MARKETING

How Much Do Bing Ads Cost?

If you’re here, you must be wondering “how much do Bing ads cost?”

You’re smart to focus on Bing and other search engines instead of just Google ads.

According to Statista, Bing has 1.03 billion unique global visitors per month. In addition, 38 percent of Bing users had an annual income of $100,000 or more.

Not only is the search engine installed in billions of devices, but the platform is also appealing to a significant number of high-income earners.

In this article, we’ll share everything you need to know about Bing ads.

Factors Affecting the Cost of Bing Ads

Microsoft Advertising provides pay-per-click (PPC) ads for Bing–but how much do Bing ads cost?

Well, it depends. Advertisers only pay when a potential lead clicks on their ad.

Because of this, you need to assess your budget in terms of cost-per-click (CPC) and the number of clicks.

Let’s say you want a PPC ad to get 100 clicks per day. Every click has a maximum CPC of $0.50. To determine your possible daily cost, multiply $0.50 by 100—$50 per day.

If you want to change your budget, make the necessary adjustments on the Microsoft Advertising platform.

There are two budget types in the Bing ad platform:

- Daily: Targeted daily limit for PPC ad spend (actual amount could be a bit higher or lower).

- Shared: Lets you set up multiple campaigns with a shared budget.

Microsoft’s daily budget types let you estimate the amount you may spend on advertising per month using the following formula:

monthly budget = daily budget x days in the month

If you change your daily ad spend, use this formula to figure out the monthly cost:

monthly budget = amount spent-to-date + (daily budget x days remaining)

Although PPC spend could surpass the estimated monthly limit, Microsoft Advertising will refund the excess cost at the end of the month.

Types of Bing Ads

Now that we’ve looked at Bing ad costs, let’s take a look at the different types of Bing Ads you can create.

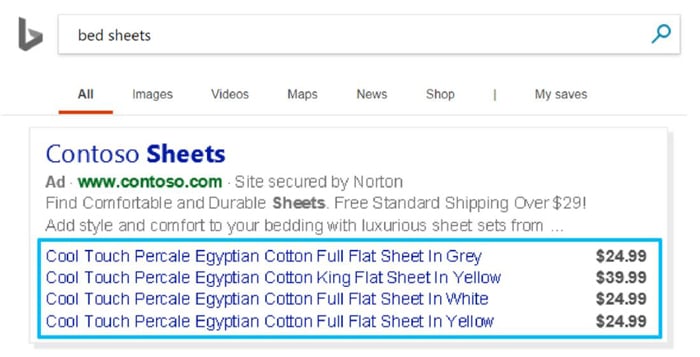

Expanded Text Ads

This type of ad is usually found in search results. The title allows three headlines of up to 30 characters each, and text including up to two descriptions of up to 90 characters each.

Here’s how it looks:

Dynamic Search Ads

These appear on relevant search queries related to your website. There’s no need to manage bids, maintain keyword lists, and customize ad titles.

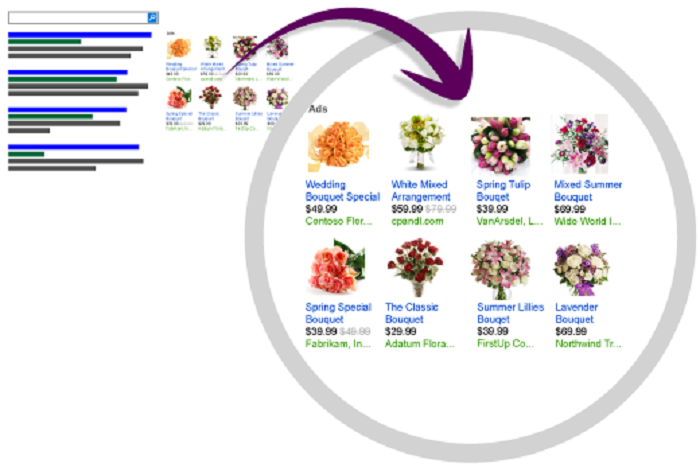

Product Ads

Product ads include product images, prices, promotional text, and seller information.

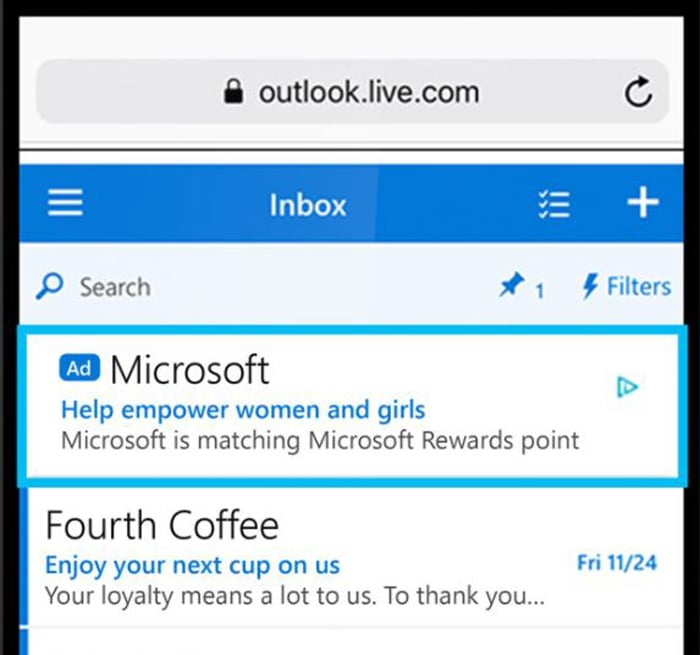

Microsoft Audience Ads

These ads enable businesses to collect non-search traffic through contextual and strategic placements. They can be placed in an article or page content to provide additional avenues for brands to communicate with visitors.

Microsoft Advertising in Bing Smart Search

Smart Search results showcase a preview of your landing page.

App Install Ads

These look like regular text ads but have direct links to your app store, leading you to a post from which you can download the advertised app.

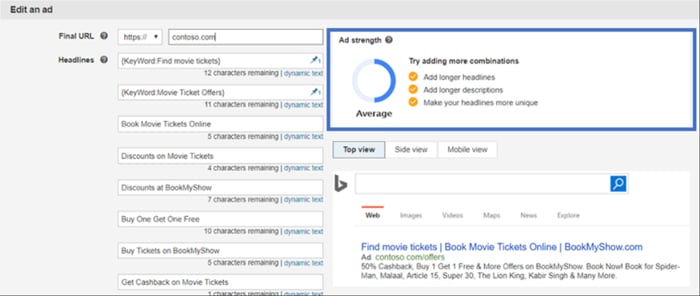

Responsive Search Ads

These ads eliminate the need to identify ideal headlines and ad descriptions. All you need to do is list 15 headlines and four descriptions; then, Microsoft Advertising determines the best combinations.

Bidding Strategy

Microsoft Advertising has several bidding strategies to help ensure your money is well-spent based on clicks, conversions, and searches.

Consider the following ways this platform can manage your bids:

- Enhanced CPC: This is the default way to manage bids in your campaigns. To get started, select your ad group and keyword bids. Then, Microsoft Advertising modifies bids in real-time to potentially boost conversions.

- Maximize Clicks: This lets you achieve the most clicks possible based on your specified budget.

- Maximize Conversions: True to its name, this enables Bing to set bids and gain as many conversions as possible based on your budget. You can set a maximum CPC, so you don’t have to pay more than a specific amount for a click.

- Target Cost Per Acquisition (CPA): You can set a 30-day target CPA, and Microsoft Advertising will automate bids. In this strategy, keyword bids are optimized based on ad schedule, device, and location.

- Target Return on Ad Spend (ROAS): This metric allows you to set a budget with a target 30-day average ROAS. Once it’s specified, Microsoft Advertising enables users to bid in real-time to attain this average.

- Manual CPC: Manual CPC lets you manage your keyword bids and ad groups.

Bing Ad Metrics

Once you set up a campaign, you’ll find several performance metrics based on your keywords.

Here are the key performance metrics in Microsoft Advertising:

- Estimated Monthly Clicks: number of times people are expected to click your ads per month based on your budget, targeting, and keywords

- Estimated Monthly Impressions: number of times people should see your ads in a month based on your budget, targeting, and keywords

- Estimated Monthly Spend: estimated cost of the ad group per month

- Estimated Average Position: placement of the ad in the search results, such as top, side, or bottom

There are also other common metrics that you can use to measure an ad’s performance and your ROI.

- Impressions: the number of times your PPC ads were featured on the Bing SERPs

- Conversions: number of clicks on PPC campaign ads

- Conversion Rate: percentage of visitors who clicked your website upon viewing the ad

- Cost Per Action (CPA): average cost of conversion from your PPC campaign ad

- Average CPC: total paid for all clicks divided by the total number of clicks

- Total Ad Spend: total spent on all clicks

- Return on Ad Spend: total revenue generated from PPC ads divided by the total amount spent on this channel

- Average Position: the average position of the PPC ad on the Bing SERPs

- CTR: average rate of clicks on your PPC ads

- Revenue total revenue generated from conversions

Bing Ads Cost Per Industry

Bing may not be as popular as Google, but it often has great results anyway.

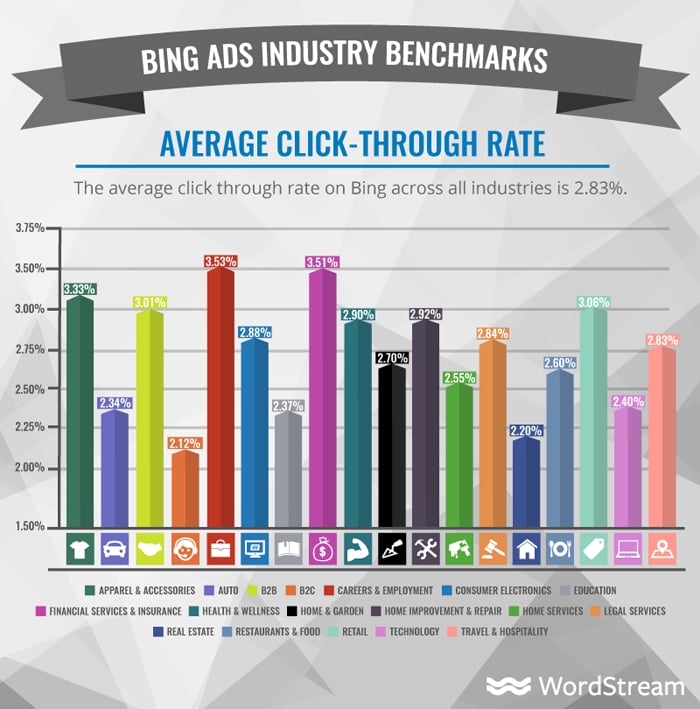

Users may experience higher CTRs and conversion rates at lower CPCs and CPAs.

A WordStream study suggests the average CTR for Bing across all industries is around 2.83 percent. B2B services have an even higher CTR at 3.01 percent, making this worth investigating if that’s your type of business.

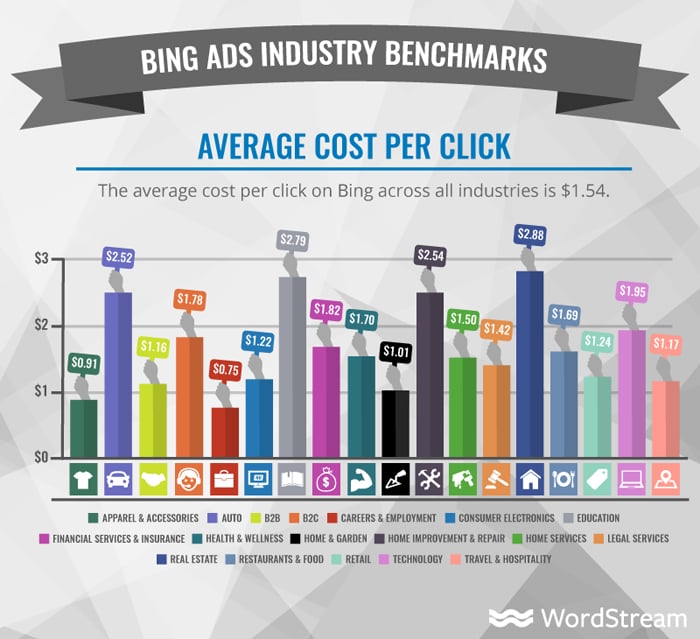

Then, there’s CPC. Bing’s average cost per click is $1.54—33 percent lower than Google Ads.

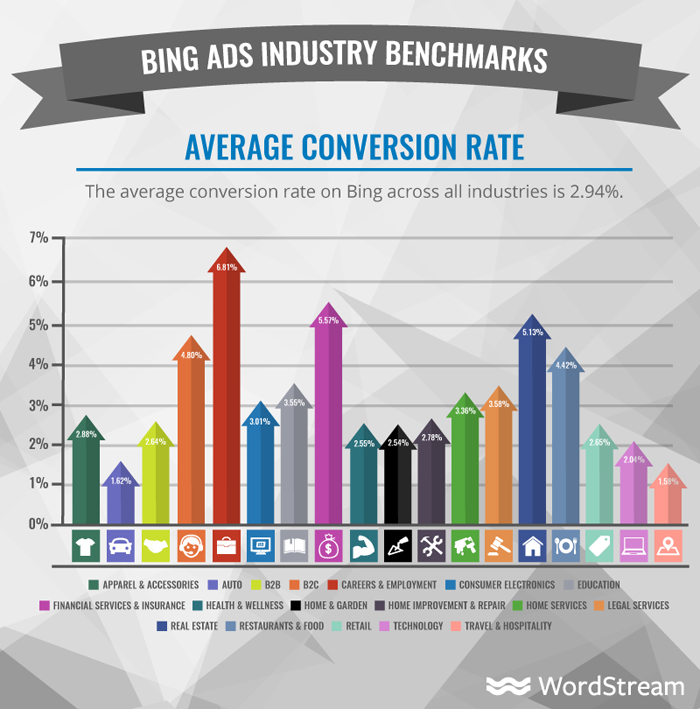

Of course, you want to get people to convert. Bing’s conversion rate is an average of 2.94 percent, with varying industries experiencing conversion rates between about 1.58 and 6.81 percent.

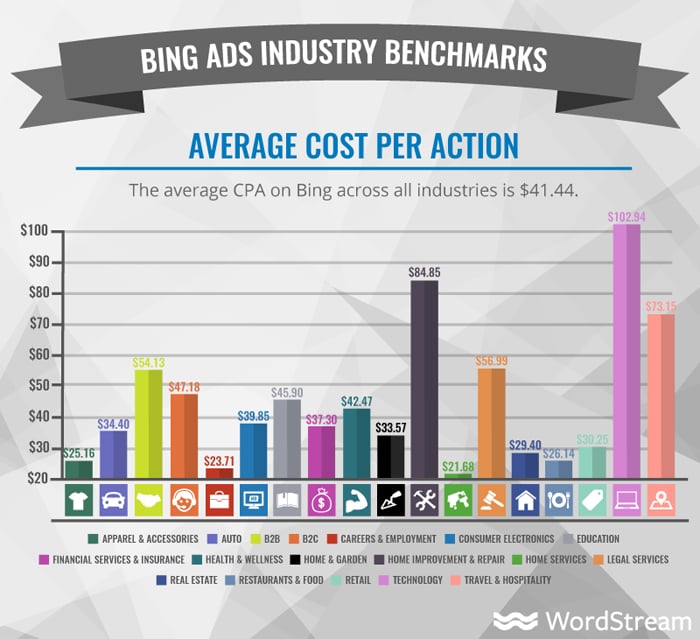

Bing’s average CPA across industries is $41.44.

Small businesses on a tight budget may be delighted to learn the average CPA is 30 percent lower than the AdWords customers’ average. Industries that enjoy a low CPA include home services ($21.68), careers and employment ($23.71), and apparel and accessories ($25.16).

These numbers prove Bing is an ideal platform for launching PPC ads. Marketers can expect stronger performance and better results by leveraging Bing for their paid search campaigns.

What Affects Bing Ad Spend?

How much do Bing ads cost? How much money should you allot for PPC campaigns? There are a few variables that could impact your budget.

Here are some of the factors to consider.

Account Size

Account size is determined by the number of ad groups, keywords, and campaigns in your account. Big companies with multiple PPC campaigns need larger budgets to keep multiple ads running.

Geographical Area

Location is another crucial factor impacting your PPC budget. Places with bigger populations may require higher CPCs, meaning larger budgets.

Industry

As we’ve mentioned previously, niche or industry could impact your cost per click.

According to a WordStream study, the lowest CPCs for Bing include careers and employment ($0.75), as well as apparel and accessories ($0.91). Costs are higher for other industries such as real estate ($2.88), education ($2.79), and automotive ($2.52). Moreover, you may have to pay more to target competitive keywords.

On average, CPC is slightly lower on Bing than on Google AdWords. However, it’s better to understand the average CPCs in your industry so you can plan accordingly.

Duration and Holidays

Since Bing advertising has a daily budget, a longer campaign duration means higher costs. Fortunately, you can modify the maximum amount you can spend each day so you don’t overspend.

When planning your campaign’s duration, take note of holidays, as these may impact the campaign’s cost. For instance, the fourth quarter of the year has a ton of holidays, so it may not be an ideal time for B2Bs to spend extra money on ads.

To maximize your ad spend, consider the ideal time for clicks and conversions of your past PPC campaigns. Scheduling your campaigns at the best times may ensure your money will be well-spent.

Audience Size

Your audience size impacts your campaign budget. A large audience could result in hundreds of clicks, but if the people clicking aren’t your ideal buyers, that’s money going to waste. Use data from your clicks to determine if you need to change your tactics.

Conclusion

So how much do Bing Ads cost? As you now know, it depends on which ad types you use, how long you run your campaign, and how well your CPC performs on your PPC ads.

While Bing is a lesser-known search engine, it can also help you improve your PPC campaigns.

If you plan ahead and keep an eye on your data, you could enjoy clicks and conversions at lower prices than other search engines.

If setting up your ad campaigns on Bing sounds daunting, we can assist you!

What successes have you had when advertising on Bing?

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

- SEO – unlock massive amounts of SEO traffic. See real results.

- Content Marketing – our team creates epic content that will get shared, get links, and attract traffic.

- Paid Media – effective paid strategies with clear ROI.

MARKETING

18 Events and Conferences for Black Entrepreneurs in 2024

Welcome to Breaking the Blueprint — a blog series that dives into the unique business challenges and opportunities of underrepresented business owners and entrepreneurs. Learn how they’ve grown or scaled their businesses, explored entrepreneurial ventures within their companies, or created side hustles, and how their stories can inspire and inform your own success.

It can feel isolating if you’re the only one in the room who looks like you.

MARKETING

IAB Podcast Upfront highlights rebounding audiences and increased innovation

Podcasts are bouncing back from last year’s slowdown with digital audio publishers, tech partners and brands innovating to build deep relationships with listeners.

At the IAB Podcast Upfront in New York this week, hit shows and successful brand placements were lauded. In addition to the excitement generated by stars like Jon Stewart and Charlamagne tha God, the numbers gauging the industry also showed promise.

U.S. podcast revenue is expected to grow 12% to reach $2 billion — up from 5% growth last year — according to a new IAB/PwC study. Podcasts are projected to reach $2.6 billion by 2026.

The growth is fueled by engaging content and the ability to measure its impact. Adtech is stepping in to measure, prove return on spend and manage brand safety in gripping, sometimes contentious, environments.

“As audio continues to evolve and gain traction, you can expect to hear new innovations around data, measurement, attribution and, crucially, about the ability to assess podcasting’s contribution to KPIs in comparison to other channels in the media mix,” said IAB CEO David Cohen, in his opening remarks.

Comedy and sports leading the way

Podcasting’s slowed growth in 2023 was indicative of lower ad budgets overall as advertisers braced for economic headwinds, according to Matt Shapo, director, Media Center for IAB, in his keynote. The drought is largely over. Data from media analytics firm Guideline found podcast gross media spend up 21.7% in Q1 2024 over Q1 2023. Monthly U.S. podcast listeners now number 135 million, averaging 8.3 podcast episodes per week, according to Edison Research.

Comedy overtook sports and news to become the top podcast category, according to the new IAB report, “U.S. Podcast Advertising Revenue Study: 2023 Revenue & 2024-2026 Growth Projects.” Comedy podcasts gained nearly 300 new advertisers in Q4 2023.

Sports defended second place among popular genres in the report. Announcements from the stage largely followed these preferences.

Jon Stewart, who recently returned to “The Daily Show” to host Mondays, announced a new podcast, “The Weekly Show with Jon Stewart,” via video message at the Upfront. The podcast will start next month and is part of Paramount Audio’s roster, which has a strong sports lineup thanks to its association with CBS Sports.

Reaching underserved groups and tastes

IHeartMedia toasted its partnership with radio and TV host Charlamagne tha God. Charlamagne’s The Black Effect is the largest podcast network in the U.S. for and by black creators. Comedian Jess Hilarious spoke about becoming the newest co-host of the long-running “The Breakfast Club” earlier this year, and doing it while pregnant.

The company also announced a new partnership with Hello Sunshine, a media company founded by Oscar-winner Reese Witherspoon. One resulting podcast, “The Bright Side,” is hosted by journalists Danielle Robay and Simone Boyce. The inspiration for the show was to tell positive stories as a counterweight to negativity in the culture.

With such a large population listening to podcasts, advertisers can now benefit from reaching specific groups catered to by fine-tuned creators and topics. As the top U.S. audio network, iHeartMedia touted its reach of 276 million broadcast listeners.

Connecting advertisers with the right audience

Through its acquisition of technology, including audio adtech company Triton Digital in 2021, as well as data partnerships, iHeartMedia claims a targetable audience of 34 million podcast listeners through its podcast network, and a broader audio audience of 226 million for advertisers, using first- and third-party data.

“A more diverse audience is tuning in, creating more opportunities for more genres to reach consumers — from true crime to business to history to science and culture, there is content for everyone,” Cohen said.

The IAB study found that the top individual advertiser categories in 2023 were Arts, Entertainment and Media (14%), Financial Services (13%), CPG (12%) and Retail (11%). The largest segment of advertisers was Other (27%), which means many podcast advertisers have distinct products and services and are looking to connect with similarly personalized content.

Acast, the top global podcast network, founded in Stockholm a decade ago, boasts 125,000 shows and 400 million monthly listeners. The company acquired podcast database Podchaser in 2022 to gain insights on 4.5 million podcasts (at the time) with over 1.7 billion data points.

Measurement and brand safety

Technology is catching up to the sheer volume of content in the digital audio space. Measurement company Adelaide developed its standard unit of attention, the AU, to predict how effective ad placements will be in an “apples to apples” way across channels. This method is used by The Coca-Cola Company, NBA and AB InBev, among other big advertisers.

In a study with National Public Media, which includes NPR radio and popular podcasts like the “Tiny Desk” concert series, Adelaide found that NPR, on average, scored 10% higher than Adelaide’s Podcast AU Benchmarks, correlating to full-funnel outcomes. NPR listeners weren’t just clicking through to advertisers’ sites, they were considering making a purchase.

Advertisers can also get deep insights on ad effectiveness through Wondery’s premium podcasts — the company was acquired by Amazon in 2020. Ads on its podcasts can now be managed through the Amazon DSP, and measurement of purchases resulting from ads will soon be available.

The podcast landscape is growing rapidly, and advertisers are understandably concerned about involving their brands with potentially controversial content. AI company Seekr develops large language models (LLMs) to analyze online content, including the context around what’s being said on a podcast. It offers a civility rating that determines if a podcast mentioning “shootings,” for instance, is speaking responsibly and civilly about the topic. In doing so, Seekr adds a layer of confidence for advertisers who would otherwise pass over an opportunity to reach an engaged audience on a topic that means a lot to them. Seekr recently partnered with ad agency Oxford Road to bring more confidence to clients.

“When we move beyond the top 100 podcasts, it becomes infinitely more challenging for these long tails of podcasts to be discovered and monetized,” said Pat LaCroix, EVP, strategic partnerships at Seekr. “Media has a trust problem. We’re living in a time of content fragmentation, political polarization and misinformation. This is all leading to a complex and challenging environment for brands to navigate, especially in a channel where brand safety tools have been in the infancy stage.”

Dig deeper: 10 top marketing podcasts for 2024

MARKETING

Foundations of Agency Success: Simplifying Operations for Growth

Why do we read books like Traction, Scaling Up, and the E-Myth and still struggle with implementing systems, defining processes, and training people in our agency?

Those are incredibly comprehensive methodologies. And yet digital agencies still suffer from feast or famine months, inconsistent results and timelines on projects, quality control, revisions, and much more. It’s not because they aren’t excellent at what they do. I

t’s not because there isn’t value in their service. It’s often because they haven’t defined the three most important elements of delivery: the how, the when, and the why.

Complicating our operations early on can lead to a ton of failure in implementing them. Business owners overcomplicate their own processes, hesitate to write things down, and then there’s a ton of operational drag in the company.

Couple that with split attention and paper-thin resources and you have yourself an agency that spends most of its time putting out fires, reacting to problems with clients, and generally building a culture of “the Founder/Creative Director/Leader will fix it” mentality.

Before we chat through how truly simple this can all be, let’s first go back to the beginning.

When we start our companies, we’re told to hustle. And hustle hard. We’re coached that it takes a ton of effort to create momentum, close deals, hire people, and manage projects. And that is all true. There is a ton of work that goes into getting a business up and running.

The challenge is that we all adopt this habit of burning the candle at both ends and the middle all for the sake of growing the business. And we bring that habit into the next stage of growth when our business needs… you guessed it… exactly the opposite.

In Mike Michalowitz’s book, Profit First he opens by insisting the reader understand and accept a fundamental truth: our business is a cash-eating monster. The truth is, our business is also a time-eating monster. And it’s only when we realize that as long as we keep feeding it our time and our resources, it’ll gobble everything up leaving you with nothing in your pocket and a ton of confusion around why you can’t grow.

Truth is, financial problems are easy compared to operational problems. Money is everywhere. You can go get a loan or go create more revenue by providing value easily. What’s harder is taking that money and creating systems that produce profitably. Next level is taking that money, creating profit and time freedom.

In my bestselling book, The Sabbatical Method, I teach owners how to fundamentally peel back the time they spend in their company, doing everything, and how it can save owners a lot of money, time, and headaches by professionalizing their operations.

The tough part about being a digital agency owner is that you likely started your business because you were great at something. Building websites, creating Search Engine Optimization strategies, or running paid media campaigns. And then you ended up running a company. Those are two very different things.

How to Get Out of Your Own Way and Create Some Simple Structure for Your Agency…

- Start Working Less

I know this sounds really brash and counterintuitive, but I’ve seen it work wonders for clients and colleagues alike. I often say you can’t see the label from inside the bottle and I’ve found no truer statement when it comes to things like planning, vision, direction, and operations creation.

Owners who stay in the weeds of their business while trying to build the structure are like hunters in the jungle hacking through the brush with a machete, getting nowhere with really sore arms. Instead, define your work day, create those boundaries of involvement, stop working weekends, nights and jumping over people’s heads to solve problems.

It’ll help you get another vantage point on your company and your team can build some autonomy in the meantime.

- Master the Art of Knowledge Transfer

There are two ways to impart knowledge on others: apprenticeship and writing something down. Apprenticeship began as a lifelong relationship and often knowledge was only retained by ONE person who would carry on your method.

Writing things down used to be limited (before the printing press) to whoever held the pages.

We’re fortunate that today, we have many ways of imparting knowledge to our team. And creating this habit early on can save a business from being dependent on any one person who has a bunch of “how” and “when” up in their noggin.

While you’re taking some time to get out of the day-to-day, start writing things down and recording your screen (use a tool like loom.com) while you’re answering questions.

Deposit those teachings into a company knowledge base, a central location for company resources. Some of the most scaleable and sellable companies I’ve ever worked with had this habit down pat.

- Define Your Processes

Lean in. No fancy tool or software is going to save your company. Every team I’ve ever worked with who came to me with a half-built project management tool suffered immensely from not first defining their process. This isn’t easy to do, but it can be simple.

The thing that hangs up most teams to dry is simply making decisions. If you can decide how you do something, when you do it and why it’s happening that way, you’ve already won. I know exactly what you’re thinking: our process changes all the time, per client, per engagement, etc. That’s fine.

Small businesses should be finding better, more efficient ways to do things all the time. Developing your processes and creating a maintenance effort to keep them accurate and updated is going to be a liferaft in choppy seas. You’ll be able to cling to it when the agency gets busy.

“I’m so busy, how can I possibly work less and make time for this?”

You can’t afford not to do this work. Burning the candle at both ends and the middle will catch up eventually and in some form or another. Whether it’s burnout, clients churning out of the company, a team member leaving, some huge, unexpected tax bill.

I’ve heard all the stories and they all suck. It’s easier than ever to start a business and it’s harder than ever to keep one. This work might not be sexy, but it gives us the freedom we craved when we began our companies.

Start small and simple and watch your company become more predictable and your team more efficient.

-

PPC6 days ago

PPC6 days agoHow the TikTok Algorithm Works in 2024 (+9 Ways to Go Viral)

-

SEO6 days ago

SEO6 days agoBlog Post Checklist: Check All Prior to Hitting “Publish”

-

SEO5 days ago

SEO5 days agoHow to Use Keywords for SEO: The Complete Beginner’s Guide

-

MARKETING5 days ago

MARKETING5 days agoHow To Protect Your People and Brand

-

PPC7 days ago

PPC7 days agoHow to Craft Compelling Google Ads for eCommerce

-

SEARCHENGINES7 days ago

SEARCHENGINES7 days agoGoogle Started Enforcing The Site Reputation Abuse Policy

-

MARKETING6 days ago

MARKETING6 days agoElevating Women in SEO for a More Inclusive Industry

-

PPC6 days ago

PPC6 days agoHow to Brainstorm Business Ideas: 9 Fool-Proof Approaches