AFFILIATE MARKETING

This Is What’s Driving the Next Wave of Growth in Affiliate Marketing

Opinions expressed by Entrepreneur contributors are their own.

The affiliate industry today is growing rapidly, but it’s not simply from the overall increase in consumers shifting their buying habits to ecommerce. Affiliate marketing has long been a staple in most online retailers’ marketing mix, and it’s estimated that affiliate marketing currently accounts for 16% of all online purchases in the U.S. and Canada. Every year, it grows about another 10% according to Statista, and is expected to reach $8.2 billion in 2022.

Now, loyalty and cashback rewards programs built upon the existing “infrastructure” of the affiliate industry are spurring new growth in the affiliate channel.

How affiliate marketing laid the foundation for cashback and loyalty rewards

In the affiliate-marketing advertising model, online retailers pay fees in the form of commissions, most often as a percentage of sales, for referrals from “publisher” web sites. This is also commonly known as revenue sharing, or “rev share.”

Publishers come in many shapes and sizes, including content sites on a specific topic, deal-finder sites, blogs in niche verticals, social-media influencers and more. These publishers promote links to retailer sites in their content in the hopes of driving their audience to those retailers and earning sales commissions from the traffic they drive.

Related: One Way to Start a Lucrative Career From Home That Could Pay $50,000 in a Day

Affiliate-marketing networks such as CJ, Impact, ShareASale and others provide retailers with technology platforms that track referrals from publishers in order to attribute the purchases that result from those referrals to the appropriate publisher and convey rev-share payments from merchants to publishers.

In effect, affiliate networks serve as marketplaces connecting publishers with online retailers, enabling them to create marketing relationships with each other. Publishers join the network so they can access online retailers that are willing to pay them for sales driven by their audience. Online retailers join the network so they can cost-effectively acquire customers and drive incremental sales.

How cashback and loyalty programs run on affiliate networks

The existing affiliate-network tracking platforms provide incredibly efficient infrastructure to power rewards and loyalty programs. Rewards platform and solutions providers are now publishers that participate in affiliate programs with rev-share commissions paid on sales by online retailers. But, unlike traditional affiliate publishers that keep the commissions, rewards and loyalty programs offer part or all of the commissions earned back to consumers (e.g. their audience) in the form of shopping rewards, such as cash back.

These types of cashback rewards programs, powered by the existing affiliate infrastructure, have exploded in popularity in the last few years. Examples of these programs include PayPal’s Honey, Capital One Shopping, Microsoft Rewards, and Acorns Earn, among others.

Related: 3 Secret Reasons Why Your Brand Needs a Rewards Program

Why should brands consider adding cashback and rewards programs to their affiliate-marketing channel?

Affiliate-powered coupon and rewards programs benefit rewards providers and consumers in two ways:

-

Rewards program providers see stronger brand loyalty, better customer retention, lower cost of user acquisition and increased revenue.

Online retailers also benefit directly in several ways.

Increasing conversion rate and reducing shopping cart abandonment

Activating cashback rewards during an online purchase increases the likelihood of the customer completing that purchase. When a shopper activates a cashback incentive at the start of a shopping journey, it acts as a magnet, drawing the customer from the first click to a converted sale.

Globally, the average ecommerce conversion rate is 3.29% (the percent of ecommerce website visitors that complete a purchase). However, according to data from Wildfire Systems, when consumers activate cashback rewards during their online shopping trip, over 15% of them complete the transaction — that’s a 6-10 times increase.

Boosting average order value

The typical order value for retailers in the Wildfire merchant network was historically in the $60 to $70 range when consumers made purchases after visiting the retailers’ site via social-media platforms such as Pinterest and Facebook. But, in Wildfire’s experience, average order value climbs to $130 when customers activate cashback during an online shopping experience. The psychology of “getting a bargain” is at play here.

According to data from CJ, a leading affiliate network, publishers in the loyalty and rewards vertical drive substantially larger transaction size, with 25% higher average order value compared to other publishers in the CJ network based upon the past two years of data.

Related: Here Are the Most Valuable Hotel Rewards Programs in 2022

Improving return on ad spend (ROAS) by shifting budgets

The price of cost-per-click (CPC) and cost-per-1000-impressions (CPM) advertising continues to rise. In fact, pricing in these channels is at an all-time high, according to Tinuiti, a performance marketing agency, and it is becoming increasingly difficult to target social and digital advertising given the evolving legislation relating to privacy and third-party cookies. Furthermore, advertisers’ trust in CPC advertising continues to erode due to the prevalence of click-fraud and bots. The cybersecurity firm CHEQ estimates that bots and fake users now make up a whopping 40% of all online traffic, which is directly detrimental to ROAS for CPC- and CPM-based advertising.

This combination of factors is pushing online retailers to shift budget towards the affiliate channel due to its performance-based model of paying publishers a percentage of the actual ecommerce sale generated. By shifting spend further into the purchase funnel, affiliate marketing presents one of the highest ROAS and lowest risk components of advertisers’ marketing mix. In fact, CJ also noted that in 2021, loyalty and rewards affiliate publishers in its network earned a 34% higher ROAS than other publishers.

Rewards programs have entered the mainstream, and consumers are not just growing accustomed to these benefits, they’re increasingly expecting them. This is a win-win-win for everyone in the ecosystem: Consumers benefit from rewards and discounts, retailers benefit from higher sales conversion and lower ROAS, and the services that offer rewards programs benefit from retention, user acquisition and new revenue streams. You can expect to see a proliferation of rewards and loyalty programs in the form of online-shopping companions as these programs graduate from being differentiators to becoming table stakes.

Source link

AFFILIATE MARKETING

Learn a New Language with This Fresh Approach

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

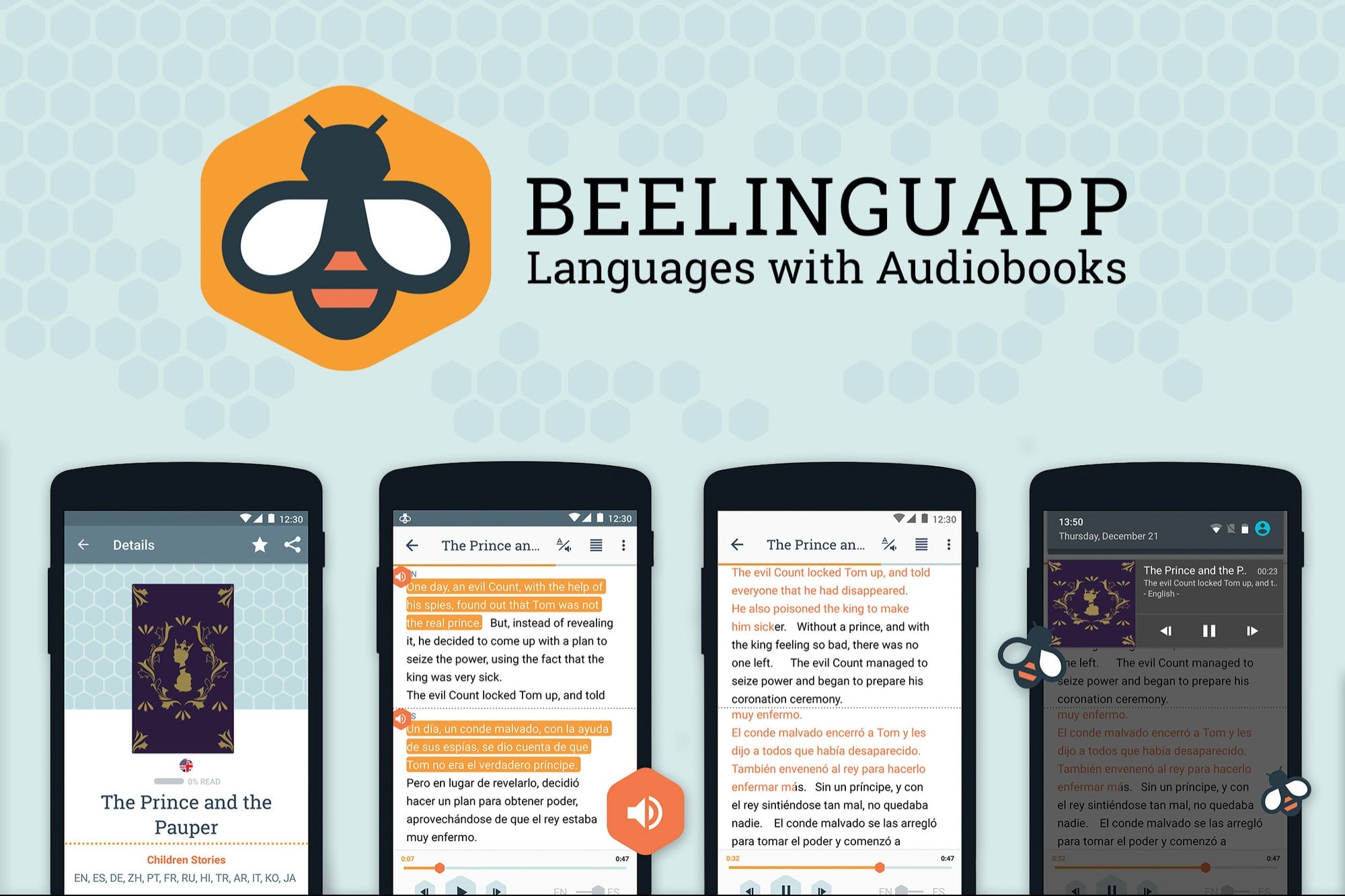

As exciting as it may be, learning a new language can often feel like a daunting task, with the typical endless vocabulary drills and grammar exercises. But Beelinguapp is here to change the game.

This innovative language learning app takes a fresh approach by combining audiobooks and dual-text reading to create an immersive, engaging experience. And right now, you can get a lifetime subscription to Beelinguapp—and all 14 of its languages—for just $34.99 (reg. $100) when you use code TAKE5 at checkout.

Traditional language learning methods can be time-consuming and overwhelming, especially for busy professionals. Beelinguapp offers a new, intuitive way to learn, making it easy to fit into your daily routine. Instead of memorizing endless vocabulary lists, you’ll follow along as you read and listen to a native speaker, seeing the same text in two languages side by side.

This side-by-side format is the core of Beelinguapp’s unique approach. It allows you to compare your native language to the one you’re learning, improving your understanding in real time. It’s like a language-learning karaoke, where you can follow the text in both languages while listening to a fluent speaker guide you through the pronunciation.

Beelinguapp caters to modern learners by offering 14 languages, including Spanish, English, German, French, Korean, and more. With its audiobook-style lessons and an ever-growing library of texts, you can choose from a wide variety of content—whether you’re interested in fairy tales, news articles, science papers, or novels.

This flexibility allows you to learn the way that best fits your lifestyle, all while gaining real-world conversation skills. The app provides texts at different levels, so you can start as a beginner and gradually build up to more advanced reading and listening skills.

If you’re hoping to learn a new language to help grow your business, this might be just the approach you need.

Through October 27, you can get a lifetime subscription to Beelinguapp for just $34.99 (reg. $100) when you use code TAKE5 at checkout.

StackSocial prices subject to change.

AFFILIATE MARKETING

Nvidia CEO Jensen Huang: Demand For Blackwell AI Is Insane

In May, Nvidia CEO Jensen Huang said that “the next industrial revolution has begun,” and AI will drive “significant productivity gains.” It looks like he’s right — industry demand for Nvidia’s next-generation AI chip, Blackwell, is through the roof.

“Blackwell is in full production, Blackwell is as planned, and the demand for Blackwell is insane,” Huang told CNBC on Thursday. “Everybody wants to have the most, and everybody wants to be first.”

Related: Nvidia CEO Jensen Huang’s Biggest Worry Shows that Success Has a Downside

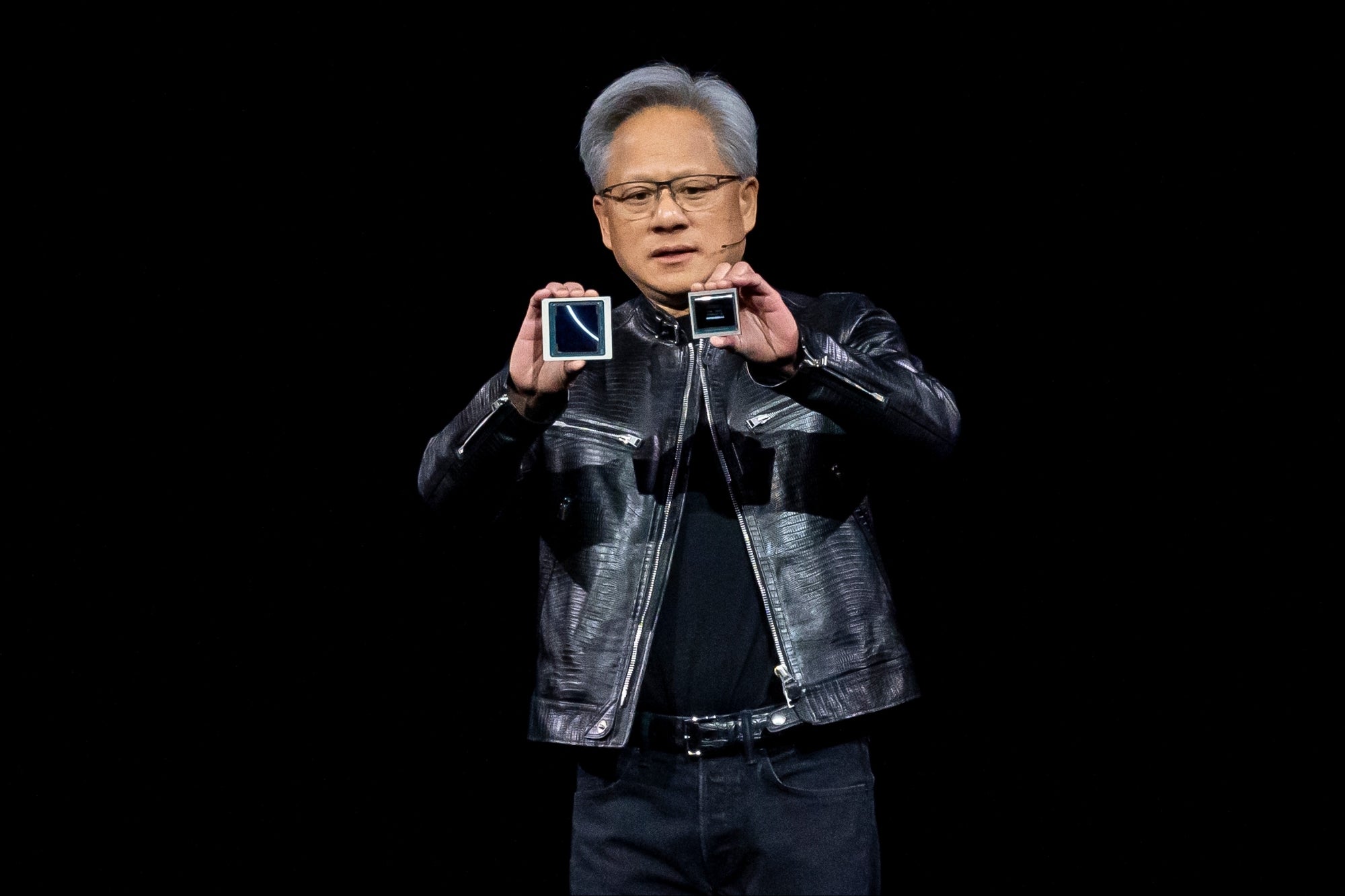

Nvidia first announced Blackwell in March and stated that it was the most powerful AI chip in the world with advanced security capabilities, better performance, and more memory. The biggest names in AI, including OpenAI, Microsoft, Meta, Amazon, and Google, will use Blackwell to power their AI efforts.

Nvidia CEO Jensen Huang displays the new Blackwell GPU chip, left, and the Hopper GPU chip, right, in March 2024. Photographer: David Paul Morris/Bloomberg via Getty Images

“There is currently nothing better than NVIDIA hardware for AI,” Tesla and xAI CEO Elon Musk stated, at the time.

Since the initial announcement, Blackwell has hit a few snags in production, leading to delays. Nvidia CFO Colette Kress said in late August that the company has fixed the issue and expects to ship “several billion dollars” worth of the chip in the fourth quarter of 2024.

Related: Nvidia’s Immense Market Power Is Worrying Investors — Here’s Why

The chip costs between $30,000 to $40,000 and took $10 billion to develop.

Huang said that Nvidia has updated its platform significantly with Blackwell, and intends to continue updating it. Nvidia has increased performance by two to three times from its 2022 Hopper chip to its Blackwell chip, which Huang says increases revenue for Nvidia’s customers by two to three times.

“What we’re looking at now is the beginning of the next wave of AI, the biggest wave of AI,” Huang told CNBC. “This is really about companies around the world using AI to be more productive as their digital employees and AI agents and co-pilots and however people describe them, as well as using AI, generative AI, to revolutionize the way they build their products and the products they build.”

Huang said last month that intense demand for Nvidia’s technology and software keeps him up at night. On Wednesday, Nvidia partnered with Accenture to train 30,000 of Accenture’s employees on Nvidia’s technology.

AFFILIATE MARKETING

5 Work Ethic Lessons Entrepreneurs Can Learn From Elite Athletes

Opinions expressed by Entrepreneur contributors are their own.

Anyone who has found success as an athlete will tell you that sport teaches lessons that go far beyond the playing field. If you’re looking to succeed in the competitive business environment, there may be no better models than champion athletes. What is it that allows these individuals to achieve greatness? What makes someone a winner? There’s not a single answer. Rather, it’s a combination of things. We’re sharing five of them here. If you follow these lessons, you’ll be poised for a championship in the business world.

Related: 4 Productivity Tips from Extreme Athletes That Will Make Your Business Stronger

Show supreme confidence

Champions have a robust belief in themselves and their ability to succeed. Importantly, this does not mean they expect the journey to be easy. Most things worth having require tremendous effort. Champion athletes devote “blood, sweat and tears” in pursuit of excellence, and they’re willing to make the sacrifice because they know it will pay off. Self-doubters abandon the journey when it gets too hard or when they encounter a few obstacles. Champions persevere because they believe in themselves to the core. This stout self-confidence becomes self-fulfilling. When you fully believe you’ll win if you keep on grinding, you’ll out-grind your less confident competitors. Supreme confidence leads to supreme effort, and supreme effort leads to success.

Like a champion athlete, a winning entrepreneur stays committed when things are tough. Tomorrow’s industry leaders are those who will continue to refine their current pitches and marketing strategies as many times as it takes to reach a breakthrough. They will not be deterred by rejection but rather will learn from it, make adjustments, and come back stronger. This willingness to learn and improve, in fact, is another defining feature of champions.

Always look to improve

Champion athletes, while supremely confident, also possess enough humility to know they always have room to learn and grow. When they take a loss, they review the game film to identify the mistakes they’ve made and see where they need to adjust for the next time. Even when they win, they look at what they could have done better. They also seek input from others. When a coach points out a flaw in their technique, they’re receptive to the feedback and incorporate it into their training. They also look to teammates and even to opponents to learn what others are doing well.

As an entrepreneur, if you lose out on a deal or find a competitor holding a larger share of your targeted market, then look at what they are doing to succeed. Be open to learning and humble enough to seek help from others. Champions are usually their own harshest critics, and their high standards drive them to keep improving. So even when you have some successes, continue looking to level up.

Focus on what you can control

Champions do everything they can to control the variables involved in their sport. Knowing that they can’t fully control the outcome, they go all-in on what they can control, including attitude, effort, and preparation. Entrepreneurs ought to do the same by analyzing their markets, rehearsing presentations multiple times, and scouting both their competition and their potential customers. If you’re meeting with a client, study them ahead of time so you can anticipate the questions they may ask and have impressive answers prepared. Be obsessive about your preparation.

A corollary to this lesson is focusing your post-hoc explanations on what you can – or could have – controlled. After a tough loss, champions do not blame the referee. Instead, they look at what they could have done differently so the referee’s calls would not have mattered. As an entrepreneur, be cautious of attributing bad results to luck or of claiming things weren’t fair. When you do so, you lose motivation to make adjustments for next time. Instead, follow a champion’s lead and know there’s always something you could have done better.

Improvise when needed

Even as champions focus on what they can control, they also recognize that they can’t control everything. Rarely does something go exactly as planned, and the best performers adapt and improvise. Something can always go wrong, and rather than panicking when it does, winners stay confident and make the needed adjustments. Thus, even as you work to control what you can embrace the uncertainty of your sport – or your business, as the case may be.

Related: 5 Lessons Entrepreneurs Can Learn from Pro Sports Teams

Be flexible

You may have noticed that the lessons described above hold some contradictions. Champions have supreme confidence yet also believe they need to get better. They also focus on what they can control while accepting they can’t control everything. Thus, another key to success is adapting your mindset based on the situation at hand. Champions have the mental flexibility to do so seamlessly. Rather than looking for a recipe to follow every time, they embrace the fluidity required to succeed consistently.

This willingness to adapt – to possess an unfixed mindset – is the main premise of the book Extreme Balance: Paradoxical Principles That Make You a Champion, published by Entrepreneur Press. This volume, which I have co-authored with champion athlete and coach Ben Askren and successful business leader Joe De Sena, describes how various champions balance contradictory principles to succeed in their respective sports. It includes chapters such as “Thinking You’re Good Enough and Thinking You’re Never Good Enough,” and “Preparing for Everything and Expecting the Unexpected.” These sections expand upon the lessons described here – and many others – in greater depth. If you want to be a champion entrepreneur, it’s a great resource to help get you there.

-

WORDPRESS3 days ago

WORDPRESS3 days agoWordPress biz Automattic details WP Engine deal demands • The Register

-

SEARCHENGINES5 days ago

Daily Search Forum Recap: September 30, 2024

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Volatility With Gains & Losses, Updated Web Spam Policies, Cache Gone & More Search News

-

SEO7 days ago

SEO7 days ago6 Things You Can Do to Compete With Big Sites

-

SEARCHENGINES4 days ago

Daily Search Forum Recap: October 1, 2024

-

SEO6 days ago

SEO6 days agoAn In-Depth Guide For Businesses

-

AFFILIATE MARKETING6 days ago

AFFILIATE MARKETING6 days agoThis Minimalist Lamp Lets You Pick From 16 Million+ Lighting Colors for Maximum Productivity

-

AFFILIATE MARKETING6 days ago

AFFILIATE MARKETING6 days agoNvidia CEO Jensen Huang Praises Nuclear Energy to Power AI

![Holistic Marketing Strategies That Drive Revenue [SaaS Case Study] Holistic Marketing Strategies That Drive Revenue [SaaS Case Study]](https://articles.entireweb.com/wp-content/uploads/2024/09/Holistic-Marketing-Strategies-That-Drive-Revenue-SaaS-Case-Study-400x240.png)

![Holistic Marketing Strategies That Drive Revenue [SaaS Case Study] Holistic Marketing Strategies That Drive Revenue [SaaS Case Study]](https://articles.entireweb.com/wp-content/uploads/2024/09/Holistic-Marketing-Strategies-That-Drive-Revenue-SaaS-Case-Study-80x80.png)

You must be logged in to post a comment Login