MARKETING

How to calculate customer lifetime value and maximize it for your business

How valuable are your existing customers? It costs less to retain an existing customer than it does to find and attract a new one. Existing customers build value over time, and you can measure that value by tracking a metric called customer lifetime value, or CLV. It’s not just about the purchases your customers make, but about the relationships they build and bring to your business.

Key takeaways

- Customer lifetime value (CLV) measures the value a customer provides over the length of their relationship

- To calculate CLV, multiply the average order value by the average number of transactions per period by the expected lifetime of that customer

- Tracking CLV helps you identify your best customers, improve retention rates, reduce customer acquisition costs, develop more effective sales and marketing strategies, and improve your forecasting

What is customer lifetime value?

Customer lifetime value (often referred to as just lifetime value, or LTV) is a way to measure the value a customer brings to your business over the entire length of your relationship. At its most basic, CLV estimates the total income a customer can expect to generate for as long as that individual remains a customer. It’s a measurement and it’s a projection that attempts to quantify how much retaining a customer is worth to your business.

Know that while you may end up with a similar CLV number for a given customer, how that number is arrived at can differ significantly from customer to customer. Does a given customer generate value based on multiple low-dollar purchases or fewer higher-dollar sales? It’s possible for a customer you see only once a year to have a higher CLV than one you see every week—or vice versa.

How do you calculate customer lifetime value?

To calculate CLV, you need three separate inputs:

- Average number of transactions per period

- Expected length of engagement

This data is easily gathered via Salesforce or other CRM solutions—which can also help you analyze the data and provide further insights. Let’s look at each of these inputs separately.

Average order value

The first step in calculating CLV is to determine your average order value for a specific customer or customer type—that is, the dollar value of that customer’s average sale. It’s best to look at this value for a 12-month period to even out seasonal fluctuations. Go back too far, however, and inflation effects will tend to underestimate the average value.

Average number of transactions per period

Next, determine the average number of transactions made by that customer or customer type over an extended period of time. Going back just a year might not be enough. It’s better to gauge customer transactions over a three- to five-year period.

Expected length of engagement

Finally, you need to determine how long the average customer—not a specific customer—remains a customer. Some products and brands inspire lifelong loyalty, others have more transient customer bases. The expected length of customer engagement is a more objective measurement than the first two and requires you to make some hard choices.

Calculate CLV

With these three metrics in hand, you can now calculate CLV by multiplying the three of them together, like this:

Average transaction size x number of transactions x expected length of engagement = CLV

As an example, take the following numbers:

- Average transaction size of $100

- Average number of transactions per year of 4

- Expected length of engagement of 10 years (customers stay customers for 10 years, on average)

Multiply these three factors together and you get:

$100 x 4 x 10 = $40,000

That is, the lifetime value of this particular customer is $40,000. Put another way, losing this customer could cost you $40,000 in lifetime revenue.

How can you maximize customer lifetime value in your business?

Focusing on CLV has benefits to any business. In a recent survey, 81% of companies say increasing CLV results in more sales, 68% say it increases customer retention, 56% say it encourages brand loyalty, and 52% say it results in more timely marketing.

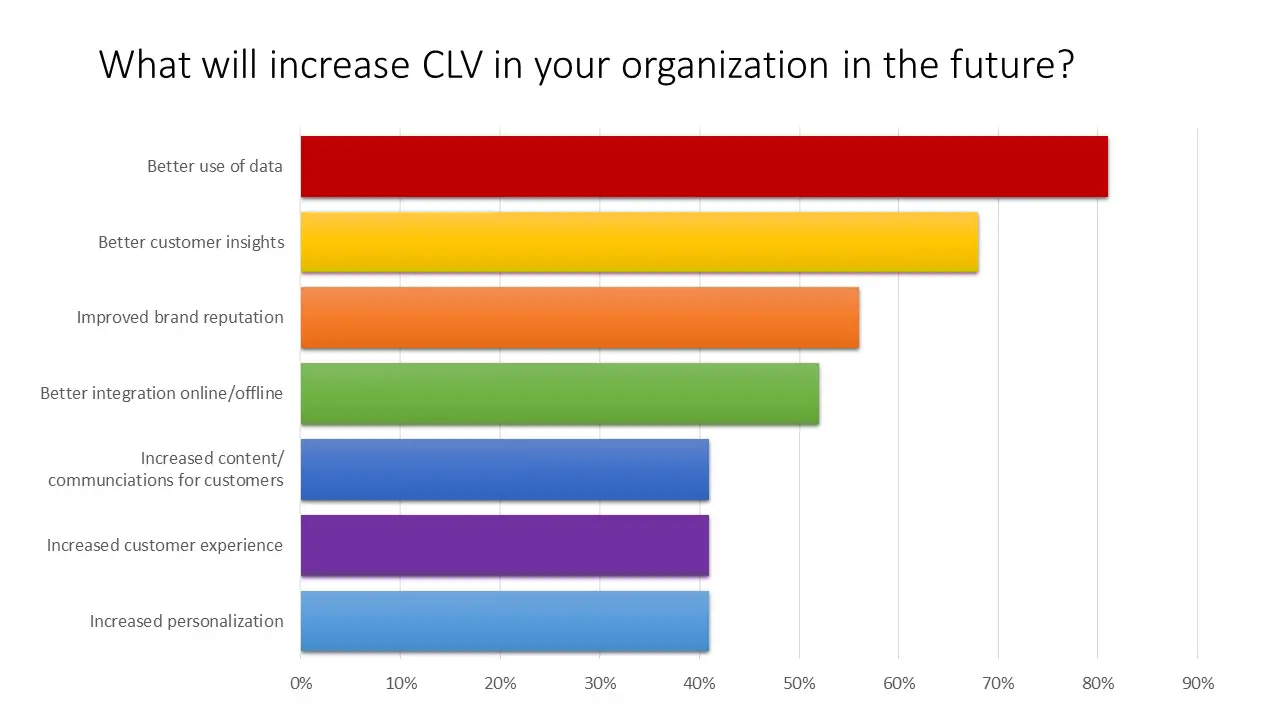

There are several approaches you can take to increase your company’s CLV, including better using your available data, extracting better insights in your customers, and improving your grand reputation. Here are a few more of the most significant ways your business can maximize customer lifetime value.

Identify and better serve your best customers

Calculating CLV for individual customers or customer segments helps you identify your best customers—those with the highest lifetime value. By segmenting customers in terms of CLV, you can better target customer products and offers to different groups of customers.

For example, you can send more offers to your best customers because you know they’re more inclined to buy from you. This could mean sending them more frequent email offers, inviting them to special “favorite customer” events, and promoting add-on sales that generate higher profit margins.

Improve retention rates

Studies have shown that it costs five times more to attract new customers than it does to retain existing ones. This is easily demonstrated by comparing your CLV with the cost of acquiring a new customer. If you have a low CLV and a high customer acquisition cost, you can’t afford to lose old customers. Tracking CLV forces you to pay attention to retaining your existing customers to maximize their lifetime value.

Optimize customer acquisition and reduce acquisition costs

While we’re on the topic of customer acquisition, analyzing existing high-CLV customers can help you identify potential customers with similar characteristics. If your high-CLV customers tend to live in a particular ZIP code, have a certain level of education, or share certain hobbies, you can target new customers in the same ZIP code, with the same education level, or who also participate in those hobbies.

By better targeting potential customers, you don’t waste your acquisition spend and end up not only attracting more customers but reducing your customer acquisition costs. You also attract more potential high-CLV customers.

Develop more effective sales and marketing efforts

When you dig deeper into the individual components of CLV, you can start making developing more effective sales and marketing strategies. Personalizing your efforts towards specific customer segments almost always produces better results.

In a real-world example of this, Tea Forte, a global luxury tea brand, improved CLV by 25% by using Optimizely to introduce personalized campaigns tailored to specific customer types. The better you understand what drives your customers, the more effectively you can market to them.

More accurate forecasting

Tracking CLV helps you make more accurate sales forecasts because you have a better handle on future revenue streams from your customer base. This in turn helps you make better-informed decisions about staffing, inventory and other costs. More detailed forecasting also leads to increased productivity and reduced costs, both of which positively impact your bottom line.

Let Optimizely help you utilize CLV in your business

When you want to better utilize CLV in your business, turn to the experts at Optimizely. Our Digital Experience Platform not only tracks the data you need to measure CLV, it also helps you provide a more personalized experience for your customers, which increases customer retention and increases CLV. We’ll work with you to turn your customer data into a compelling digital experience across all possible touchpoints.

Contact Optimizely today to learn how personalizing the customer experience increases CLV.

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-400x240.png)

![How AEO Will Impact Your Business's Google Visibility in 2026 Why Your Small Business’s Google Visibility in 2026 Depends on AEO [Webinar]](https://articles.entireweb.com/wp-content/uploads/2026/01/How-AEO-Will-Impact-Your-Businesss-Google-Visibility-in-2026-80x80.png)