AMAZON

How Europe overtook the US in championing free markets

The deregulation of major U.S. industries like telecom and energy in the 1970s and 80s sparked competition that lowered consumer prices and drove product innovation between competitors. Europe, on the other hand, lagged behind with more expensive internet, phone plans, airline tickets, and more until around 2000 when a major reversal of this trend began. Strikingly, when the EU strengthened deregulation and antitrust efforts to open its markets to more competition, it was the U.S. that reversed course.

According to a new book by French economist Thomas Philippon, Americans’ view of their country as the world’s beacon of free market competition and Europe as an over-regulated region of lethargic corporate giants is out of date, and may be inhibiting our ability to recognize growing corporatism at home. Philippon, a professor of finance at NYU Stern who earned a Ph.D. in Economics from MIT, was named one of the top 25 economists under age 45 by the International Monetary Fund.

“If you have nothing interesting or relevant to say, you can always take a jab at European bureaucrats. It’s the political equivalent of complaining about the weather…”

Based on Organization for Economic Cooperation and Development (OECD) data, the U.S. now has more regulations for opening a new business than every EU country except Greece and Poland — a complete reversal since 1998, when only the UK had fewer rules than the U.S. Per capita GDP growth in the EU outpaced that of the U.S. over 1999-2017. On a purchasing power parity basis, Americans have experienced a 7% increase in prices (relative to EU residents) for the same goods, due specifically to increased profit margins of companies with reduced competition.

The reason for this divergence? According to Philippon, corporate incumbents in the U.S. gained outsized political influence and have used it to a) smother potential antitrust reviews and b) implement regulations that inhibit startups from competing against them. As a result, the U.S. regulatory system prioritizes the interests of incumbents at the expense of free market competition, he says.

Philippon makes his case in “The Great Reversal: How America Gave Up on Free Markets,” released this past Tuesday by Harvard University Press. The book builds an argument from extensive data and pre-empts likely critiques by investigating numerous potential confounding variables or differences in research methodology. It is a compelling read for those interested in the dynamics of the overall innovation economy or the political debate over antitrust and Big Tech.

Incumbents over startups

Philippon, who was na states upfront that he isn’t claiming Europe is a bigger startup hub. In fact, he writes that “the U.S. has better universities and a stronger ecosystem for innovation from venture capital to technological expertise.”

What he does do is ring the alarm about a systemic shift in market consolidation in the U.S. that results in a small number of large incumbents charging high prices, an economy-wide prioritization of share buybacks over investments in innovation and government policy that inhibits competition from new entrants.

An important take-away for readers: there’s a concerning trend toward more barriers to successful entrepreneurship, higher prices for countless goods and services that startups use, an overall decrease of corporate investment in new technologies and fewer potential startup acquirers.

There are half as many publicly-traded companies in the U.S. as there were in 1997, and turnover within rankings of the top five companies per industry has declined sharply since the late 1990s as well.

Market concentration isn’t due to superstars

“The Great Reversal” considers that increased market concentration could be the result of “superstar” firms whose increased productivity is a win-win for shareholders and consumers alike. This has indeed occurred during the 1990s but the correlation between increased concentration and increased productivity ended around 2000 (with the exception of the retail sector).

Corporate after-tax profits as a percent of U.S. GDP were stationary for decades at 6-7% but increased to 10% in the last two decades, highlighting increased “rent-seeking” that shouldn’t occur if the leaders in most industries were facing the same amount of domestic competition or increased international competition.

From the 1960s through the 1990s, American companies poured an average of 20 cents from each dollar of operating profit into investments (R&D, capital expenditures, etc.). Since 2000, that’s fallen to 10 cents per dollar. With reduced competition, large companies are focusing less on advancing their product offerings and more on extracting profits for shareholders out of existing business operations.

Big tech isn’t exempt

Major tech companies — specifically Alphabet (Google), Amazon, Facebook, Apple, and Microsoft — are the focus of multiple chapters of analysis by Philippon, who rejects the notion that these companies are somehow unprecedented relative to the leading companies of prior decades from an antitrust standpoint. They account for a smaller portion of U.S. GDP and stock market value, and they have similar profit margins. Network effects and accelerating economies of scales are not new concepts in economics — existing antitrust regulations are capable of dealing with these companies.

In our interview, Philippon said that leaders of monopolies typically claim they need to maintain their monopoly in order to have the means to invest in innovation. He calls it bogus — companies innovate when competition pushes them to find ways to offer a better product at lower cost. Admittedly, the tech community has perhaps bought in too much to the narrative that the dominance of Alphabet, Apple, and Facebook has provided more long-term R&D into endeavors that will advance humanity.

These companies’ “moonshot” projects act as effective marketing for this narrative, distracting from the many billions more dollars that would be poured into innovation investments in the economy if the markets they are in were more competitive.

America’s most important industries are among its least competitive

Philippon acknowledges that the heart of America’s problem isn’t its failure to effectively regulate Silicon Valley; it’s the failure to stop increased concentration in the industries that most shape consumer spending: healthcare, energy, transportation and telecommunications.

During our interview, he estimated that this “great reversal” in the U.S. has cost the median household an additional $300 per month in markups on goods and services — reduced competition has allowed incumbents to increase profit margins at the expense of consumers.

The lack of competition in these industries contributes to America’s deteriorating infrastructure. More than 700,000 Californians experienced blackouts in recent weeks due to Pacific Gas & Electric’s failure to make capital expenditures that maintained and improved its assets. Most of the 15 million people who live inside the utility’s service area have no where else to turn.

What makes Europe different

A critical factor in Europe’s relative improvements over the U.S., Philippon argues, is the greater independence of EU regulatory agencies like the Directorate General for Competition from corporate or political influence. In negotiating over the creation of these agencies, European politicians were more fearful of agencies falling under the control of other member countries than they were fearful of lacking influence over the agencies. Regulators have frequently intervened in mergers even when politicians from the companies’ home countries lobbied to permit the deals. In the tech industry, the EU has insisted on consumers retaining ownership of their data and the freedom to take it with them in switching to a competing software service.

Less tied to election cycles and specific political parties, the independence of EU regulators enables them to iterate when new regulations have unintended consequences. Philippon argues that U.S. regulators fail to act in the first place because of concerns that if they don’t craft the perfect policy upfront, there will be political repercussions.

Regulatory influence is for sale in the U.S.

Philippon makes the case that politicians’ survival is the U.S. has become more heavily tied to fundraising and the overwhelming majority of that fundraising comes directly and indirectly from corporate interests. The top 1% of donors account for about 75% of all political contributions (and the top 0.01% for 40% of all political contributions). Business lobbies are by far the dominant source of money in American political campaigns according to statistics he cites from the Center for Responsive Politics.

Benchmarked against antitrust reviews in the EU, Philippon finds that the decline in the number of antitrust actions in the U.S. (by the DOJ and FCC) has largely corresponded to increased lobbying spending that targets the DOJ and FCC. Each doubling of lobbying expenditures in the U.S. by a given industry corresponds with a 9% decrease in antitrust reviews in that industry, and such lobbying spend tripled overall from 1998 to 2008. He also cites a 2008 book by UVA professor Christine Mahoney finding that the majority of lobbying efforts in the U.S. by corporations and trade associations are successful whereas the majority of lobbying efforts by citizen groups and foundations fail.

What we should take away from “The Great Reversal”

I find “The Great Reversal” to be a timely analysis of the weakening of America’s regulatory regime for protecting free market competition. The recent rise of populism as the driving force in American politics has included resounding cries from activists in both parties that capitalism is broken, that free markets have failed us. Tying in the analysis from this book, the more accurate target for this criticism, however, should likely be the country’s embrace of corporatism over free market capitalism.

Citizens’ complaints about large companies abusing their power are often blamed on capitalism in general, when the issue is often regulatory capture that protects those companies from being held accountable by competitors. Companies that treat customers poorly don’t survive in competitive markets.

Within the circles of politicians and media pundits, policies are referred to as generically “pro-business.” The term brushes over the often conflicting interests of the country’s largest companies and the vast landscape of small and medium size businesses who compete with them. America’s political leadership has been pro-corporate at the expense of entrepreneurs.

It’s a case for political reform but also a case for the country’s entrepreneurs and venture capitalists to form a more unified voice in Washington separate from industry trade groups that primarily act on behalf of the largest companies in each industry.

AMAZON

How Auto-GPT will revolutionize AI chatbots as we know them

Artificial intelligence chatbots such as OpenAI LP’s ChatGPT have reached a fever pitch of popularity recently not just for their ability to hold humanlike conversations, but because they can perform knowledge tasks such as research, searches and content generation.

Now there’s a new contender taking social media by storm that extends the capabilities of OpenAI’s offering by automating its abilities even further: Auto-GPT. It’s part of a new class of AI tools called “autonomous AI agents” that take the power of GPT-3.5 and GPT-4, the generative AI technologies behind ChatGPT, to approach a task, build on its own knowledge, and connect apps and services to automate tasks and perform actions on the behalf of users.

ChatGPT might seem magical to users for its ability to answer questions and produce content based on user prompts, such as summarizing large documents or generating poems and stories or writing computer code. However, it’s limited in what it can do because it’s capable of doing only one task at a time. During a session with ChatGPT, a user can prompt the AI with only one question at a time and refining those prompts or questions can be a slow and tedious journey.

Auto-GPT, created by game developer Toran Bruce Richards, takes away these limitations by allowing users to give the AI an objective and a set of goals to meet. Then it spawns a bot that acts like a person would, using OpenAI’s GPT model to perform AI prompts in order to approach that goal. Along the way, it learns to refine its prompts and questions in order to get better results with every iteration.

It also has internet connectivity in order to gather additional information from searches. Moreover, it has short- and long-term memory through database connections so that it can keep track of sub-tasks. And it uses GPT-4 to produce content such as text or code when required. Auto-GPT is also capable of challenging itself when a task is incomplete and filling in the gaps by changing its own prompts to get better results.

According to Richards, although current AI chatbots are extremely powerful, their inability to refine their own prompts on the fly and automate tasks is a bottleneck. “This inspiration led me to develop Auto-GPT, which can apply GPT-4’s reasoning to broader, more complex problems that require long-term planning and multiple steps,” he told Vice.

Auto-GPT is available as open source on GitHub. It requires an application programming interface key from OpenAI to access GPT-4. And to use it, people will need to install Python and a development environment such as Docker or VS Code with a Dev Container extension. As a result, it might take a little bit of technical knowhow to get going, though there’s extensive setup documentation.

How does it work?

In a text interface, Auto-GPT asks the user to give the AI a name, a role, an objective and up to five goals that it should reach. Each of these defines how the AI agents will approach the action the user wants and how it will deliver the final product.

First, the user sets a name for the AI, such as “RestaurantMappingApp-GPT,” and then set a role, such as “Develop a web app that will provide interactive maps for nearby restaurants.” The user can then set a series of goals, such as “Write a back-end in Python” and “Program a front end in HTML,” or “Offer links to menus if available” and “Link to delivery apps.”

Once the user hits enter, Auto-GPT will begin launching agents, which will produce prompts for GPT-4, then approach the original role and each of the different goals. Finally, it will then begin refining and recursing through the different prompts that will allow it to connect to Google Maps using Python or JavaScript.

It does this by breaking the overall job into smaller tasks to work on each, and it uses a primary monitoring AI bot that acts as a “manager” to make sure that they coordinate. This particular prompt asks the bot to build a somewhat complex app that could go awry if it doesn’t keep track of a number of different moving parts, so it might take a large number of steps to get there.

With each step, each AI instance will “narrate” what it’s doing and even criticize itself in order to refine its prompts depending on its approach toward the given goal. Once it reaches a particular goal, each instance will finalize its process and return its answer back to the main management task.

Trying to get ChatGPT or even the more advanced, subscription-based GPT-4 to do this without supervision would take a large number of manual steps that would have to be attended to by a human being. Auto-GPT does them on its own.

The capabilities of Auto-GPT are beneficial for neophyte developers looking to get ahead in the game, Brandon Jung, vice president of ecosystem at AI-code completion tool provider Tabnine Ltd., told SiliconANGLE.

“One benefit is that it’s a good introduction for those that are new to coding, and it allows for quick prototyping,” Jung said. “For use cases that don’t require exactness or have security concerns, it could speed up the creation process without having to be part of a broader system that includes an expert for review.”

Being able to build apps rapidly, including all the code all at once, from a simple series of text prompts would bring a lot of new templates for code into the hands of developers. Essentially providing them with rapid solutions and foundations to build on. However, they would have to go through a thorough review first before being put into production.

What kind of applications can Auto-GPT be used for?

That’s just one example of Auto-GPT’s capabilities. With its capabilities, it has wide-reaching possibilities that are currently being explored by developers, project managers, AI researchers and anyone else who can download its source code.

“There are numerous examples of people using Auto-GPT to do market research, create business plans, create apps, automate complex tasks in pursuit of a goal, such as planning a meal, identifying recipes and ordering all the ingredients, and even execute transactions on behalf of the user,” Sheldon Monteiro, chief product officer at the digital business transformation firm Publicis Sapient, told SiliconANGLE.

With its ability to search the internet, Auto-GPT can be tasked with quick market research such as “Find me five gaming keyboards under $200 and list their pros and cons.” With its ability to break a task up into multiple subtasks, the autonomous AI could then rapidly search multiple review sites, produce a market research report and come back with a list of gaming keyboards that come in under that amount and supply their prices as well as information about them.

A Twitter user named MOE created an Auto-GPT bot named “Isabella” that can autonomously analyze market data and outsource to other AIs. It does so by using the AI framework Lang-chain to gather data autonomously and do sentiment analysis on different markets.

autogpt was trying to create an app for me, recognized I don’t have Node, googled how to install Node, found a stackoverflow article with link, downloaded it, extracted it, and then spawned the server for me.

My contribution? I watched. pic.twitter.com/2QthbTzTGP

— Varun Mayya (@VarunMayya) April 6, 2023

Because Auto-GPT has access to the internet, and it can take actions on behalf of the user, it can also install applications. In the case of Twitter user Varun Mayya, who ask the bot to build some software, it discovered that he did not have Node.js installed – an environment that allows JavaScript to be run locally instead of in a web browser. As a result, it searched the internet, discovered a StackOverflow tutorial and installed it for him so it could proceed with building the app.

Auto-GPT isn’t the only autonomous agent AI currently available. Another that has come into vogue is BabyAGI, which was created by Yohei Nakajima, a venture capitalist and artificial intelligence researcher. AGI refers to “artificial general intelligence,” a hypothetical type of AI that would have the ability to perform any intellectual task – but no existing AI is anywhere close. BabyAGI is a Python-based task management system that uses the OpenAI API, like Auto-GPT, that prioritizes and builds new tasks toward an objective.

There are also AgentGPT and GodMode, which are much more user-friendly in that they use a web interface instead of needing an installation on a computer, so they can be accessed as a service. These services lower the barrier to entry by making it simple for users because they don’t require any technical knowledge to use and will perform similar tasks to Auto-GPT, such as generating code, answering questions and doing research. However, they can’t write documents to the computer or install software.

Autonomous agents are powerful but experimental

These tools do have drawbacks, however, Monteiro warned. The examples on the internet are cherry-picked and paint the technology in a glowing light. For all the successes, there are a lot of issues that can happen when using it.

“It can get stuck in task loops and get confused,” Monteiro said. “And those task loops can get pretty expensive, very fast with the costs of GPT-4 API calls. Even when it does work as intended, it might take a fairly lengthy sequence of reasoning steps, each of which eats up expensive GPT-4 tokens.”

Accessing GPT-4 can cost money that varies depending on how many tokens are used. Tokens are based on words or parts of phrases sent through the chatbot. Charges range from three cents per 1,000 tokens for prompts to six cents per 1,000 tokens for results. That means using Auto-GPT running through a complex project or getting stuck in a loop unattended could end up costing a few dollars.

At the same time, GPT-4 can be prone to errors, known as “hallucinations,” which could spell trouble during the process. It could come up with totally incorrect or erroneous actions or, worse, produce insecure or disastrously bad code when asked to create an application.

“[Auto-GPT] has the ability to execute on previous output, even if it gets something wrong it keeps going on,” said Bern Elliot, a distinguished vice president analyst at Gartner. “It needs strong controls to avoid it going off the rails and keeping on going. I expect misuse without proper guardrails will cause some damaging unexpected and unintended outcomes.”

The software development side could be equally problematic. Even if Auto-GPT doesn’t make a mistake that causes it to produce broken code, which would cause the software to simply fail, it could create an application riddled with security issues.

“Auto-GPT is not part of a full software development lifecycle — testing, security, et cetera — nor is it integrated into an IDE,” Jung said, warning about the potential issues that could arise from the misuse of the tool. “Abstracting complexity is fine if you are building on a strong foundation. However, these tools are by definition not building strong code and are encouraging bad and insecure code to be pushed into production.”

The future of Auto-GPT and other autonomous agents

Tools such as Auto-GPT, BabyAGI, AgentGPT and GodMode are still experimental, but there are broader implications in how they could be used to replace routine tasks such as vacation planning or shopping, explained Monteiro.

Right now, Microsoft has even developed simple examples of a plugin for Bing Chat. It allows users to ask it to offer them dinner suggestions that will have its AI – which is powered by GPT-4 – will roll up a list of ingredients and then launch Instacart to have them prepared for delivery. Although this is a step in the direction of automation, bots such as Auto-GPT are edging toward a potential future of all-out autonomous behaviors.

A user could ask for Auto-GPT to look through local stores, prepare lists of ingredients, compare prices and quality, set up a shopping cart and even complete orders autonomously. At this experimental point, many users may not be willing to allow the bot to go all the way through with using their credit card and deliver orders all on its own, for fear that it could go haywire and send them several hundred bunches of basil.

A similar future where an AI does this for travel agents using Auto-GPT may not be far away. “Give it your parameters — beach, four-hour max travel, hotel class — and your budget, and it will happily do all the web browsing for you, comparing options in quest of your goal,” said Monteiro. “When it is done, it will present you with its findings, and you can also see how it got there.”

As these tools begin to mature, they have a real chance of providing a way for people to automate away mundane step-by-step tasks that happen on the internet. That could have some interesting implications, especially in e-commerce.

“How will companies adapt when these agents are browsing sites and eliminating your product from the consideration set before a human even sees the brand?” said Monteiro. “From an e-commerce standpoint, if people start using Auto-GPT tools to buy goods and services online, retailers will have to adapt their customer experience.”

* Image: Freepik

AMAZON

The Top 10 Benefits of Amazon AWS Lightsail: Why It’s a Great Choice for Businesses

Amazon Web Services (AWS) is a popular cloud computing platform that offers a wide range of services to individuals and businesses alike. One of the services offered by AWS is Amazon Lightsail, which is a simplified and user-friendly way to launch and manage virtual private servers (VPS). In this article, we will discuss the benefits of using Amazon Lightsail for your business.

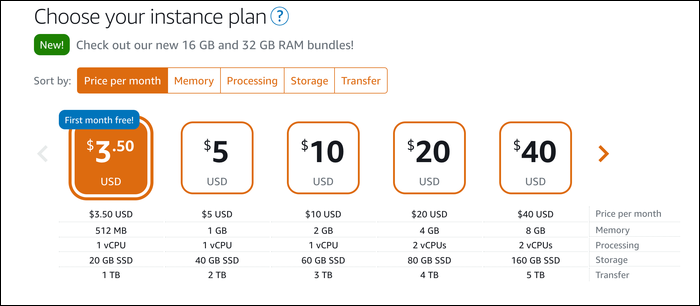

Cost-effective

One of the primary advantages of using Amazon Lightsail is its cost-effectiveness. The service offers a flat monthly fee for each instance, which makes it easy to predict costs and plan for your budget. Moreover, the pricing is transparent, with no hidden costs or surprises.

User-friendly

Amazon Lightsail is designed to be user-friendly, making it easy for even non-technical users to deploy and manage virtual private servers. The platform provides a simplified control panel that includes pre-configured software packages, such as WordPress, LAMP, and more. These packages are preconfigured, making it easy to deploy and set up a web application in minutes.

Scalable

Amazon Lightsail is designed to be scalable, which means you can easily upgrade your resources as your business grows. The platform provides a range of instance sizes to choose from, with varying CPU, RAM, and storage options. You can also scale up or down as needed, making it easy to manage your resources and costs.

Reliable

Amazon Lightsail is built on top of the AWS infrastructure, which means it benefits from AWS’s robust and reliable cloud infrastructure. This ensures that your applications and data are always available and accessible, with minimal downtime.

Secure

Amazon Lightsail provides a secure and reliable environment for your applications and data. The platform includes a range of security features, such as built-in firewalls, DDoS protection, and SSL/TLS encryption. Moreover, Lightsail instances are isolated from each other, which provides an additional layer of security.

Integrated with AWS services

Amazon Lightsail is fully integrated with other AWS services, making it easy to use Lightsail with other AWS services such as Amazon S3, Amazon RDS, and more. This integration provides a comprehensive cloud computing platform, enabling you to build and run complex applications.

Quick and easy deployment

Amazon Lightsail provides a quick and easy way to deploy web applications, with pre-configured templates for popular applications such as WordPress, Drupal, Joomla, and more. This makes it easy to deploy a web application in just a few clicks, without the need for technical knowledge.

High-performance

Amazon Lightsail instances are built on top of the latest generation of AWS infrastructure, providing high-performance and low-latency connectivity. This ensures that your applications and data are always accessible and responsive, with fast and efficient data transfer.

Easy to manage

Amazon Lightsail provides a simplified management interface, making it easy to manage your virtual private servers. The platform includes tools for monitoring your instances, configuring backups, managing DNS records, and more. Moreover, the platform provides a range of APIs and CLI tools, making it easy to automate management tasks.

Flexible

Amazon Lightsail is flexible, allowing you to choose the operating system and software stack that best suits your needs. The platform supports a range of operating systems, including Ubuntu, Debian, CentOS, and more. Moreover, you can install and configure any software stack that you need, giving you complete control over your environment.

In conclusion, Amazon Lightsail is a cost-effective, user-friendly, scalable, reliable, secure, integrated, quick, high-performance, easy-to-manage, and flexible platform for deploying and managing virtual private servers. If you’re looking for a simplified and efficient way to manage your cloud computing resources, Amazon Lightsail is definitely worth considering.

Get started today with Amazon Lightsail

AMAZON

Binance’s BNB Chain to Offer New Decentralized Storage System

The release of the decentralized storage system’s white paper was having a modest effect on the price of other storage tokens on Wednesday. Filecoin (FIL), storj (STORJ), and arweave (AR) are now trading 2%, 5% and 6%, respectively, above their pre-announcement prices.

-

SEARCHENGINES6 days ago

Daily Search Forum Recap: April 19, 2024

-

WORDPRESS7 days ago

WORDPRESS7 days agoHow to Make $5000 of Passive Income Every Month in WordPress

-

WORDPRESS6 days ago

WORDPRESS6 days ago13 Best HubSpot Alternatives for 2024 (Free + Paid)

-

MARKETING6 days ago

MARKETING6 days agoBattling for Attention in the 2024 Election Year Media Frenzy

-

WORDPRESS6 days ago

WORDPRESS6 days ago7 Best WooCommerce Points and Rewards Plugins (Free & Paid)

-

AFFILIATE MARKETING7 days ago

AFFILIATE MARKETING7 days agoAI Will Transform the Workplace. Here’s How HR Can Prepare for It.

-

MARKETING5 days ago

MARKETING5 days agoAdvertising in local markets: A playbook for success

-

SEO6 days ago

SEO6 days agoGoogle Answers Whether Having Two Sites Affects Rankings