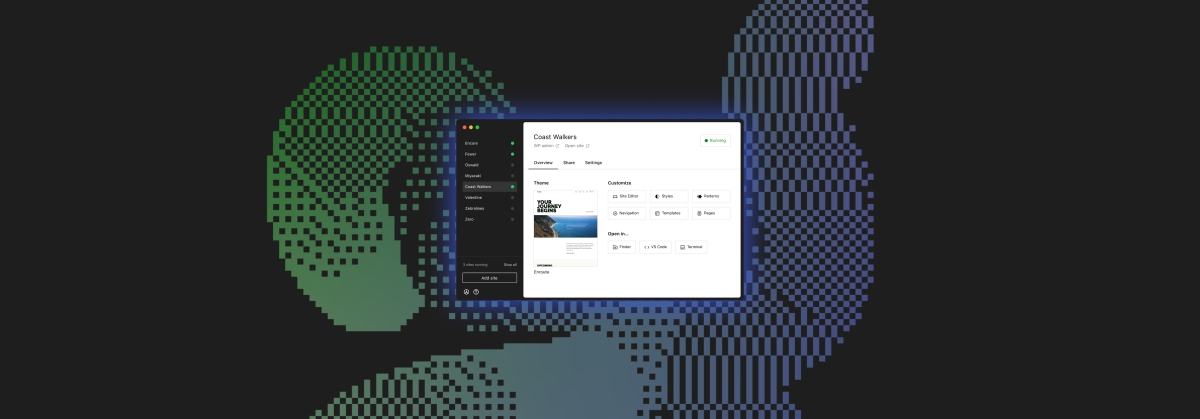

Meet Studio by WordPress.com, our new, free, open source local WordPress development environment.

WORDPRESS

7 Best Payment Gateways of 2023

Payment gateways are services that enable businesses to accept online payments. They act as intermediaries between the customer and the business, facilitating payments and protecting merchants and customers from fraud. Secure payment gateways are essential to the success of any business today.

Read on to learn more about our picks for the best payment gateways, how they work and how you can choose the one that’s right for your business.

Our Top Picks for the Best Payment Gateways

Best Payment Gateways Review

- Setup is fast and easy

- 24/7 email and phone support

- Wide variety of integrations

- Pricing details are confusing and opaque

- Not as cheap as other payment gateways

Why we chose it: Clover is one of the best payment gateways for small, brick-and-mortar businesses as it’s easy for non-technical people to use.

Clover’s features include reporting tools to track revenue, get aggregated sales across all your business locations, track total sales per employee, view end-of-day reports and analyze your busiest times. It also offers a rapid deposit option, which lets you access funds from your sales transactions within minutes (though this costs a 1% fee). Clover allows you to create physical and digital gift cards and accept payments via Apple Pay, Google Pay, Venmo and PayPal.

Clover’s pricing has four components: the upfront cost, monthly fees for hardware, transaction processing fees and a monthly fee to use Clover’s point-of-sale (POS) system. Clover combines these factors into three pricing tiers: Starter, Standard and Advanced.

These three tiers are set up differently for full-service dining restaurants, quick-service dining restaurants, retail stores, personal services, professional services and home and field services. On top of that, there are third-party sellers of Clover merchant services.

This is why Clover’s pricing is difficult to figure out. However, some business owners will appreciate the customization that Clover offers for different business types, as a spa will have different payment-related needs than an accountant, for example.

Clover offers over 300 integrations, including payroll software, meal delivery platforms, e-commerce platforms, accounting software and more. However, Clover doesn’t integrate with popular customer relationship management (CRM) providers like Zoho and Salesforce. It offers its own CRM features, but they may not be as comprehensive as dedicated CRM providers.

Clover has generally positive online reviews, with some mentions praising the system’s set up process and ease-of-use for in-person and cash sales. Frequent complaints include the number of fees Clover charges, poor customer service with no chat logs provided to customers and the company holding funds for lengthy periods.

- No monthly fee

- Transparent pricing with easy-to-understand fees

- Funds available within two business days

- Expensive for small or low-volume businesses

- No chat support

- Limited number of integrations compared to other payment gateways

Why we chose it: Like all payment gateways, Helcim has transaction fees, but unlike others, it doesn’t have a monthly fee. It also offers a unique bundle of features, such as a merchant account, a point-of-sale system, hosted payment pages, credit card processing and invoicing.

Helcim’s features include secure storage of customer and card information, inventory management and online payments. You’ll also get a virtual terminal to take credit card payments over the phone, online payment pages, and the ability to set up subscription plans and customized invoices.

Helcim’s point-of-sale software is included. The company’s card reader comes with a flat fee and no monthly fee, making it cheaper than other payment gateways.

Many businesses want to integrate payment gateways with their existing software, but Helcim offers far fewer integrations than other payment gateways. The company has built-in features like CRM, point-of-sale (POS) and e-commerce tools, but these may be limited for businesses that have more advanced or complex analytical needs. It does, however, integrate with QuickBooks and other e-commerce platforms.

Helcim has overall positive scores on several product review websites. Positive reviews frequently mention Helcim’s knowledgeable customer service team and being able to talk to a “real person.” A few negative reviews state that Helcim’s system can be clunky and slow.

- Recognizable name

- Easy to use

- Hundreds of integrations

- High fees, including high chargeback fee

- Not for high-volume businesses

- No offline payment processing

Why we chose it: PayPal is one of the best payment gateways for e-commerce because it’s easy to add to your website and, due to its name recognition, customers tend to trust it. In addition to its online features, PayPal can also be used to accept payments in person, including major credit cards and Venmo.

PayPal’s features include the ability to set up subscription plans, discounted transaction fees for nonprofits and payment processing in 200 countries and 100 currencies. It has no monthly fee, but its per-transaction fees are much higher than other payment gateways.

PayPal offers many integrations, including with Constant Contact, WooCommerce, Shopify, QuickBooks and Soho. However, its branding customization is more limited than other payment gateways — you can add your logo, but there’s not much else in terms of customization options. Therefore, the payment page will look like PayPal, not like your company’s.

Since Paypal is such a large company with several different business operations, online reviews vary. Positive reviews mention that PayPal is fast and easy to use, while complaints include poor customer service and high fees.

- No monthly fee or setup fee

- 24/7 phone support

- Extensive knowledge base available on its site

- Must give two months’ written notice to terminate contract

- Minimum sales volume of $120

- Not as easy to use for people without a technical background

- No chat support

Why we chose it: Adyen’s features include payment processing for 30 currencies and multiple countries, making it a good choice for merchants who process international transactions.

Ayden offers the ability to create virtual and physical gift cards and allows merchants to add a donation option at checkout so that customers can support specific causes. Its platform also offers analytical insights such as the effectiveness of each payment method, which customers spend the most and your loyalty program’s performance.

Adyen offers over 100 integrations with third-parties such as BigCommerce, WooCommerce, Salesforce and Magento. However, it doesn’t have integrations for QuickBooks or Intuit, two of the most widespread accounting software programs.

Adyen has limited options for you to customize your checkout form. Thus, if you want a payment page that fits your branding, you’ll need technical knowledge — something that many small business owners may not have.

As for online reviews, many positive comments focus on Adyen’s support of payment processing around the world. Frequent complaints involve the platform being hard to use, with a complicated interface, difficulty getting credit card payments on business sites and poor technical support.

- Customization tool lets you create branded invoices

- Flat monthly fee is cost effective for high-volume businesses

- Highly praised customer support

- Not a good option for businesses doing under $5,000 in transactions per month

- U.S.-based businesses only

Why we chose it: Stax’s comprehensive customization tools make tailor-made branding easier than other payment gateways. Stax’s custom branding lets you tailor invoices, receipts and website payments to your brand.

Stax also has many integrations, including popular business software programs like QuickBooks, Xero, Hubspot, MS Teams, Zoho, Slack, Calendly and Google Docs.

Unlike most other payment gateways, Stax charges a flat monthly fee instead of a percentage of each transaction (however, there are still flat per-transaction fees).

With Stax, you’ll get same-day access to your funds. You can also set up digital gift cards, schedule future and recurring payments, create payment links that you can send via email or text and take payments over the phone.

Looking at several different review websites, Stax is one of the highest-rated payment gateways in the industry. Positive reviews frequently mention Stax’s excellent customer service while negative reviews — although sparse — cited confusion over Stax’s pricing model.

- 24/7 phone and chat support

- Offers many integrations

- Excellent anti-fraud and security tools available

- Requires more programming knowledge than other payment gateways

- Excludes “high-risk businesses,” which is open to Stripe’s interpretation

- Takes 7 to 14 days to receive your first payout

Why we chose it: Stripe’s more than 660 integrations make it an extremely flexible payment gateway for businesses of all sizes, from startups to large corporations. Its software development kits and application programming interfaces make it highly programmable for businesses that want to incorporate Stripe into their mobile app or software.

Stripe’s features include low-cost, automated clearing house processing, the ability to process online payments in over 135 currencies, a customizable checkout process and fraud-detection and risk-management tools. This flexibility extends to its month-to-month contract terms, so you’re not locked into a lengthy contract. Stripe’s fees are comparable to other payment gateway providers.

Online reviews overwhelmingly praise Stripe’s customer service. It offers 24/7 chat, phone and email support, extensive API documentation and detailed FAQs. Stripe also provides three levels of additional support as add-ons, including a dedicated team for your account so you always talk to the same specialists, prioritized ticket routing for faster support and high-volume event management for peak transaction days.

Stripe offers a high degree of customization, including the ability to adapt your checkout process to your company’s branding and include information about your return and refund policies. Business owners can also customize invoice PDFs, hosted invoices and email receipts. Stripe’s numerous integrations allow you to build a customized ecosystem of integrated tools, from CRM platforms to POS systems, accounting software and more.

- Transparent, simple pricing

- Easy-to-use payment portal

- Extensive features

- Limited payment processing for non-U.S. countries

- Can’t use on Windows desktop or tablet

Why we chose it: Square was one of the first payment gateways and has become known for its ease of use. Square has a massive user base and market share, making it a stable, trustworthy provider.

Square’s simple-to-use tools allow business owners to create a professional online presence without any programming or specialized tech skills. You can build a site for free using Square as the host (although a custom domain name has an extra fee), or take Square payments on sites created using other online store builders.

Square has one basic plan with no monthly fee, as well as several more complex plans with monthly fees. Every plan comes with live phone support and dispute management. Square’s standard POS software, which is available as a mobile app, is free if you use it on a device you own. You can also sign up for a monthly POS plan with more advanced features, such as getting alerts when inventory is running low.

Square offers a wide array of features for varying extra monthly fees. The features include payroll, invoices, email marketing, text message marketing, setting up an online store, POS selling, physical and digital gift cards, team scheduling and a loyalty rewards program. You can also create a Square checking account with no fees, no minimum balance and no credit check required.

Square’s website-building options include custom colors and fonts, but that’s about it. You also can’t alter the code in a Square website, so you can’t bring a developer in to spruce it up. There is customization for checkout, receipts and invoices but you can’t include your business address in an invoice.

Square offers many integrations, including QuickBooks, Groupon, Mailchimp and many others. It doesn’t, however, integrate with the most popular CRMs. Instead, Square offers its own CRM features like Customer Directory, Square Loyalty and Square Marketing.

Square’s online positive reviews praise its ease of use and robust business analytics. Complaints include poor customer service and the company putting money on hold for suspected fraud with little justification.

Other payment gateways we considered

Vagaro

- Easy to set up and use

- Can keep useful customer records, including videos, photos, PDFs and customer service preferences

- No free plan

- Hardware is much more expensive than other payment gateways’ devices

- Limited availability

Vagaro is a POS system that is easy to set up and offers solid booking, payroll, scheduling, marketing and HR tools. However, it didn’t make our list because it’s only available to beauty, wellness and fitness professionals.

Chase Payment Solutions

- Cheaper-than-average flat-rate prices

- Funds available on the next business day (if you have a Chase checking account)

- Chase lets third parties resell its service, which can result in a markup

- Not ideal for high-volume businesses with over $5 million in sales

Chase Payment Solutions offers a wide variety of features, including mobile payments with its mobile checkout app, credit card terminals, the ability to apply for a business line of credit and developer tools. However, it didn’t make our list because its standout feature — next-day access to funds — requires you to have a Chase checking account.

Payment Gateways Guide

What is a payment gateway?

Payment gateways are tools that merchants use to take payments from customers. While there is a lot of overlap, the best payment gateways aren’t necessarily the same as the best credit card processing companies because credit card processors execute the financial transaction, while payment gateways are web-based mediators to financial transactions.

An online payment gateway, which is cloud-based, allows merchants to receive online payments from their customers. A brick-and-mortar store’s payment gateway is a POS system or a card reader. For example, if you book a flight online through a website, that website will offer you several payment options. That website uses a payment gateway service that allows you to pay using the options it gives you (e.g., PayPal, credit card).

How do payment gateways work?

Before looking at how payment gateways work, it’s helpful to understand the key stakeholders involved in a payment-gateway transaction:

- Merchant: The person or business that makes the sale

- Cardholder: The customer purchasing the good or service

- Issuing bank: The financial institution that holds the customer’s account. This could be a credit card account or a checking account linked to a debit card.

- Acquiring bank: The financial institution that holds the merchant’s account

- Card schemes: Payment networks that manage payment transactions, such as Visa, Mastercard or American Express

A payment gateway connects all of these stakeholders in the payment process.

- The cardholder initiates a purchase, such as clicking a “buy now” button on a business’s website.

- The payment gateway checks with the issuing bank to ensure that there are sufficient funds in the customer’s account or the transaction doesn’t exceed their credit limit.

- The payment gateway sends encrypted card information to the card schemes so they can process the transaction.

- The card schemes approve the transaction, and the payment gateway sends the information back to the merchant to finish the transaction.

- The payment gateway sends the information to the acquiring bank so the money can move from the issuing bank to the merchant’s account.

How to pick a payment gateway

When doing a comparison of payment gateways to find the best one for your business, you may want to ask yourself the following questions:

- Is the payment gateway available in both your country and your customers’ countries?

- Which payment methods does it accept, and are these the ones your customers use?

- Does it offer an in-person point-of-sale (POS) system, if you need one?

- Does it easily integrate with your existing software systems?

- How much will it cost, given any add-ons your company will need and your sales volume?

When you’re looking for the best online payment gateways, it’s best to consider your specific needs. For example, the best payment gateways for a small business will vary based on factors like monthly sales volume and what your business sells.

Below are some of the key considerations you should make when choosing a payment gateway.

Look at how much you spend per month

When looking at a payment gateway, consider how much you’ll have to spend per month under its pricing scheme. Some payment processing gateways are most cost-effective for businesses that reach a certain threshold in their number of monthly transactions or their total monthly amount sold. Others have more favorable pricing for small businesses or startups.

Understand your target shopper’s spending habits

Understand how your target shopper typically pays. Depending on the payment gateway you choose, you might not offer the type of payment that a substantial portion of your clients use. For example, some of your customers might not use credit card payments and may prefer to make purchases via cryptocurrency or Venmo.

Make sure you pick the payment gateway that offers all the forms of payment your customers could use.

Determine where you’re selling most frequently

Are you selling most frequently online or in person? Do you need a system that can accept offline payments for times when you don’t have Wi-Fi? If you’re a brick-and-mortar business, you’ll want to make sure you consider only payment gateways that offer the best point-of-sale systems on the market.

Payment Gateway FAQ

Which payment gateways work with Payoneer?

Payoneer integrates with ecommerce platforms like Shoplazza, Ueeshop, WooCommerce, Magento and Shopline. You can also use it to transfer funds from certain payment gateways including Stripe and PayPal. However, Payoneer isn’t necessarily a payment gateway option because it doesn’t take a credit card number and doesn’t charge a purchase immediately. It’s more suitable for freelancers and sole proprietors who need to invoice clients for later payment.

Which payment gateways have OFAC restrictions?

So if you’re a U.S. person, you won’t be able to find a payment gateway that doesn’t have OFAC restrictions — and even if you could, it would inherently be an untrustworthy service as it would be facilitating illegal activity.

If you’re not a U.S. person and need options for high-risk payment gateways (i.e., payment gateways that allow you to do business with people in U.S.-sanctioned countries), consider PaymentCloud, which specializes in high-risk businesses. Keep in mind that many payment gateways have payment prohibitions on OFAC countries, regardless of whether you’re a U.S. person.

How much do payment gateways charge?

Some payment gateways charge interchange fees plus a percentage of the transaction and a per-transaction fee. Interchange fees are transaction fees that the merchant’s bank has to pay when a customer uses a credit or debit card. The fees go to the card issuer bank to cover its costs. Payment gateways do not set interchange fees, which can vary over time.

How We Chose the Best Payment Gateways

As part of our methodology for creating this list of the best payment gateways, we looked at:

- Customer satisfaction reported on various review sites

- Ease of use for people without technical or programming skills

- Transparent, easy-to-understand pricing

- Variety of integrations with other business software on offer

- Ability to customize the customer experience to your business’ branding

Summary of Money’s Best Payment Gateways of 2023

WORDPRESS

26 Best Beaver Builder Themes and Templates (2024)

Are you looking for the best Beaver Builder themes and templates?

There are many WordPress themes and templates built specifically for Beaver Builder to help you quickly create professional websites. Using such a theme or template makes the process a lot faster without compromising on design.

In this article, we will share some of the best Beaver Builder themes and templates that you can use.

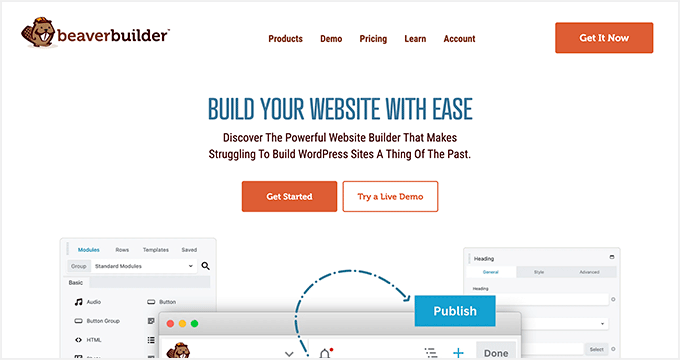

What Is Beaver Builder?

Beaver Builder is one of the best drag and drop WordPress page builder plugins on the market. It allows you to easily create beautiful websites and landing pages without writing any code.

Using the point-and-click tools, you can create highly engaging designs with a live preview. You can customize every aspect of your layouts, including custom headers, footers, sidebars, and widgets.

By default, Beaver Builder comes with dozens of ready-made templates that you can use as a starter point. It works with any WordPress theme, but using Beaver Builder-ready themes gives you even more flexibility. For more details, see our Beaver Builder review.

Expert Tip: If you are looking for a Beaver Builder alternative, then we recommend SeedProd. It’s a powerful WordPress page builder that lets you easily create custom landing pages, layouts, and themes.

Here’s how to create a completely custom WordPress theme with SeedProd (no code required).

What’s the Difference Between WordPress Theme vs. Template?

A WordPress theme is a complete package including the design, layout, features, and web pages for your site. You can use a theme to create your website without the help of any other resource. It comes with all the coding files and CSS that you need to style your website.

On the other hand, a page template is a single page layout that you can use to create landing pages or other custom pages such as a coming soon page, about us page, etc.

You can also make single page websites with WordPress templates. However, you’d still need to use third-party WordPress plugins to add features and functionality to your site.

Now that you know the difference between WordPress theme vs. template, let’s take a look at the best Beaver Builder themes and templates for your website.

Note: You also need a domain name and web hosting for your website before you can install a theme. A domain name is your site’s address on the web, like wpbeginner.com or google.com. Web hosting is the storage for all your website files.

If you don’t yet have web hosting, Bluehost is offering a great deal for WPBeginner readers. This gives you cheap web hosting plus a FREE domain name and SSL certification.

Once you have your web hosting account set up, you need to install WordPress. Then, you can choose from our best Beaver Builder themes and templates.

Best Beaver Builder Themes

There are hundreds of WordPress themes that are compatible with Beaver Builder.

However, the themes below have gone through additional review to make sure they are compatible with Beaver Builder. We specifically tested each of these themes with the Beaver Builder plugin to make sure that they work as they should.

1. Astra

Astra is a popular WordPress multi-purpose theme built for all types of websites. It’s fully compatible with drag-and-drop page builders, including Beaver Builder, as well as other options like Elementor. It also comes with dozens of starter sites and demos that you can import with 1-click and edit with Beaver Builder.

Astra is one of the best WordPress themes. It’s feature-rich with paid extensions and add-ons to add more options to your WordPress website. Every aspect of theme design can be fully customized, and you can even create your own custom layouts.

Even the free version of Astra is designed for good SEO (search engine optimization). This helps your website rank well in Google and other search engines.

2. Hestia Pro

Hestia Pro is a powerful WordPress theme that works great with Beaver Builder as well as with other popular page builder plugins.

With Hestia Pro, you get a 1-click demo content installer to help you get started right away. You can use Beaver Builder to change the content and images on the web pages.

This theme works with all popular WordPress plugins to extend functionality and add more features. Hestia Pro also fully supports WPML to create a multilingual WordPress site.

3. OceanWP

OceanWP is an excellent WordPress theme that fully integrates with Beaver Builder to customize your website. It’s packed with dozens of layouts and templates. You can install a web template to set up the structure of your website and make changes to the layout using Beaver Builder.

It comes with multiple color schemes, fonts, parallax scrolling, background images, and custom widgets. It’s also highly optimized for SEO to help you get more traffic from search engines.

4. Sydney Pro

Sydney Pro is a stylish WordPress Beaver Builder theme designed to create beautiful websites. It ships with homepage content blocks to add images, elements, widgets, and content in an organized way. It also allows you to include a featured content slider in the header section of your website.

The theme offers space for a custom logo, navigation menu, call-to-action button, and social media icons. It’s easy to set up with Beaver Builder and the WordPress customizer.

5. Potenza

Potenza is a one-page WordPress theme crafted beautifully for all kinds of websites. It’s fully customizable using the Beaver Builder page builder. This theme has a flexible layout with proper sections to add a navigation menu, image slider, content elements, widgets, testimonials, and footer on the homepage.

The theme can be customized for color choices, font styles, background images, and more. It supports WooCommerce and can be used to start an online store.

6. GeneratePress

GeneratePress is a great Beaver Builder theme for WordPress websites. It has a modern and stylish layout with all the features you need. It also comes with paid modules and extensions to add more options to your website.

You will find extensive theme options to control colors, fonts, the background, and other layout settings. GeneratePress is optimized for performance and speed, improving your site’s user experience and search rankings.

7. Customify

Customify is a simple WordPress theme designed for page builder plugins, including Beaver Builder. All design elements are easy to customize using the drag-and-drop page builder. It gives you the option for real-time editing.

It comes with multiple pre-built website demos that you can use to quickly start a blog or website. Customify also allows you to create your custom layouts using Beaver Builder.

8. Page Builder Framework

Page Builder Framework is a WordPress theme built specifically for page builders like Beaver Builder. It comes with flexible layout settings and an impressive set of features. It also offers premium extensions for transparent headers, sticky navigation, and Adobe Fonts.

It can be used to create a website for any business niche. Page Builder Framework is optimized for SEO and supports WooCommerce out of the box.

9. Lense

Lense is a WordPress photography theme designed to create beautiful websites and blogs for photographers, portfolios, and digital agencies. It’s compatible with the Beaver Builder drag-and-drop page builder and includes multiple image gallery layouts, fullscreen templates, a sidebar navigation menu, and a custom logo.

Other important features include color selection, a separate blog page, sidebar widgets, image archives, page templates, and featured content sections.

10. Neve

Neve is a lightweight and feature-rich WordPress theme. It fully integrates with Beaver Builder to customize each section of your website quickly. This theme has beautiful typography, a navigation menu, a custom logo, a header background image, and parallax scrolling.

It comes with a 1-minute installer to import the demo content and replace it with your content to launch the website. Neve has eCommerce settings and cart options to run an online store easily.

Best Beaver Builder Templates

Beaver Builder offers beautiful, ready-made templates that can be used as landing pages for any website niche. These templates can be edited with the drag-and-drop page builder.

To install and use the Beaver Builder templates, you need to download and activate the Beaver Builder plugin.

Now, let’s take a look at some of the best Beaver Builder templates.

1. Photography

Photography is a Beaver Builder template for photographers, artists, and bloggers. It has an attractive layout to create your photography landing page.

The dark color in the background makes your photos look stunning. You can also use this template to get more leads online.

2. Creative Agency

Creative Agency is a beautiful Beaver Builder template for marketing and web agencies, small businesses, and online stores. It supports WooCommerce to showcase your products beautifully.

It has a simple layout with a minimalist design, which creates a nice user experience.

3. Small Business

Small Business is a perfect Beaver Builder business template. It has a minimal and sleek design to promote business landing pages.

The template comes with a fullscreen background image and a call-to-action button. It uses beautiful typography with bold fonts, which makes your text more noticeable.

4. Construction

Construction is a stylish Beaver Builder template for real estate, contractors, and construction businesses. Its modern layout creates a great first impression.

With Beaver Builder’s Construction template, you can create beautiful landing pages to promote your business and services.

5. Fullscreen

Fullscreen is a minimalist Beaver Builder template suitable for any website. It can be used to create fullscreen landing pages with text and a call-to-action button.

You can use the Beaver Builder drag-and-drop builder to customize the colors, background, and fonts to match your brand colors.

6. Editorial

Editorial is an excellent Beaver Builder template for bloggers, editors, online magazines, and authors. It offers a fullscreen background image for your landing page.

You can also add content in the sections below the header area. It’s designed to make your content stand out and increase your page views.

7. Restaurant

Restaurant is a beautiful Beaver Builder template for food and recipe blogs, restaurants, and cafes. It has crisp typography and a dark background, giving your landing page a very modern look.

The template also has custom icons, elegant typography, and CSS animations to create an interactive user experience.

8. Musician

Musician is a Beaver Builder music template for DJs, bands, artists, singers, and performers. It features large-sized buttons for call-to-action and redirection to your landing pages. It also uses bold fonts to create a casual and entertaining experience for visitors.

9. Crossfit

Crossfit is a modern Beaver Builder template for the gym, CrossFit, yoga, and fitness websites. It features a stunning layout with an impressive header image. It can also be used with any WordPress theme for CrossFit and gyms to attract more customers.

10. Family Church

Family Church is a Beaver Builder template for church services, non-profits, and religious websites. It has a beautiful combination of fonts and colors, a custom background image, and an attractive layout. You can add your own content and images with the Beaver Builder page builder.

11. Coming Soon

Coming Soon is a simple and neat Beaver Builder template for your coming soon page. It features a custom tagline, a countdown timer, and an email newsletter subscription box.

You can use the WordPress customizer with its live preview for easy customization.

12. Law Firm

Law Firm is the perfect Beaver builder template to create a beautiful landing page for your legal firm’s website. It’s highly customizable using the Beaver Builder page builder, and you can easily change the background color, text, font style, and more.

13. eBook

eBook is a professional Beaver Builder template for writers, bloggers, authors, online libraries, and literary websites. The template features a large image on the top with your call to action text.

It’s compatible with WooCommerce, so you can showcase and organize all your eBooks. You can also use it to create a landing page for a single eBook.

14. General Business

General Business is a Beaver Builder business template for online agencies, brands, and small businesses. It features a header section on the top, followed by your most important content.

This template has space for your custom logo, full-width featured background, tagline, and call-to-action button. It can be edited with the Beaver Builder and WordPress Live Customizer.

15. Mobile App

Mobile App is a clean and sleek Beaver Builder app template designed to showcase your mobile apps, gadgets, and accessories. It offers a simple layout with a white background.

It’s easy to set up using Beaver Builder page builder. The Mobile App template can also be used to promote your apps and boost the number of downloads.

16. Educational

Educational is an elegant Beaver Builder template for schools, universities, libraries, and private institutions. It can be used to create landing page designs to promote an online course, announce new classes, or attract new students. It’s fully customizable, so you can replace the default content with your own.

We hope this article helped you find the best Beaver Builder themes and templates for WordPress. You may also want to check out our other WordPress guides for your website.

Best WordPress Guides for Growing Your Site

If you liked this article, then please subscribe to our YouTube Channel for WordPress video tutorials. You can also find us on Twitter and Facebook.

WORDPRESS

Your New Favorite Way to Develop WordPress Locally – WordPress.com News

Say goodbye to manual tool configuration, slow site setup, and clunky local development workflows, and say hello to Studio by WordPress.com, our new, free, open source local WordPress development environment.

We’ve built Studio to be the fastest and simplest way to build WordPress sites locally.

Designed to empower developers, designers, and site builders, Studio offers a seamless solution for creating and running WordPress sites directly on your local machine, as well as showcasing work-in-progress sites with your clients, teams, and colleagues.

Check out a few of our favorite features in the video below:

A new way to develop WordPress locally, available for free

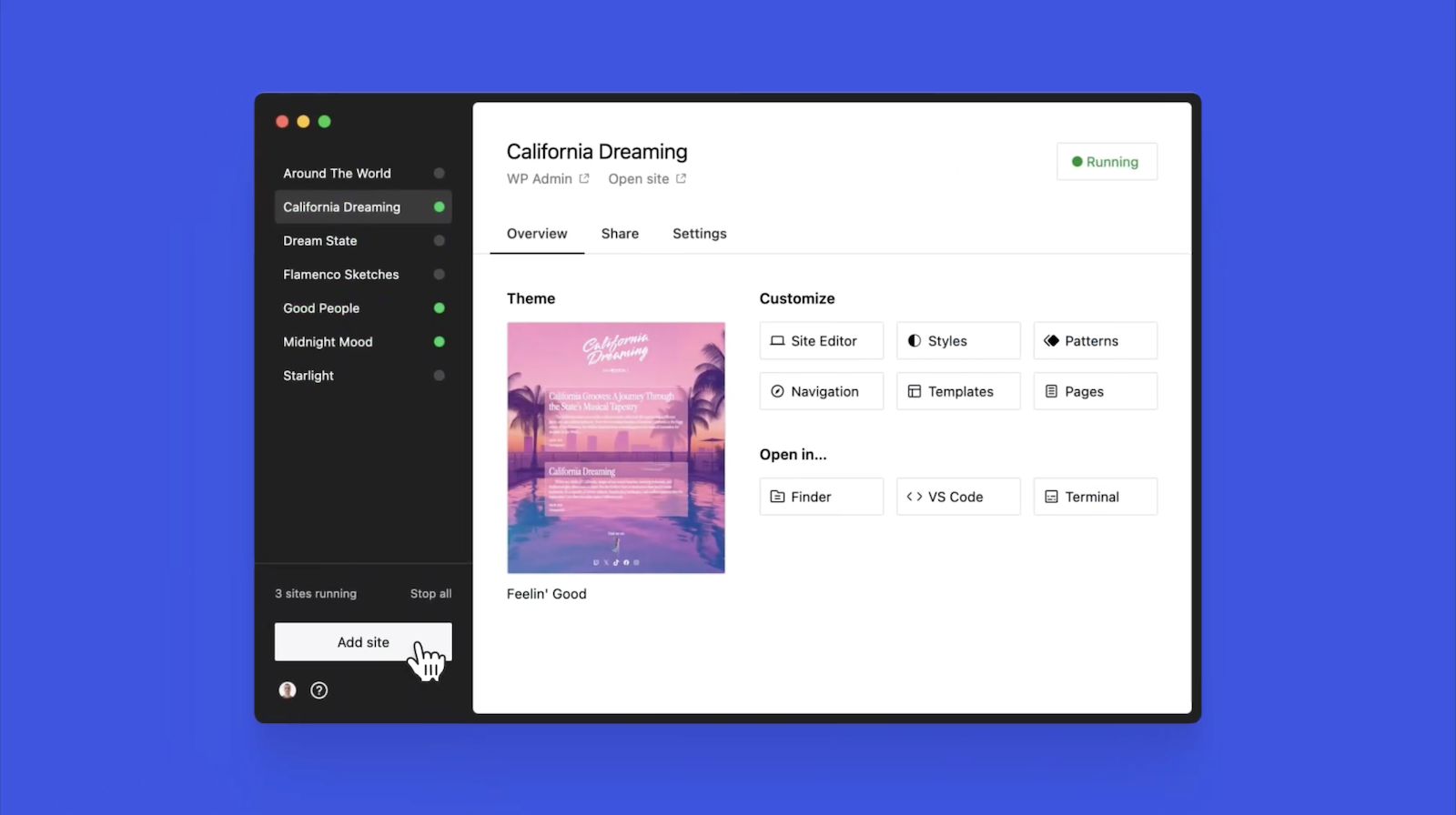

Studio is now available to use for free on Mac*, and you can get up and running with a new local site in just a few minutes:

- Download Studio for Mac.

- Install and open Studio.

- Click Add site, and you’re done!

Once you have a local site running, you can access WP Admin, the Site Editor, global styles, and patterns, all with just one click—and without needing to remember and enter a username or password.

You can even open your local sites in your favorite development tools, such as VS Code, PhpStorm, Terminal, and Finder, making it even easier to add Studio to your existing development workflow.

Plus, Studio is open source; feel free to fork away on GitHub.

*A Windows version of Studio is coming soon, and you can request early access here.

Effortlessly share your work and keep moving forward

In the realm of web development, showcasing local work has often been a challenge when projects live solely on your machine. With Studio’s demo sites, you have a convenient, built-in solution for sharing your progress with your team, clients, or designers.

These publicly-accessible demo sites, hosted on WordPress.com, are a convenient way to share your work without the need for complex server setups or lengthy deployments. In less than 15 seconds, you can have a shareable link to your local site that stays active for seven days.

The best part? Demo sites can be refreshed to reflect your latest build, allowing you to easily convey any updates or changes!

Breaking free from traditional constraints

Unlike traditional local environment tools like MAMP or Docker, Studio takes a fresh approach to local WordPress development. Studio is a lightweight and efficient solution that minimizes overhead and maximizes simplicity by forgoing the need for web servers, MySQL servers, or virtualization technologies.

Behind the scenes, Studio uses WordPress Playground, the WebAssembly-powered PHP binary. Thanks to this technology, there is no need to use a traditional web server, making your development experience much quicker and smoother.

Say goodbye to complex setups and compatibility issues. Studio makes it easier than ever to build and manage WordPress sites locally.

Let’s get building

At WordPress.com, we’re committed to making your website management experience seamless. In the last few years alone, we launched staging sites with synchronization features, SSH and WP-CLI access, global edge caching, GitHub Deployments, and more.

Studio is yet another powerful feature to add to your toolkit. Stay tuned for more exciting updates, and remember to follow our blog to stay in the loop.

And, of course, download Studio today. Your local development workflow will thank you.

Major kudos to the Studio team on this launch! Antonio Sejas, Antony Agrios, Kateryna Kodonenko, Philip Jackson, Carlos García Prim, David Calhoun, Derek Blank, Siobhan Bamber, Tanner Stokes, Matt West, Adam Zielinski, Brandon Payton, Berislav Grgicak, Alexa Peduzzi, Jeremy Massel, Gio Lodi, Olivier Halligon, Matthew Denton, Ian Stewart, Daniel Bachhuber, Kei Takagi, Claudiu Filip, Niranjan Uma Shankar, Noemí Sánchez, and our beta testers.

Join 110.2M other subscribers

WORDPRESS

Smooth Transition: A Comprehensive Guide to Migrating from WooCommerce to Shopify

Are you considering migrating from WooCommerce to Shopify but feeling overwhelmed by the process? Fear not! This comprehensive guide is designed to walk you through every step of the migration journey, ensuring a smooth transition for your online store. Whether you’re looking to capitalize on Shopify’s user-friendly interface or seek better scalability for your growing business, this guide has covered you. Let’s dive into the essential steps and strategies for seamlessly migrating from WooCommerce to Shopify.

Understanding the Migration Process

Assessing Your Current WooCommerce Setup

Before embarking on the migration journey, take a thorough inventory of your current WooCommerce setup. Identify your products, categories, customers, and any customizations you’ve made to your store. This assessment will provide a clear roadmap for transferring your data to Shopify without missing any crucial elements.

Choosing the Right Shopify Plan

Shopify offers a range of plans tailored to different business needs, from basic to advanced. Take the time to evaluate your requirements and select the plan that aligns best with your budget and growth goals. Whether you’re a small startup or an established enterprise, Shopify has a plan to suit your needs.

Preparing Your Data for Migration

Backing Up Your WooCommerce Data

Before initiating the migration process, creating a backup of your WooCommerce data is essential. This ensures that you have a safety net in case anything goes awry during the transition. Export your product listings, customer information, order history, and other relevant WooCommerce data.

Importing Your Data into Shopify

Once you’ve backed up your WooCommerce data, it’s time to import it into Shopify. Shopify provides tools and apps that streamline the data migration process, making it easy to transfer your products, customers, and orders seamlessly. Follow the step-by-step instructions provided by Shopify to upload your data accurately.

Additionally, if you’re migrating from WooCommerce to Shopify, it’s crucial to understand the specific steps involved in this process. Ensure that you follow the recommended procedures and utilize the available resources to facilitate a smooth transition.

Designing Your Shopify Store

Choosing a Theme

One of the perks of migrating to Shopify is access to a wide range of professionally designed themes. Browse Shopify’s theme library to find a design that reflects your brand identity and complements your products. Whether you prefer a minimalist aesthetic or a bold, eye-catching layout, Shopify has a theme to suit your style.

Customizing Your Theme

Once you’ve selected a theme, customize it to align with your brand’s look and feel. Shopify’s intuitive drag-and-drop editor makes it easy to tweak your theme’s layout, colors, fonts, and imagery without any coding knowledge required. Experiment with different customization options until you’re satisfied with the overall design of your Shopify store.

Configuring Your Settings and Features

Setting Up Payment Gateways

Shopify offers a variety of payment gateways to accommodate different customer preferences. Configure your preferred payment methods, including credit cards, PayPal, Apple Pay, and more, to provide a seamless checkout experience for your customers. Ensure that your payment gateways are integrated securely to protect sensitive customer information.

Managing Shipping Options

Streamline your shipping process by configuring your shipping settings in Shopify. Set up shipping zones, rates, and fulfillment preferences to ensure accurate shipping costs and delivery times for your customers. Shopify’s built-in shipping tools make it easy to manage your shipping logistics efficiently.

Launching Your Shopify Store

Testing Your Store

Before going live with your Shopify store, thoroughly test its functionality to identify and resolve any issues. Conduct test transactions, navigate the checkout process, and review your store’s performance on different devices and browsers. Address any bugs or discrepancies to ensure a smooth launch for your Shopify store.

Announcing Your Launch

Once you’re satisfied with the functionality and design of your Shopify store, it’s time to announce your launch to the world. Generate excitement among your audience by promoting your new store on social media, email newsletters, and other marketing channels. Offer exclusive deals or discounts to incentivize customers to explore your new Shopify storefront.

Post-Migration Optimization

Monitoring Performance Metrics

After migrating to Shopify, monitor your store’s performance metrics to gauge its success. Track key metrics such as traffic, conversion rates, and average order value to identify areas for improvement. Use Shopify’s built-in analytics tools or integrate third-party analytics platforms to gain valuable insights into your store’s performance.

Continuously Improving Your Store

Optimize your Shopify store based on the insights gleaned from your performance metrics. Experiment with different marketing strategies, product offerings, and user experience enhancements to maximize your store’s potential. Continuously seek customer feedback and iterate on your store’s design and functionality to stay ahead of the competition.

Conclusion

In conclusion, migrating from WooCommerce to Shopify can be a manageable task. By following the steps outlined in this comprehensive guide, you can navigate the migration process with confidence and ease. From assessing your current setup to launching your new Shopify store and beyond, this guide equips you with the knowledge and tools to make a smooth transition. Embrace Shopify’s opportunities for scalability, flexibility, and growth, and watch your online business thrive in its new home.

Related

-

PPC6 days ago

PPC6 days ago19 Best SEO Tools in 2024 (For Every Use Case)

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 19, 2024

-

SEARCHENGINES7 days ago

Daily Search Forum Recap: April 18, 2024

-

WORDPRESS6 days ago

WORDPRESS6 days agoHow to Make $5000 of Passive Income Every Month in WordPress

-

WORDPRESS7 days ago

WORDPRESS7 days ago10 Amazing WordPress Design Resouces – WordPress.com News

-

SEO6 days ago

SEO6 days ago25 WordPress Alternatives Best For SEO

-

WORDPRESS5 days ago

WORDPRESS5 days ago7 Best WooCommerce Points and Rewards Plugins (Free & Paid)

-

MARKETING5 days ago

MARKETING5 days agoBattling for Attention in the 2024 Election Year Media Frenzy