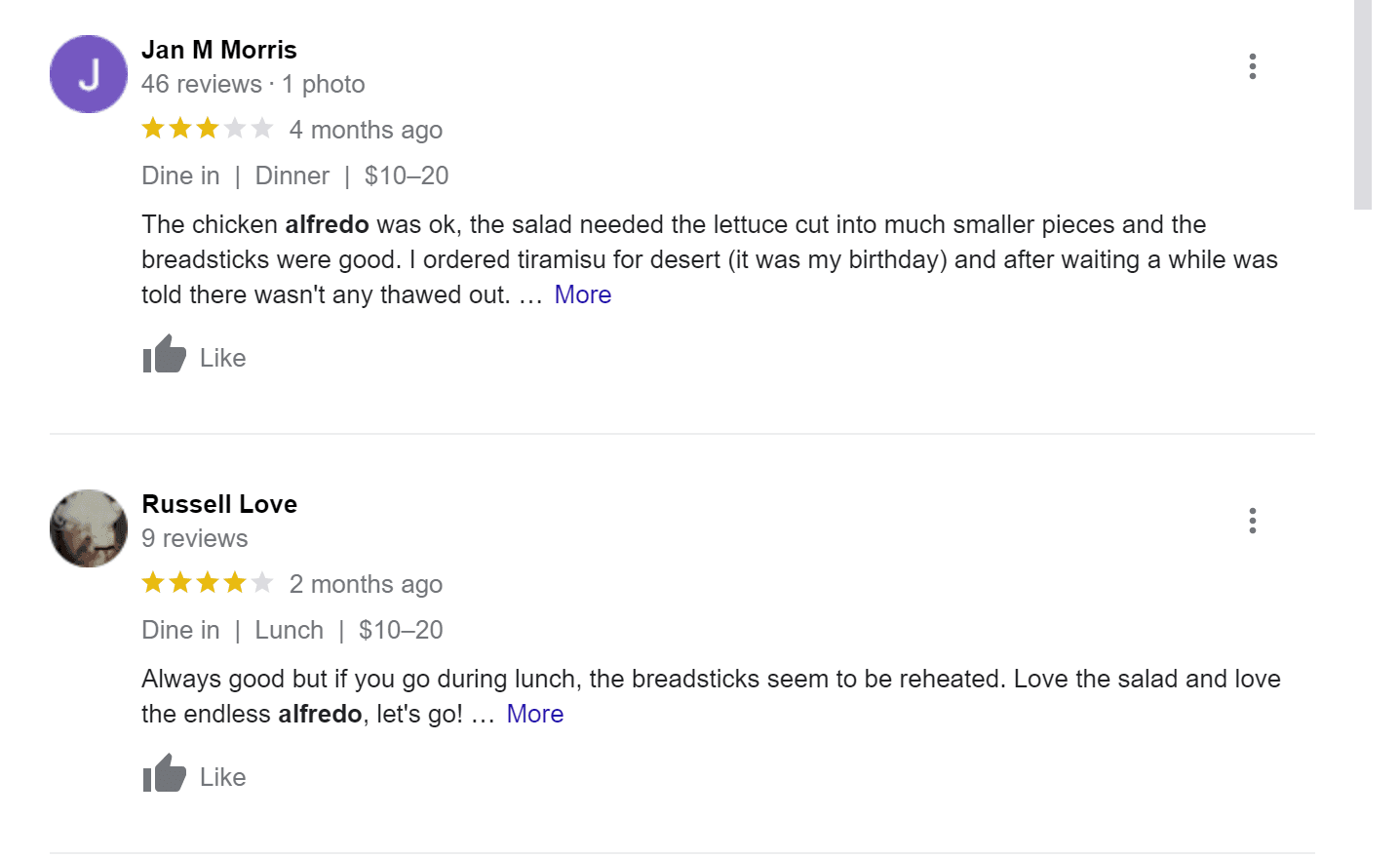

Place Topics simply indicate which subjects are being mentioned most by your reviewers. For example, lots of reviews might mention your alfredo. That’s good to know as a first step. But the essential second step is to understand what people are actually saying about your alfredo. Place Topics don’t automatically tell you whether the sentiment is positive or negative. As seen above, these two reviews characterize alfredo quite differently, as being worthy of love and as being just okay, but both count as Place Topic mentions.

The simplest way to drill down is to choose one of the Place Topics Google is surfacing on your listing and then combine it with a ‘Sort By’ filter. Here, you can see that I’ve combined “alfredo” with “most recent”:

This filtered view will allow you to see if the most recent customers talking about your alfredo are satisfied or not. By scrolling through the reviews surfaced by this filter combo and noting down what you see, you can get a sense of present performance for a most-talked-about topic. You can then go through the same process with both the ‘Highest’ and ‘Lowest’ filters to note the best and worst sentiment you’ve ever received on the topic. You could create a spreadsheet to compare how you’re currently doing with a particular topic to your overall highs and lows. The ability to use Place Topics in combination with sorting makes the information a bit more intelligible!

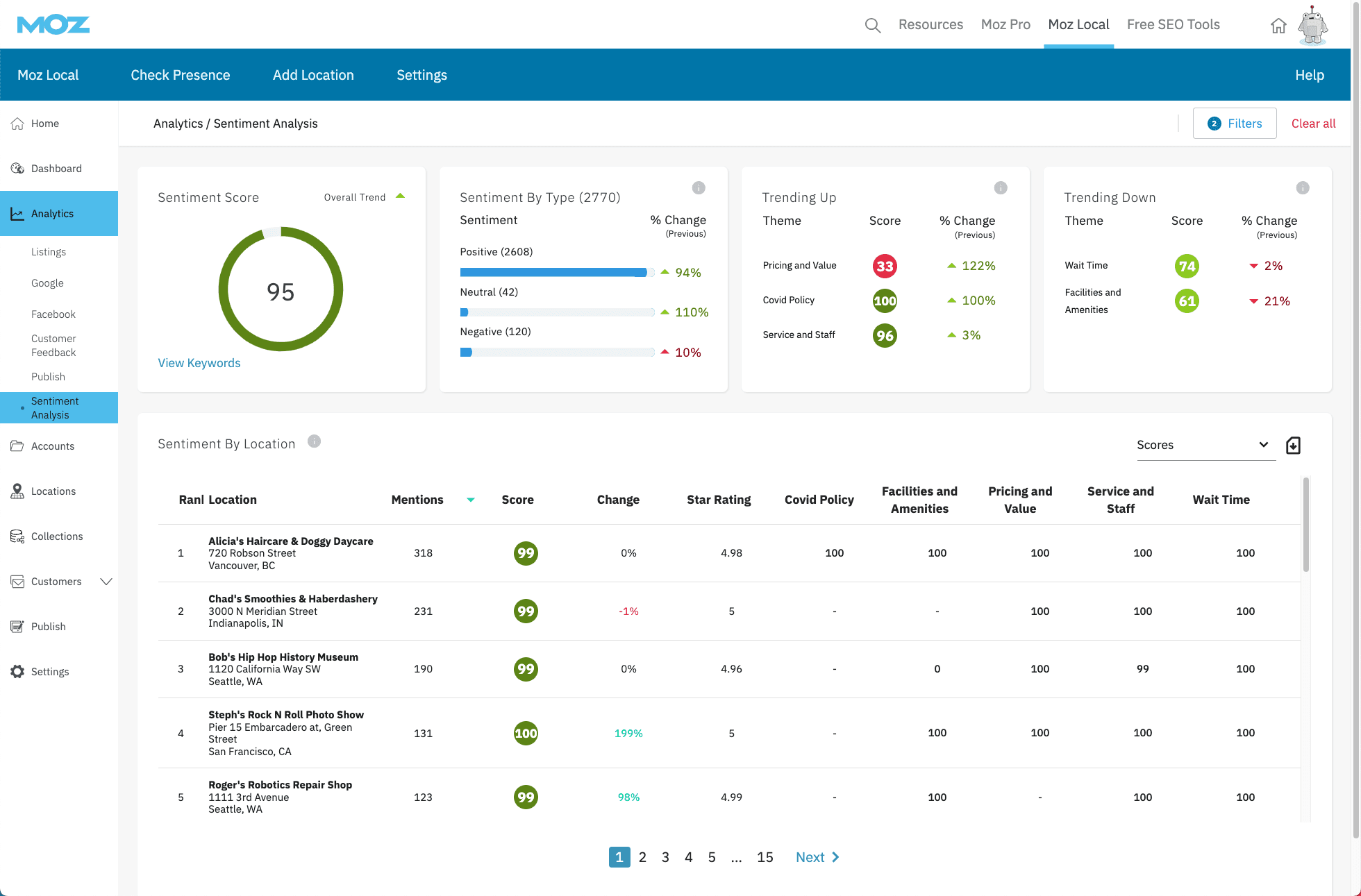

This workflow is reasonably manageable for the 10 Place Topics shown by Google for a single-location business. It becomes less so for each additional location of a multi-location business. And, of course, Place Topics only relate to your Google reviews – not to your customers’ sentiments across multiple review platforms. While this feature is useful, it’s limited and feels very manual. If you’re starting to realize this, you may be at a point of learning that an investment in more sophisticated sentiment analysis would make sense if it could highlight multiple most-discussed review elements across all your listings and across various platforms. In that case, you might want to sign up for software like Moz Local, with its more sophisticated sentiment analysis data and clues to whether your locations are trending upward or downward in terms of customer satisfaction:

But back to the more limited Place Topics, what should you actually be doing with this information?

What to do with Place Topic information

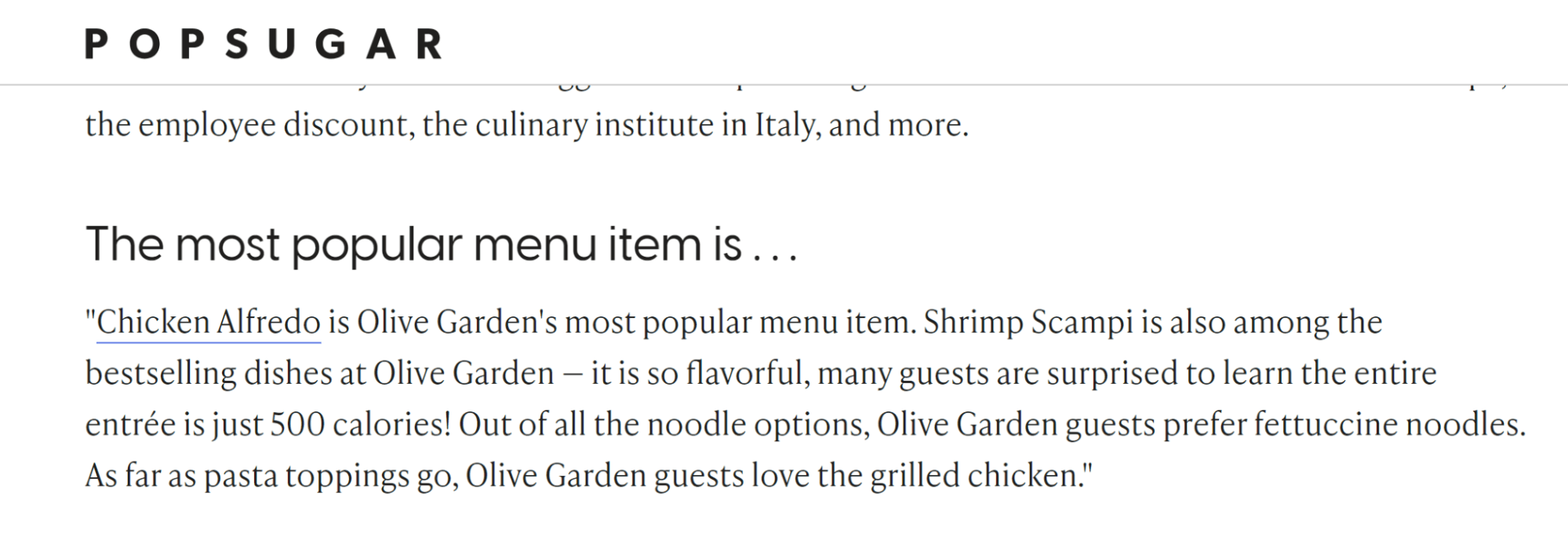

I was interested to see that only one truly large restaurant chain appeared to be given a top spot for my search through the 50 state capitals: an Olive Garden in Topeka, Kansas. All the rest were small businesses. I spent a little time looking at a variety of Olive Garden listings. According to Popsugar, chicken alfredo is this well-known brand’s most popular dish, and this is borne out by it showing up as a Place Topic for the Kansas City location in my screenshots above, as well as for many other locations.

The most practical use of Place Topics for restaurants (or any other businesses) is to understand that they represent the factors you must get right, because they are the things your customers will talk about most in your reviews.

86% of consumers say local business reviews are either the most important or a somewhat important factor in whether they can trust a nearby company. We can readily imagine prospective diners looking at all the sentiment about whether they can get a good alfredo at Olive Garden. If the sentiment is positive, this would be a yes. If negative, maybe not. Whatever the majority of your customers are writing about in your reviews, you need to examine those areas of your operations with a magnifying glass to ensure that you are giving customers every reason to speak well of your most prominent features.

Additionally, if worrisome Place Topics are trending on your Google Business Profile, it’s an actionable piece of business intelligence. For example, if enough people are writing about food temperature to make “cold” a top Place Topic on your listing, a structural fix will be needed so that guests are no longer experiencing this problem, and other things they’re mentioning can replace this word as a Place Topic. Even during the brief period of my study, I saw Place Topics change for specific locations, so take courage from that.

If the restaurant you’re marketing is experiencing a downtrend, you might also want to check out your top competitors’ Place Topics for amazing, fast insight into what their customers think they are getting right (and wrong). How does your establishment stack up, and what changes might you make to catch up?

Big takeaways for today’s restaurants

Overall, what we’ve learned about restaurants from this examination of Place Topics is that for top-ranked dining establishments:

-

Your food matters most. It is the subject that the overwhelming majority of your guests will mention most in their reviews.

-

Your amenities come second but still get lots of mentions in your reviews.

This may come as no surprise, but I grew up in a funny era where the emphasis on food in restaurants threatened to disappear. As food writer M.F.K. Fisher described the 1980s,

“Many of those young chefs pay more attention to the way food is arranged than the way it tastes.”

And as food historian Sylvia Lovegren explains the habits of eighties two-income fueled, credit card-wielding diners in that era,

“When they went out to dinner, it wasn’t to a quiet corner bistro where they could relax over a favorite and familiar dish. It was to an expensive, flashy, trendy place, where the fame of the chef or the hipness of the food might help guarantee their place in the demanding, unending struggle for status.”

If Google Business Profiles had existed back then, amenities might well have topped the Place Topics, but the 2020s are a very different period, with Americans feeling poor for good reason and restaurateurs really struggling to source affordable ingredients to keep menu pricing reasonable for patrons. Given these factors, it makes sense that the actual food on the table is what drives customers to write about their experiences rather than the atmosphere or social cachet of the spot.

When I look around my own town, I see how many pretty restaurants have closed over the past few years, while every night, a very ugly parking lot near me is filled to bursting with people seeking the affordable and fabulous Mexican entrees of a humble food truck:

In fact, they’ve been so successful in their tiny mobile kitchen that they’ve got a second truck now, and its location, which is totally lacking in prestige or ambiance, is full now, too. Reviews tell the story of success while also helping to build it.

This is a great week to form a new habit of analyzing Place Topics on a regular basis to see what matters to your best salespeople over time, perfecting your fulfillment of those components which could help your reputation most and give a meaningful boost to new customer acquisition.

MARKETING

How To Develop a Great Creative Brief and Get On-Target Content

Every editor knows what it feels like to sit exasperated in front of the computer, screaming internally, “It would have been easier if I’d done it myself.”

If your role involves commissioning and approving content, you know that sinking feeling: Ten seconds into reviewing a piece, it’s obvious the creator hasn’t understood (or never bothered to listen to) a damn thing you told them. As you go deeper, your fingertips switch gears from polite tapping to a digital Riverdance as your annoyance spews onto the keyboard. We’ve all been there. It’s why we drink. Or do yoga. Or practice voodoo.

In truth, even your best writer, designer, or audiovisual content creator can turn in a bad job. Maybe they had an off day. Perhaps they rushed to meet a deadline. Or maybe they just didn’t understand the brief.

The first two excuses go to the content creator’s professionalism. You’re allowed to get grumpy about that. But if your content creator didn’t understand the brief, then you, as the editor, are at least partly to blame.

Taking the time to create a thorough but concise brief is the single greatest investment you can make in your work efficiency and sanity. The contrast in emotions when a perfectly constructed piece of content lands in your inbox could not be starker. It’s like the sun has burst through the clouds, someone has released a dozen white doves, and that orchestra that follows you around has started playing the lovely bit from Madame Butterfly — all at once.

Here’s what a good brief does:

- It clearly and concisely sets out your expectations (so be specific).

- It focuses the content creator’s mind on the areas of most importance.

- It encourages the content creator to do a thorough job rather than an “it’ll-do” job.

- It results in more accurate and more effective content (content that hits the mark).

- It saves hours of unnecessary labor and stress in the editing process.

- It can make all the difference between profit and loss.

Arming content creators with a thorough brief gives them the best possible chance of at least creating something fit for purpose — even if it’s not quite how you would have done it. Give them too little information, and there’s almost no hope they’ll deliver what you need.

On the flip side, overloading your content creators with more information than they need can be counterproductive. I know a writer who was given a 65-page sales deck to read as background for a 500-word blog post. Do that, and you risk several things happening:

- It’s not worth the content creator’s time reading it, so they don’t.

- Even if they do read it, you risk them missing out on the key points.

- They’ll charge you a fortune because they’re losing money doing that amount of preparation.

- They’re never going to work with you again.

There’s a balance to strike.

There’s a balance to be struck.

Knowing how to give useful and concise briefs is something I’ve learned the hard way over 20 years as a journalist and editor. What follows is some of what I’ve found works well. Some of this might read like I’m teaching grandma to suck eggs, but I’m surprised how many of these points often get forgotten.

Who is the client?

Provide your content creator with a half- or one-page summary of the business:

- Who it is

- What it does

- Whom it services

- What its story is

- Details about any relevant products and services

Include the elevator pitch and other key messaging so your content creator understands how the company positions itself and what kind of language to weave into the piece.

Who is the audience?

Include a paragraph or two about the intended audience. If a company has more than one audience (for example, a recruitment company might have job candidates and recruiters), then be specific. Even a sentence will do, but don’t leave your content creator guessing. They need to know who the content is for.

What needs to be known?

This is the bit where you tell your content creator what you want them to create. Be sure to include three things:

- The purpose of the piece

- The angle to lead with

- The message the audience should leave with

I find it helps to provide links to relevant background information if you have it available, particularly if the information inspired or contributed to the content idea, rather than rely on content creators to find their own. It can be frustrating when their research doesn’t match or is inferior to your own.

How does the brand communicate?

Include any information the content creators need to ensure that they’re communicating in an authentic voice of the brand.

- Tone of voice: The easiest way to provide guidance on tone of voice is to provide one or two examples that demonstrate it well. It’s much easier for your content creators to mimic a specific example they’ve seen, read, or heard than it is to interpret vague terms like “formal,” “casual,” or “informative but friendly.”

- Style guide: Giving your content creator a style guide can save you a lot of tinkering. This is essential for visuals but also important for written content if you don’t want to spend a lot of time changing “%” to “percent” or uncapitalizing job titles. Summarize the key points or most common errors.

- Examples: Examples aren’t just good for tone of voice; they’re also handy for layout and design to demonstrate how you expect a piece of content to be submitted. This is especially handy if your template includes social media posts, meta descriptions, and so on.

All the elements in a documented brief

Here are nine basic things every single brief requires:

- Title: What are we calling this thing? (A working title is fine so that everyone knows how to refer to this project.)

- Client: Who is it for, and what do they do?

- Deadline: When is the final content due?

- The brief itself: What is the angle, the message, and the editorial purpose of the content? Include here who the audience is.

- Specifications: What is the word count, format, aspect ratio, or run time?

- Submission: How and where should the content be filed? To whom?

- Contact information: Who is the commissioning editor, the client (if appropriate), and the talent?

- Resources: What blogging template, style guide, key messaging, access to image libraries, and other elements are required to create and deliver the content?

- Fee: What is the agreed price/rate? Not everyone includes this in the brief, but it should be included if appropriate.

Depending on your business or the kind of content involved, you might have other important information to include here, too. Put it all in a template and make it the front page of your brief.

Prepare your briefs early

It’s entirely possible you’re reading this, screaming internally, “By the time I’ve done all that, I could have written the damn thing myself.”

But much of this information doesn’t change. Well in advance, you can document the background about a company, its audience, and how it speaks doesn’t change. You can pull all those resources into a one- or two-page document, add some high-quality previous examples, throw in the templates they’ll need, and bam! You’ve created a short, useful briefing package you can provide to any new content creator whenever it is needed. You can do this well ahead of time.

I expect these tips will save you a lot of internal screaming in the future. Not to mention drink, yoga, and voodoo.

This is an update of a January 2019 CCO article.

HANDPICKED RELATED CONTENT:

Cover image by Joseph Kalinowski/Content Marketing Institute

MARKETING

Quiet Quitting vs. Setting Healthy Boundaries: Where’s The Line?

MARKETING

Microsoft unveils a new small language model

Phi-3-Mini is the first in a family of small language models Microsoft plans to release over the coming weeks. Phi-3-Small and Phi-3-Medium are in the works. In contrast to large language models like OpenAI’s ChatGPT and Google’s Gemini, small language models are trained on much smaller datasets and are said to be much more affordable for users.

We are excited to introduce Phi-3, a family of open AI models developed by Microsoft. Phi-3 models are the most capable and cost-effective small language models (SLMs) available, outperforming models of the same size and next size up across a variety of language, reasoning, coding and math benchmarks.

What are they for? For one thing, the reduced size of this language model may make it suitable to run locally, for example as an app on a smartphone. Something the size of ChatGPT lives in the cloud and requires an internet connection for access.

While ChatGPT is said to have over a trillion parameters, Phi-3-Mini has only 3.8 billion. Sanjeev Bora, who works with genAI in the healthcare space, writes: “The number of parameters in a model usually dictates its size and complexity. Larger models with more parameters are generally more capable but come at the cost of increased computational requirements. The choice of size often depends on the specific problem being addressed.”

Phi-3-Mini was trained on a relatively small dataset of 3.3 trillion tokens — instances of human language expressed numerically. But that’s still a lot of tokens.

Why we care. While it is generally reported, and confirmed by Microsoft, that these SLMs will be much more affordable than the big LLMs, it’s hard to find exact details on the pricing. Nevertheless, taking the promise at face-value, one can imagine a democratization of genAI, making it available to very small businesses and sole proprietors.

We need to see what these models can do in practice, but it’s plausible that use cases like writing a marketing newsletter, coming up with email subject lines or drafting social media posts just don’t require the gigantic power of a LLM.

Dig deeper: How a non-profit farmers market is leveraging AI

-

MARKETING6 days ago

MARKETING6 days agoEffective Communication in Business as a Crisis Management Strategy

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Won’t Change The 301 Signals For Ranking & SEO

-

SEO6 days ago

SEO6 days agobrightonSEO Live Blog

-

PPC7 days ago

PPC7 days ago9 Ecommerce Trends to Boost Your Business in 2024

-

SEO7 days ago

SEO7 days agoHow To Write ChatGPT Prompts To Get The Best Results

-

SEO5 days ago

SEO5 days agoGoogle March 2024 Core Update Officially Completed A Week Ago

-

WORDPRESS5 days ago

WORDPRESS5 days ago9 Best WooCommerce Multi Vendor Plugins (Compared)

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 25, 2024