SOCIAL

Pinterest Reports Slowing User Growth in Q2, More Engagement Among Younger Audiences

Pinterest has published its Q2 2023 performance update, which shows some concerning signs for overall platform growth, though it is growing, which is a positive trend.

First off, on users. Pinterest added 2 million more users in Q2, taking it to 465 million monthly actives.

That’s Pinterest’s slowest growth rate in a year, though again, it is growing, which in itself is welcome news after the platform suffered a decline in usage following the pandemic bump.

In Q1 2021, at the height of the COVID lockdowns, when everyone was seeking alternative shopping options, Pinterest rose to 478 million users, before sliding back over the next year to 431 million. Since then, it’s been steadily regaining its footing, so while its growth has slowed in this quarter, it is maintaining an upward trajectory, though slower growth will logically spook the market.

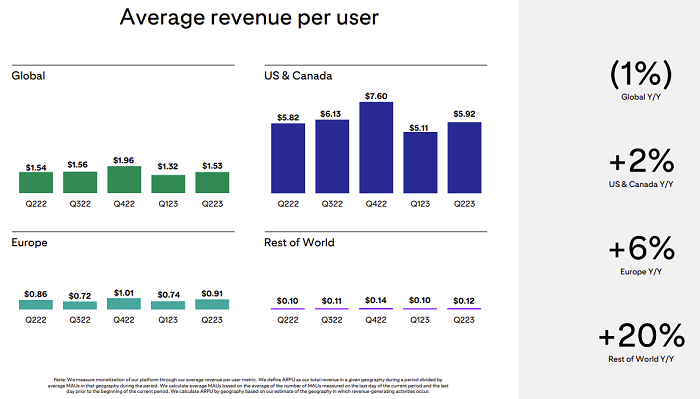

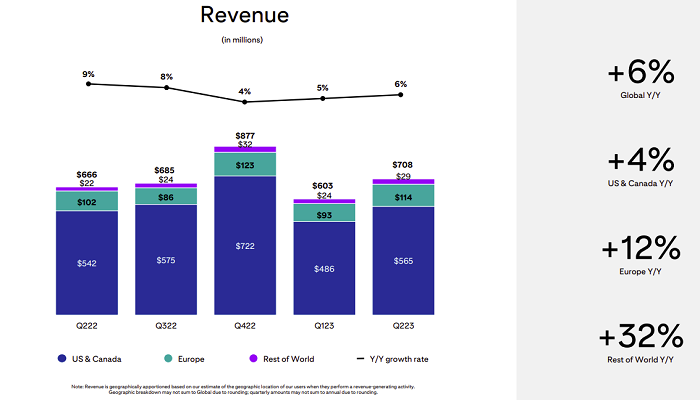

What’s particularly concerning in this respect, however, is that Pinterest is actually losing ground in its most lucrative user markets. U.S. growth has stagnated, while European usage declined, with all of its new users coming from the ‘Rest of the World’ category.

Which just doesn’t generate as much revenue for the app.

Pinterest is clearly reliant on the North American market, and while global expansion will facilitate new opportunities, as you can see in these charts, the revenue impact of such pales in comparison to its key centers.

The fact that EU users are seemingly losing interest is a concerning sign, while Pinterest needs to see at least some growth in the US to boost its revenue potential. It hasn’t increased its US user count for essentially a year now, and that’s something that’ll come under more scrutiny as analysts look to project the app’s future potential.

But right now at least, Pinterest is maintaining revenue growth, posting a 6% year-over-year increase to $705 million for the period.

It’s steady, and it’s not going to blow anybody away. But along with cost-reduction measures, Pinterest is maintaining its margins, and growing its business opportunities, which will see it hold firm for now amid shifting market conditions.

In terms of usage, Pinterest says that sessions, impressions, and Pin saves all grew faster than MAUs, which it claims is indicative of it ‘deepening engagement with our user base’. In other words, while Pinterest may not be adding a heap of new users, those that are using the app are engaging for longer, and more often, so it’s in a better position to monetize its most engaged audience.

Though again, you would want more of these users to be in the U.S. and EU, but 465 million engaged shoppers is still a very valuable audience, which many retailers, in particular, will be interested in.

Pinterest also notes that it’s seeing solid growth in usage among younger audiences:

“In Q2, Gen Z were our largest contributor to overall engagement growth and the fastest growing cohort, growing double digits and accounting for a larger portion of our overall mix.”

That’s also a good indicator for future success, but a lot of this is projecting forward, with the immediate results reflecting more of a holding pattern for the app.

Pinterest also says that it’s seeing engagement growth in various key verticals, including men’s fashion, autos, health, and travel, again highlighting expanded opportunity.

Auto marketing has emerged as a bigger focus for the app, in a niche that many wouldn’t expect, and it’s worth highlighting in this context, as Pinterest does see a lot of engagement in several verticals that are outside of its normal DTC focus.

So what do these results suggest for marketers?

Pinterest remains a potentially valuable consideration for a wide range of brands, and really, you need to explore the app for yourself to understand your opportunities, and how brands in your niche are performing.

465 million users is a big audience, with a wide range of interests, and you can use tools like Pinterest Trends to get a handle on what people are engaging with, and how that relates to your business.

It’s not exploding with new users, and some of the growth numbers here are a concern. But with such a big group of users coming to the app with shopping intent, there are still significant opportunities for the right brands.

SOCIAL

12 Proven Methods to Make Money Blogging in 2024

This is a contributed article.

This is a contributed article.

The world of blogging continues to thrive in 2024, offering a compelling avenue for creative minds to share their knowledge, build an audience, and even turn their passion into profit. Whether you’re a seasoned blogger or just starting, there are numerous effective strategies to monetize your blog and achieve financial success. Here, we delve into 12 proven methods to make money blogging in 2024:

1. Embrace Niche Expertise:

Standing out in the vast blogosphere requires focus. Carving a niche allows you to cater to a specific audience with targeted content. This not only builds a loyal following but also positions you as an authority in your chosen field. Whether it’s gardening techniques, travel hacking tips, or the intricacies of cryptocurrency, delve deep into a subject you’re passionate and knowledgeable about. Targeted audiences are more receptive to monetization efforts, making them ideal for success.

2. Content is King (and Queen):

High-quality content remains the cornerstone of any successful blog. In 2024, readers crave informative, engaging, and well-written content that solves their problems, answers their questions, or entertains them. Invest time in crafting valuable blog posts, articles, or videos that resonate with your target audience.

- Focus on evergreen content: Create content that remains relevant for a long time, attracting consistent traffic and boosting your earning potential.

- Incorporate multimedia: Spice up your content with captivating images, infographics, or even videos to enhance reader engagement and improve SEO.

- Maintain consistency: Develop a regular publishing schedule to build anticipation and keep your audience coming back for more.

3. The Power of SEO:

Search Engine Optimization (SEO) ensures your blog ranks high in search engine results for relevant keywords. This increases organic traffic, the lifeblood of any monetization strategy.

- Keyword research: Use keyword research tools to identify terms your target audience searches for. Strategically incorporate these keywords into your content naturally.

- Technical SEO: Optimize your blog’s loading speed, mobile responsiveness, and overall technical aspects to improve search engine ranking.

- Backlink building: Encourage other websites to link back to your content, boosting your blog’s authority in the eyes of search engines.

4. Monetization Magic: Affiliate Marketing

Affiliate marketing allows you to earn commissions by promoting other companies’ products or services. When a reader clicks on your affiliate link and makes a purchase, you get a commission.

- Choose relevant affiliates: Promote products or services that align with your niche and resonate with your audience.

- Transparency is key: Disclose your affiliate relationships clearly to your readers and build trust.

- Integrate strategically: Don’t just bombard readers with links. Weave affiliate promotions naturally into your content, highlighting the value proposition.

5. Display Advertising: A Classic Approach

Display advertising involves placing banner ads, text ads, or other visual elements on your blog. When a reader clicks on an ad, you earn revenue.

- Choose reputable ad networks: Partner with established ad networks that offer competitive rates and relevant ads for your audience.

- Strategic ad placement: Place ads thoughtfully, avoiding an overwhelming experience for readers.

- Track your performance: Monitor ad clicks and conversions to measure the effectiveness of your ad placements and optimize for better results.

6. Offer Premium Content:

Providing exclusive, in-depth content behind a paywall can generate additional income. This could be premium blog posts, ebooks, online courses, or webinars.

- Deliver exceptional value: Ensure your premium content offers significant value that justifies the price tag.

- Multiple pricing options: Consider offering tiered subscription plans to cater to different audience needs and budgets.

- Promote effectively: Highlight the benefits of your premium content and encourage readers to subscribe.

7. Coaching and Consulting:

Leverage your expertise by offering coaching or consulting services related to your niche. Readers who find your content valuable may be interested in personalized guidance.

- Position yourself as an expert: Showcase your qualifications, experience, and client testimonials to build trust and establish your credibility.

- Offer free consultations: Provide a limited free consultation to potential clients, allowing them to experience your expertise firsthand.

- Develop clear packages: Outline different coaching or consulting packages with varying time commitments and pricing structures.

8. The Power of Community: Online Events and Webinars

Host online events or webinars related to your niche. These events offer valuable content while also providing an opportunity to promote other monetization avenues.

- Interactive and engaging: Structure your online events to be interactive with polls, Q&A sessions, or live chats. Click here to learn more about image marketing with Q&A sessions and live chats.

9. Embrace the Power of Email Marketing:

Building an email list allows you to foster stronger relationships with your audience and promote your content and offerings directly.

- Offer valuable incentives: Encourage readers to subscribe by offering exclusive content, discounts, or early access to new products.

- Segmentation is key: Segment your email list based on reader interests to send targeted campaigns that resonate more effectively.

- Regular communication: Maintain consistent communication with your subscribers through engaging newsletters or updates.

10. Sell Your Own Products:

Take your expertise to the next level by creating and selling your own products. This could be physical merchandise, digital downloads, or even printables related to your niche.

- Identify audience needs: Develop products that address the specific needs and desires of your target audience.

- High-quality offerings: Invest in creating high-quality products that offer exceptional value and user experience.

- Utilize multiple platforms: Sell your products through your blog, online marketplaces, or even social media platforms.

11. Sponsorships and Brand Collaborations:

Partner with brands or businesses relevant to your niche for sponsored content or collaborations. This can be a lucrative way to leverage your audience and generate income.

- Maintain editorial control: While working with sponsors, ensure you retain editorial control to maintain your blog’s authenticity and audience trust.

- Disclosures are essential: Clearly disclose sponsored content to readers, upholding transparency and ethical practices.

- Align with your niche: Partner with brands that complement your content and resonate with your audience.

12. Freelancing and Paid Writing Opportunities:

Your blog can serve as a springboard for freelance writing opportunities. Showcase your writing skills and expertise through your blog content, attracting potential clients.

- Target relevant publications: Identify online publications, websites, or magazines related to your niche and pitch your writing services.

- High-quality samples: Include high-quality blog posts from your site as writing samples when pitching to potential clients.

- Develop strong writing skills: Continuously hone your writing skills and stay updated on current trends in your niche to deliver exceptional work.

Conclusion:

Building a successful blog that generates income requires dedication, strategic planning, and high-quality content. In today’s digital age, there are numerous opportunities to make money online through blogging. By utilizing a combination of methods such as affiliate marketing, sponsored content, and selling digital products or services, you can leverage your blog’s potential and achieve financial success.

Remember, consistency in posting, engaging with your audience, and staying adaptable to trends are key to thriving in the ever-evolving blogosphere. Embrace new strategies, refine your approaches, and always keep your readers at the forefront of your content creation journey. With dedication and the right approach, your blog has the potential to become a valuable source of income and a platform for sharing your knowledge and passion with the world, making money online while doing what you love.

Image Credit: DepositPhotos

SOCIAL

Snapchat Explores New Messaging Retention Feature: A Game-Changer or Risky Move?

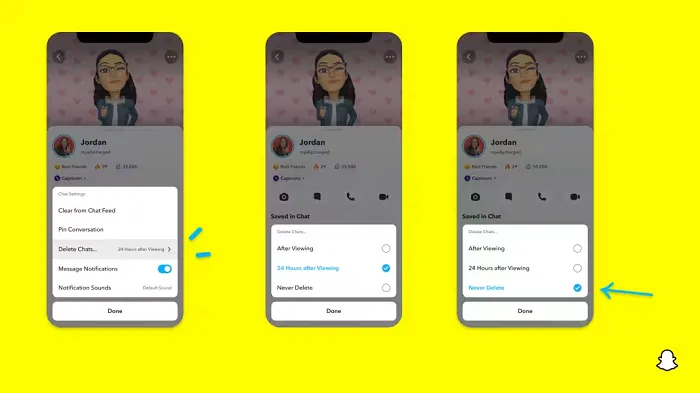

In a recent announcement, Snapchat revealed a groundbreaking update that challenges its traditional design ethos. The platform is experimenting with an option that allows users to defy the 24-hour auto-delete rule, a feature synonymous with Snapchat’s ephemeral messaging model.

The proposed change aims to introduce a “Never delete” option in messaging retention settings, aligning Snapchat more closely with conventional messaging apps. While this move may blur Snapchat’s distinctive selling point, Snap appears convinced of its necessity.

According to Snap, the decision stems from user feedback and a commitment to innovation based on user needs. The company aims to provide greater flexibility and control over conversations, catering to the preferences of its community.

Currently undergoing trials in select markets, the new feature empowers users to adjust retention settings on a conversation-by-conversation basis. Flexibility remains paramount, with participants able to modify settings within chats and receive in-chat notifications to ensure transparency.

Snapchat underscores that the default auto-delete feature will persist, reinforcing its design philosophy centered on ephemerality. However, with the app gaining traction as a primary messaging platform, the option offers users a means to preserve longer chat histories.

The update marks a pivotal moment for Snapchat, renowned for its disappearing message premise, especially popular among younger demographics. Retaining this focus has been pivotal to Snapchat’s identity, but the shift suggests a broader strategy aimed at diversifying its user base.

This strategy may appeal particularly to older demographics, potentially extending Snapchat’s relevance as users age. By emulating features of conventional messaging platforms, Snapchat seeks to enhance its appeal and broaden its reach.

Yet, the introduction of message retention poses questions about Snapchat’s uniqueness. While addressing user demands, the risk of diluting Snapchat’s distinctiveness looms large.

As Snapchat ventures into uncharted territory, the outcome of this experiment remains uncertain. Will message retention propel Snapchat to new heights, or will it compromise the platform’s uniqueness?

Only time will tell.

SOCIAL

Catering to specific audience boosts your business, says accountant turned coach

While it is tempting to try to appeal to a broad audience, the founder of alcohol-free coaching service Just the Tonic, Sandra Parker, believes the best thing you can do for your business is focus on your niche. Here’s how she did just that.

When running a business, reaching out to as many clients as possible can be tempting. But it also risks making your marketing “too generic,” warns Sandra Parker, the founder of Just The Tonic Coaching.

“From the very start of my business, I knew exactly who I could help and who I couldn’t,” Parker told My Biggest Lessons.

Parker struggled with alcohol dependence as a young professional. Today, her business targets high-achieving individuals who face challenges similar to those she had early in her career.

“I understand their frustrations, I understand their fears, and I understand their coping mechanisms and the stories they’re telling themselves,” Parker said. “Because of that, I’m able to market very effectively, to speak in a language that they understand, and am able to reach them.”Â

“I believe that it’s really important that you know exactly who your customer or your client is, and you target them, and you resist the temptation to make your marketing too generic to try and reach everyone,” she explained.

“If you speak specifically to your target clients, you will reach them, and I believe that’s the way that you’re going to be more successful.

Watch the video for more of Sandra Parker’s biggest lessons.

-

PPC6 days ago

PPC6 days agoHow the TikTok Algorithm Works in 2024 (+9 Ways to Go Viral)

-

SEO5 days ago

SEO5 days agoHow to Use Keywords for SEO: The Complete Beginner’s Guide

-

MARKETING6 days ago

MARKETING6 days agoHow To Protect Your People and Brand

-

PPC7 days ago

PPC7 days agoHow to Brainstorm Business Ideas: 9 Fool-Proof Approaches

-

MARKETING3 days ago

MARKETING3 days agoAdvertising on Hulu: Ad Formats, Examples & Tips

-

MARKETING4 days ago

MARKETING4 days agoUpdates to data build service for better developer experiences

-

MARKETING5 days ago

MARKETING5 days agoThe Ultimate Guide to Email Marketing

-

MARKETING17 hours ago

MARKETING17 hours ago18 Events and Conferences for Black Entrepreneurs in 2024