AFFILIATE MARKETING

Types of eCommerce business models

ECommerce is an online form of buying and selling goods and services. This transactional trade evolution has revolutionized how consumers shop, providing access to a world of goods beyond the limits of location or store hours. ECommerce allows merchants to expand their market, reaching customers across multiple nations while often simplifying and streamlining the purchasing process.

Whether looking to buy a new set of headphones from China or selling homemade art from your living room, eCommerce offers a unique platform for anyone with internet access. With its continuing growth, it’s no wonder so many people are jumping on board this digital marketing revolution.

eCommerce business models

There are many business models to choose from; the ideal one for you will depend on what type of business your run. Let’s explore what eCommerce business models there are to choose from.

Business to Consumer (B2C) model

The Business Consumer (B2C) model involves selling goods and services directly from a business to its customers. This is one of the most common eCommerce models, enabling businesses to interact with consumers individually, providing personalized services and products. With this model, businesses can easily target their customers through direct email campaigns, targeted advertisements, and other marketing initiatives.

Business to Business (B2B) model

The Business to Business (B2B) eCommerce model involves selling goods or services directly between two businesses. This eCommerce model is often used by wholesalers or suppliers that specialize in providing products and services to other companies. It can also be used by retailers who want to purchase items from a more significant supplier in bulk at a discounted rate. The primary benefit of the B2B model is that it allows businesses to quickly and efficiently meet their customer’s needs without having to stock large quantities of inventory on-site.

Consumer to Consumer (C2C) model

The Consumer to Consumer (C2C) eCommerce model is based on a peer-to-peer network where individuals can buy and sell goods directly. This eCommerce model is often used for selling secondhand items or for products that are difficult to find in stores. Sites like eBay and Craigslist are two famous examples of C2C eCommerce models. The primary benefit of this business model is that it allows individuals with unique needs or wants to find exactly what they’re looking for without having to contact multiple businesses.

Affiliate marketing

Affiliate marketing is an increasingly popular form of eCommerce that involves promoting a business’s product or service on behalf of another company. This model is often used by bloggers and influencers who promote products and services to their followers in exchange for a commission when someone makes a purchase. Affiliate marketing has become a popular way to monetize blogs and social media accounts, offering content creators an additional source of income.

Consumer to Government (C2G) model

The Consumer to Government (C2G) eCommerce model involves the online selling government services and goods. This eCommerce model is standard for taxes, licenses, permits, and other governmental processes. The primary benefit of this type of business model is that it allows individuals to quickly and conveniently take care of their government-related tasks without having to visit a physical facility.

Business to Government (B2G) model

The Business to Government (B2G) eCommerce model is similar to the B2B model. Still, this type of business model involves selling products and services directly to government entities instead of selling goods and services to other businesses. Companies that provide government contracts for goods or services often use this eCommerce model.

Getting started

Getting started in eCommerce can be surprisingly straightforward. First, it’s essential to consider what products or services you aim to provide online and then make a plan for how to reach your target customer base. Establishing an attractive and informative website and setting up payment processing such as PayPal or direct debit is critical, thankfully it’s just one click away.

You’ll also need to create processes for receiving orders, stocking inventory, monitoring the delivery of orders, and ensuring customer satisfaction. But most importantly, remember that the success of any eCommerce business requires patience and perseverance while also staying ahead of the curve in terms of trends and developments in the industry.

With that said

As you can see, several different types of eCommerce business models are available depending on what best suits your particular needs. From B2C to C2G models, understanding the different types of eCommerce business models can help ensure that you select the right one for your venture. With the right choice, you’ll be well-positioned to provide your customers with the best shopping experience possible.

Regardless of your chosen model, it’s important to remember that customer service is always vital to successful eCommerce businesses. Take the time to understand how each model works, and focus on providing exceptional customer satisfaction with every transaction. With the right approach, you can build a thriving eCommerce business that meets the needs of both your customers and your bottom line.

Post Views: 700

More from FictionTalk

AFFILIATE MARKETING

AI Marketing vs. Human Expertise: Who Wins the Battle and Who Wins the War?

Opinions expressed by Entrepreneur contributors are their own.

Uncover the truth about AI in marketing and why it’s a ticking time bomb for unprepared businesses! As AI revolutionizes the marketing landscape, understanding its long-term impact is crucial.

In this video, I dive deep into the reality of AI marketing, exposing the myths and revealing strategies to stay ahead of the curve. Learn why AI might play in your favor for the next 3 years, but could spell trouble if you’re not prepared for what’s coming. Discover how to leverage AI tools effectively while developing a future-sighted approach that will keep you competitive in an AI-driven world.

Download the free ‘AI Success Kit‘ (limited time only). And you’ll also get a free chapter from Ben’s brand new book, ‘The Wolf is at The Door – How to Survive and Thrive in an AI-Driven World.’

AFFILIATE MARKETING

5 Financial Blind Spots That Could Be Preventing You From Making More Money

Opinions expressed by Entrepreneur contributors are their own.

Money can often be the barrier between being stuck where you are or breaking through to the next level. This includes having or not having a budget, using it properly, hidden revenue or even misaligned goals — all of which influence your growth trajectory. These four common secrets have helped my company elevate our clients to the next level.

1. Financial transparency for ROI

The first blindspot we often notice with new clients is not having a clear reporting connection between your tools, like ads and a CRM like HubSpot, to see which channels drive the most significant return on investment (ROI). Do you know your best-performing channels? Or your best-performing piece of sales copy? What is the most opened document that leads to a closed deal?

And we’re not just talking about marketing and sales; this applies to many connected platforms — for example, the closed-loop revenue or your ERP systems. When things are not connected, they are disjointed and siloed. You end up flying blind. Without connecting your marketing tools with your revenue tools, and with that being CRMs, finance platforms, or ERPs, to name a few, there is a disconnect, and the arms and legs end up moving in different directions.

Here’s a simple example we see all the time: If you knew that one channel drove more deals by a 75% faster conversion rate, wouldn’t you invest more time and energy in that channel than one that only had a conversion rate of 10%? Many people don’t want to share the revenue numbers within the company, but all of that information informs the other departments; without sharing these revenue numbers, your money secret is keeping it in hidden silos.

2. Strategic investment for avoiding blind spots

Another financial blindspot is not investing in marketing. We have had prospects come in with no budget and no internal marketing team, but we want to grow by 150% and spend a total of $1,000. I wish achieving growth like this was possible, but unfortunately, it’s not. The old adage that you get what you pay for, or it takes money to make money, speaks the truth. Your investment goals should match your growth goals. The amount of money invested should be measured not just by short-term, quick wins but also by looking at long-term investment to growth.

You would never measure an HR department strictly on the number of hires. However, looking at the whole picture of longevity amongst many other important KPIs, You would not use an HR department for a few months. It is something that is constant and needs care and attention. Marketing is no different — if you strictly only measure marketing by the number of leads, you are missing out on the full picture. Marketing helps push leads through nurture campaigns, creates automation, leads scoring, builds new campaigns and tests, supports sales enablement activities and many other components. A buying cycle is rarely a straight line to click and buy unless we’re discussing Amazon.

That said, everyone has budgets, margins and bumper lanes they need to stay in. I am by no means saying throw your budget to the wind, but your goal should match your budget. If you have modest growth goals, be realistic about the budget needed to get there. Set incremental micro goals but stay the course for long-term growth.

Related: You Won’t Have a Strong Budget Until You Follow These 5 Tips

3. Data-driven decisions to save money

Another money secret that costs companies is spending without the data to back it. We had a company inquire about a new website, a full blow-up, new navigation, new content, new page layouts, migration onto a new CMS, a new theme and the works. They said they had a $75,000 budget for the whole project. In theory, it sounds great, right? Willing to invest? Check. Has a budget? Check. Know what they want the end result to be? Check. But when we asked them the next question, they looked at us like we were crazy, “Do you have data that backs the changes you are looking to make?” Are you running a tool like Hotjar to see real user data behind how these proposed changes will impact your existing inquiries and the only source the sales team was currently using for leads?

The answer was no. When the heat map was overlaid, do you know what happened? Well, they were looking to build that new navigation out and replace the old one — nearly 90% of the traffic was going to two pages of their site directly from the navigation, both of which they had originally wanted to remove. In this case, it wasn’t just about having the money but also about making sure the decisions you make with the budget are informed by real data: user data, sales data, marketing data and more. The more informed you can be by closing the loop on your data, the better your end result will be.

Related: Want to Be Better at Decision Making? Here are 5 Steps to Better Data-Driven Business Decisions

4. Modern marketing channels to drive growth

What is likely costing you the most is using old-school channels without the ability to measure. Companies have spent the last decade on traditional marketing channels and are switching to digital. The company’s historical growth has relied on things like trade shows, print, postcards and online magazines. We ask what the ROI you have seen by each channel is, and rarely can they share a specific revenue number and say it is for brand awareness. Some of the budgets can be over 50 to 100 thousand dollars spent on these traditional methods, but there is no ROI attached, yet they continue them.

When the pandemic happened, we saw a massive influx in businesses shifting from once only boots on the ground to digital. The lockdown changed everything; there were no more trade shows, no more door knocking and no one picking up their mail or faxes daily. It made traditional selling channels challenging and obsolete and forced a new level of openness to try new ways to get the job done. In the example of running online magazine ads there are lots of ways to capture them, we can use UTM tracking, referral analysis or create a custom landing page for the offer and capture the leads directly. Without running them to a landing page or form, you rely only on the online publication for leads and analytics. We’ve had people show a list of just names, no emails to follow up with, or only show a random number of visitors to the page, not a single name. It’s important to know what they will provide for reporting and tracking when you publish or use traditional channels. The rule of thumb is to use connections and tools that leverage old-school methods into technology and not blindly spend on channels that cannot be measured.

Stop wasting time, energy and revenue on these blind spots. They have easy solutions, so you can avoid them and focus on growing your business!

AFFILIATE MARKETING

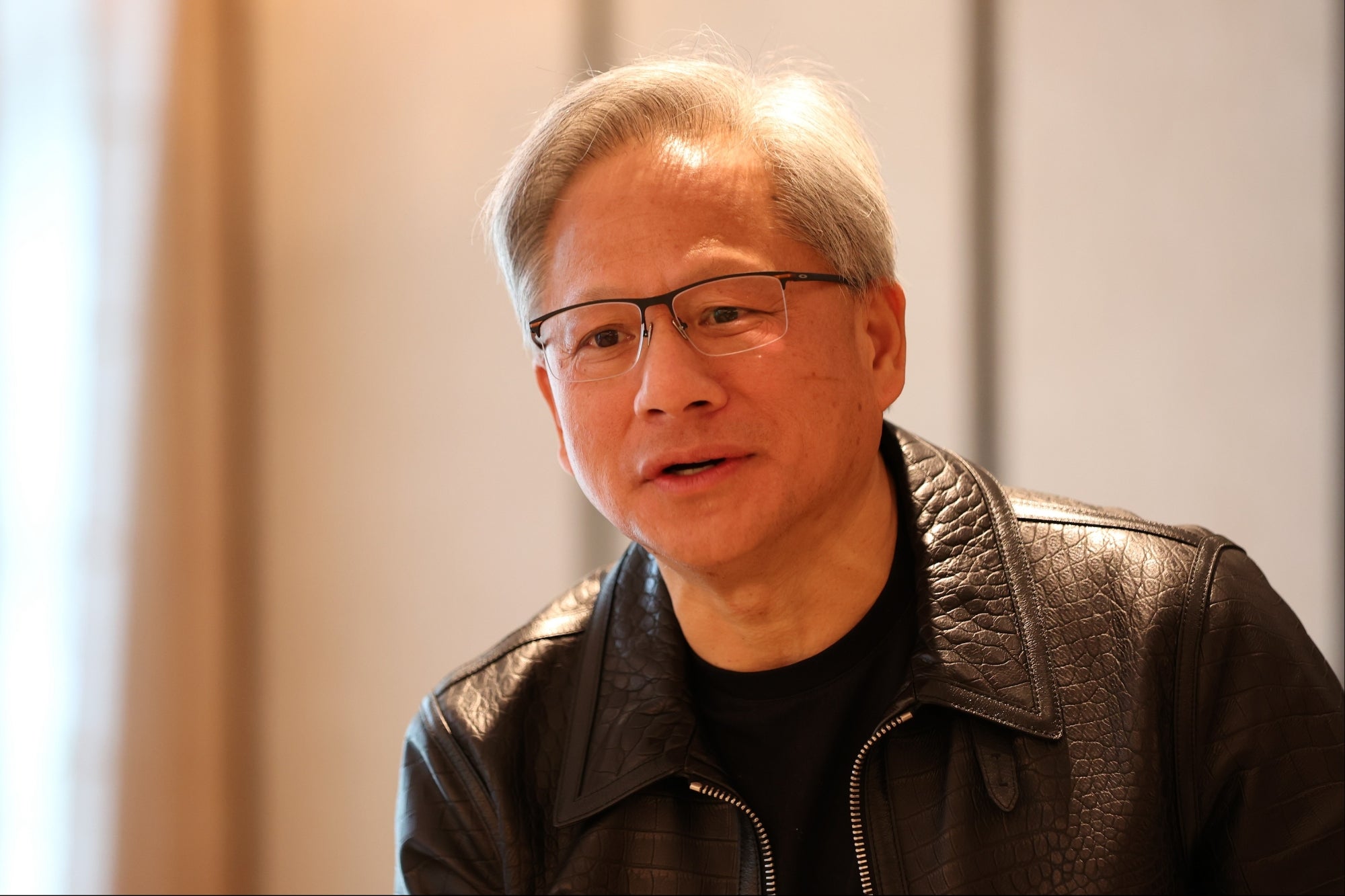

How Nvidia Pivoted From Graphics Card Maker to AI Chip Giant

A decade ago, Nvidia was a major graphics card maker, vying with competitors like AMD and Intel for dominance. Now it’s an AI giant with 70% to 95% of the market share for AI chips, and the brains of OpenAI’s ChatGPT. It’s also the best-performing stock with the highest return in the past 25 years.

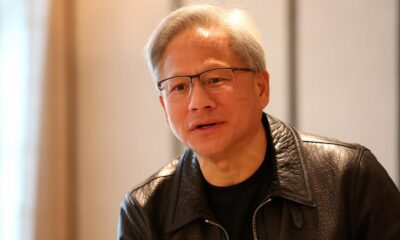

Why did Nvidia invest in AI chips over 10 years ago, ahead of the competition? CEO Jensen Huang and board member Mark Stevens, Nvidia’s two largest individual shareholders, talked to Sequoia Capital partner Roelof Botha to explain what Botha called “one of the most remarkable business pivots in history.”

Nvidia’s original product was 3D graphics cards for PC games, but company leaders noticed by the mid-2000s that the PC market was hitting a growth limit.

“We felt we were always gonna be boxed into the PC gaming market and always knocking heads with Intel if we didn’t develop a brand new market that nobody else was in,” Stevens explained.

Jensen Huang, co-founder and chief executive officer of Nvidia. Photographer: Lionel Ng/Bloomberg via Getty Images

That need for a new market intersected with a product Nvidia already had on hand: its graphics processor unit, or GPU, which could be used to power tasks outside of gaming. Researchers at universities across the world began exploring the graphics cards, eventually building advanced computers with them.

Related: Is It Too Late to Buy Nvidia? Former Morgan Stanley Strategist Says ‘Buy High, Sell Higher.’

Huang recalled meeting a quantum chemist in Taiwan who showed him a closet with a “giant array” of Nvidia’s GPUs on its shelves; house fans were rotating to keep the system cool.

“He said, ‘I built my own personal supercomputer.’ And he said to me that because of our work… he’s able to do his work in his lifetime,” Huang said.

Other researchers, like Meta AI chief Yann LeCun in New York, began reaching out to Nvidia about the computing power of its chips. Nvidia began considering the AI market when AI had yet to enter the mainstream and was a “zero billion dollar market” or a market that had yet to materialize.

“There was no guarantee that AI would ever really emerge because, keep in mind, AI had had many stops and starts over the last 40 years,” Stevens said. “I mean, AI has been around as a computer science concept for decades. But it had never really taken off as a huge market opportunity.”

Huang and other company leaders still believed in AI and decided to invest billions in the tech in the 2010s.

“This was a giant pivot for our company,” Huang said. “The company’s focus was steered away from its core business.”

Huang highlighted the extra cost, talent, and skills Nvidia had to account for with the pivot, as it affected the entire company. It took 10 to 15 years of effort, but that business decision led to Nvidia powering the AI revolution with an early ChatGPT partnership.

“Every CEO’s job is supposed to look around corners,” Huang said. “You want to be the person who believes the company can achieve more than the company believes it can.”

Related: How to Be a Billionaire By 25, According to a College Dropout Turned CEO Worth $1.6 Billion

-

SEARCHENGINES6 days ago

SEARCHENGINES6 days agoBillions Of Google goo.gl URLs To 404 In The Future

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: July 22, 2024

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Core Update Coming, Ranking Volatility, Bye Search Notes, AI Overviews, Ads & More

-

SEO6 days ago

SEO6 days ago11 Copyscape Alternatives To Check Plagiarism

-

SEO6 days ago

SEO6 days agoGoogle Warns Of Last Chance To Export Notes Search Data

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: July 23, 2024

-

AFFILIATE MARKETING6 days ago

AFFILIATE MARKETING6 days agoThe Top 5 AI Tools That Can Revolutionize Your Workflow and Boost Productivity

-

SEO4 days ago

SEO4 days agoSystem Builders – How AI Changes The Work Of SEO

You must be logged in to post a comment Login